Question: Disregarding the capital conservation buffer, does the bank have sufficient capital to meet the Basel requirements? How much in excess? How much short? A bank

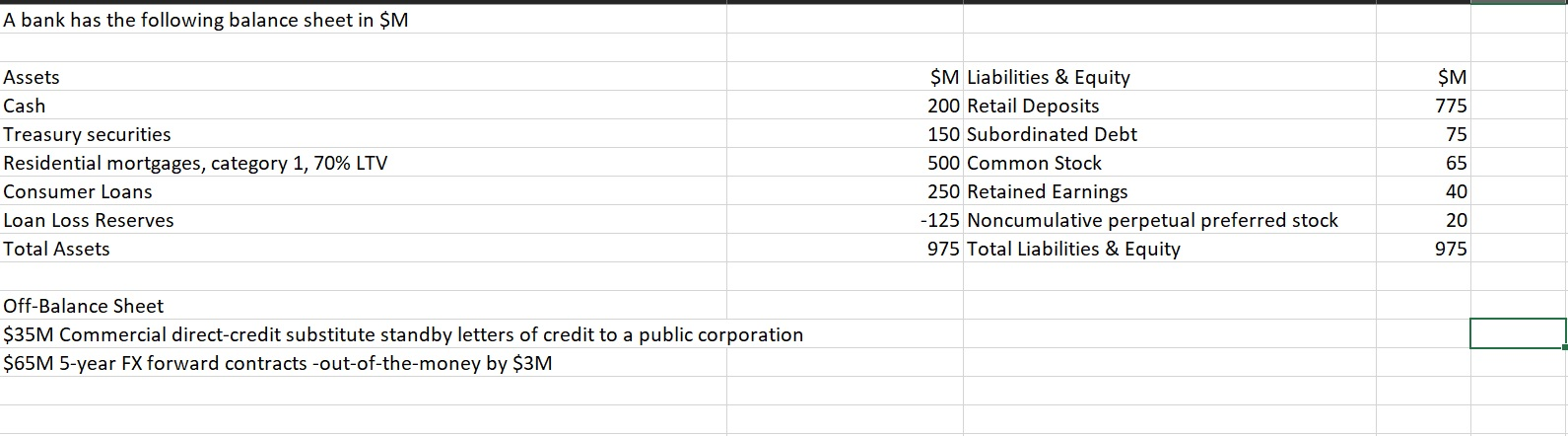

Disregarding the capital conservation buffer, does the bank have sufficient capital to meet the Basel requirements? How much in excess? How much short?

A bank has the following balance sheet in $M Assets Cash Treasury securities Residential mortgages, category 1, 70% LTV Consumer Loans Loan Loss Reserves Total Assets $M Liabilities & Equity 200 Retail Deposits 150 Subordinated Debt 500 Common Stock 250 Retained Earnings -125 Noncumulative perpetual preferred stock 975 Total Liabilities & Equity SM 775 75 65 40 20 975 Off-Balance Sheet $35M Commercial direct-credit substitute standby letters of credit to a public corporation $65M 5-year FX forward contracts -out-of-the-money by $3M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts