Question: need help with this please ebook Discussion Question 23-8 (LO. 6) Select from dropdown list the phrase that identifies each of the following with respect

need help with this please

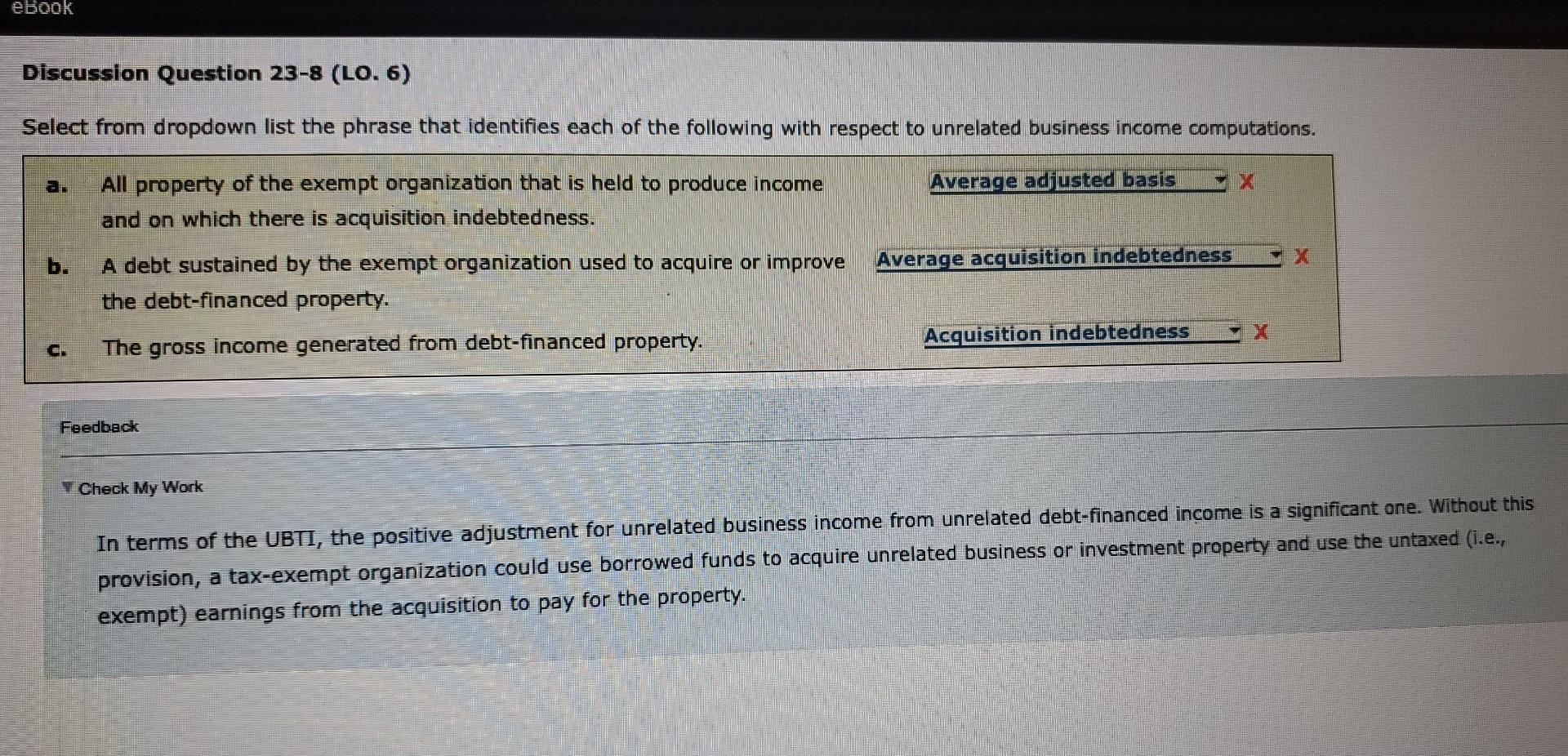

ebook Discussion Question 23-8 (LO. 6) Select from dropdown list the phrase that identifies each of the following with respect to unrelated business income computations. Average adjusted basis All property of the exempt organization that is held to produce income and on which there is acquisition indebtedness. Average acquisition indebtedness X A debt sustained by the exempt organization used to acquire or improve the debt-financed property. The gross income generated from debt-financed property. Acquisition indebtedness X Feedback Y Check My Work In terms of the UBTI, the positive adjustment for unrelated business income from unrelated debt-financed income is a significant one. Without this provision, a tax-exempt organization could use borrowed funds to acquire unrelated business or investment property and use the untaxed (i.e., exempt) earings from the acquisition to pay for the property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts