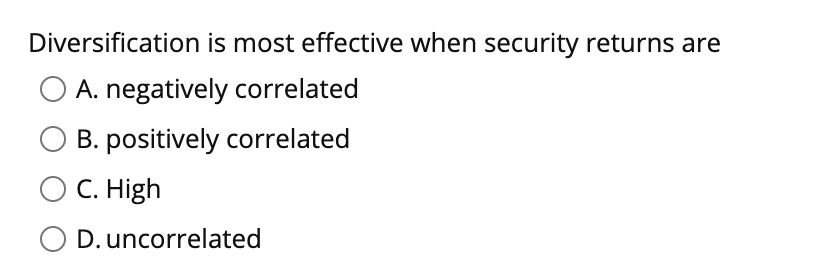

Question: Diversification is most effective when security returns are A. negatively correlated B. positively correlated C. High D. uncorrelated Bond equivalent yield is the same as

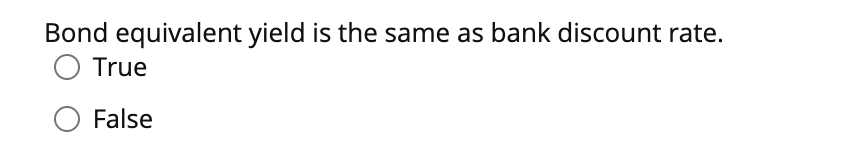

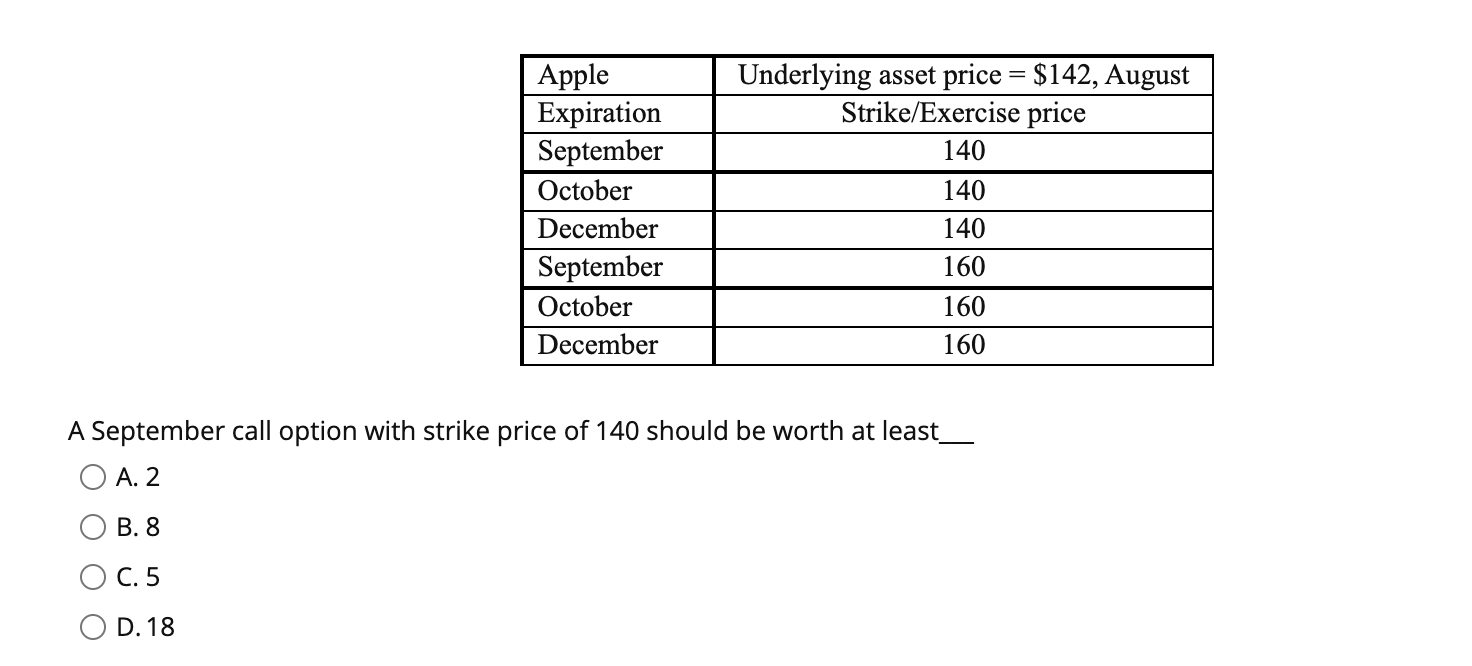

Diversification is most effective when security returns are A. negatively correlated B. positively correlated C. High D. uncorrelated Bond equivalent yield is the same as bank discount rate. O True O False Underlying asset price = $142, August Strike/Exercise price 140 140 Apple Expiration September October December September October December 140 160 160 160 A September call option with strike price of 140 should be worth at least A. 2 B. 8 C. 5 D. 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts