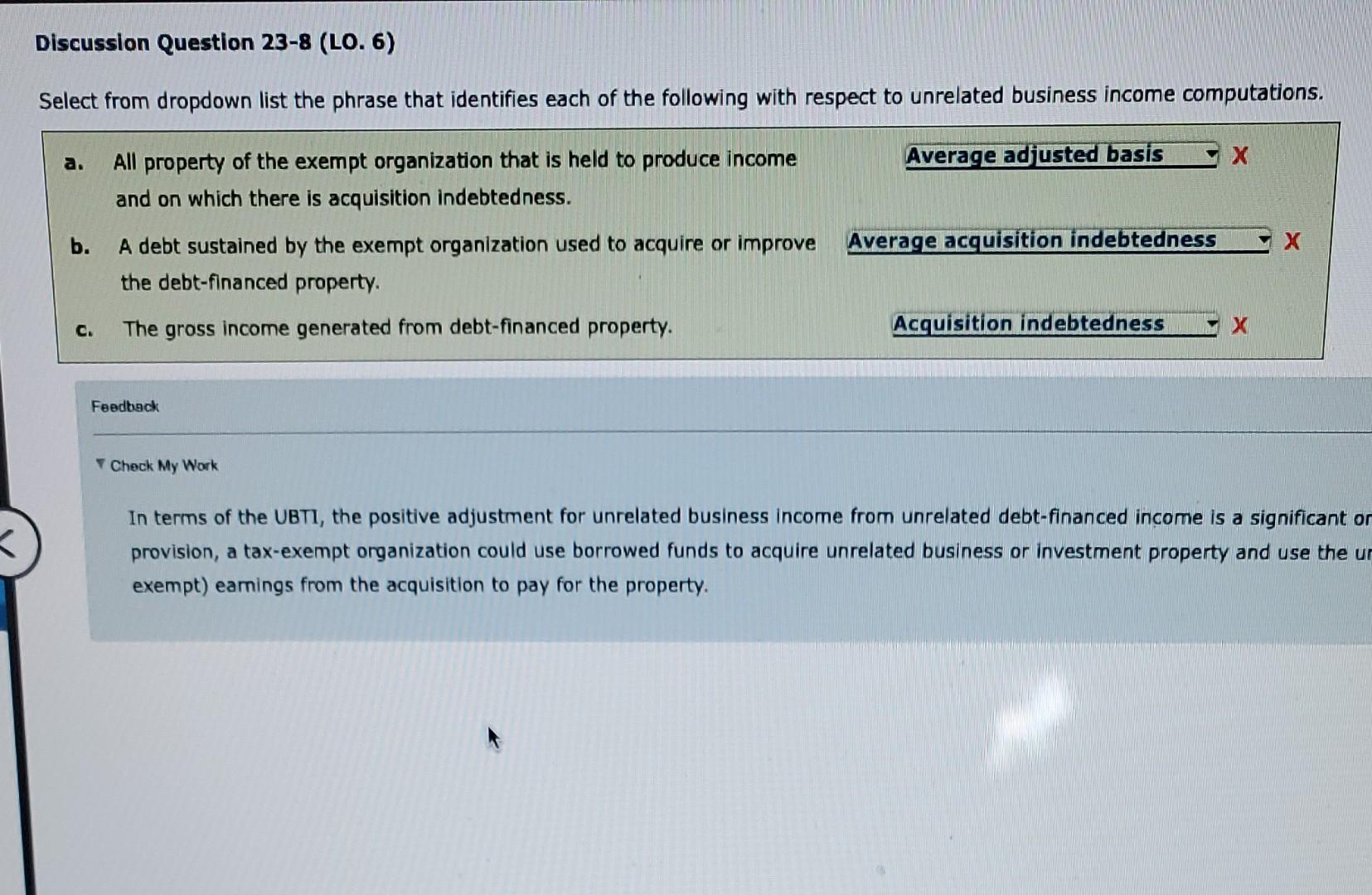

Question: Discussion Question 23-8 (LO. 6) Select from dropdown list the phrase that identifies each of the following with respect to unrelated business income computations. Average

Discussion Question 23-8 (LO. 6) Select from dropdown list the phrase that identifies each of the following with respect to unrelated business income computations. Average adjusted basis X All property of the exempt organization that is held to produce income and on which there is acquisition indebtedness. b. Average acquisition indebtedness A debt sustained by the exempt organization used to acquire or improve the debt-financed property. c. The gross income generated from debt-financed property. Acquisition indebtedness X Feedback Check My Work In terms of the UBTI, the positive adjustment for unrelated business income from unrelated debt-financed income is a significant or provision, a tax-exempt organization could use borrowed funds to acquire unrelated business or investment property and use the u exempt) earnings from the acquisition to pay for the property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts