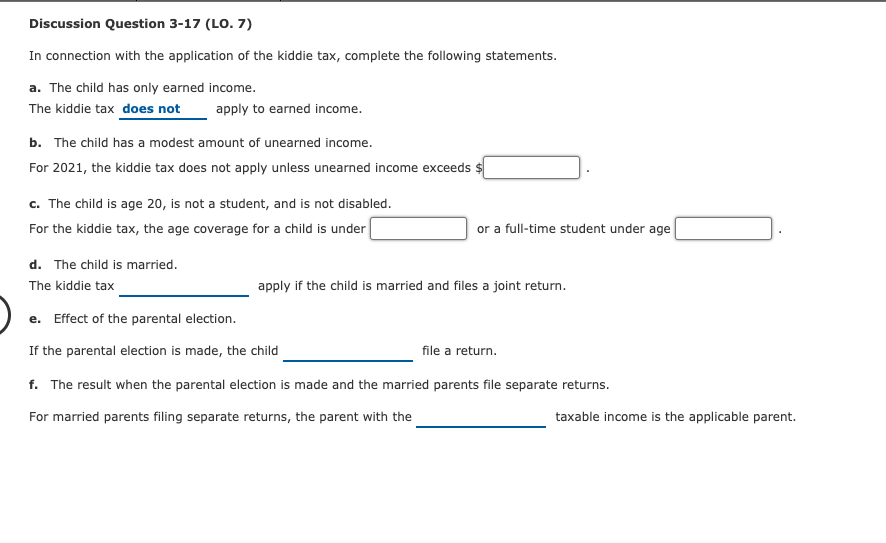

Question: Discussion Question 3-17 (LO. 7) In connection with the application of the kiddie tax, complete the following statements. a. The child has only earned income.

Discussion Question 3-17 (LO. 7) In connection with the application of the kiddie tax, complete the following statements. a. The child has only earned income. The kiddie tax does not apply to earned income. b. The child has a modest amount of unearned income. For 2021, the kiddie tax does not apply unless unearned income exceeds $ c. The child is age 20, is not a student, and is not disabled. For the kiddie tax, the age coverage for a child is under or a full-time student under age d. The child is married. The kiddie tax apply if the child is married and files a joint return. e. Effect of the parental election. If the parental election is made, the child file a return f. The result when the parental election is made and the married parents file separate returns. For married parents filing separate returns, the parent with the taxable income is the applicable parent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts