Question: Dividend amounts not split adjusted. Declared Record Payable Amount Type May 1, 2018 May 14, 2018 May 17, 2018 $.73 Regular Cash Feb 1, 2018

Dividend amounts not split adjusted.

Declared Record Payable Amount Type

May 1, 2018 May 14, 2018 May 17, 2018 $.73 Regular Cash

Feb 1, 2018 Feb 12, 2018 Feb 15, 2018 $.63 Regular Cash

Nov 2, 2017 Nov 13, 2017 Nov 16, 2017 $.63 Regular Cash

Aug 1, 2017 Aug 14, 2017 Aug 17, 2017 $.63 Regular Cash

May 2, 2017 May 15, 2017 May 18, 2017 $.63 Regular Cash

Jan 31, 2017 Feb 13, 2017 Feb 16, 2017 $.57 Regular Cash

| Period Ending | 9/30/2017 |

| Cash And Cash Equivalents | 20,289,000 |

| Short Term Investments | 53,892,000 |

| Net Receivables | 35,673,000 |

| Inventory | 4,855,000 |

| Other Current Assets | 13,936,000 |

| Total Current Assets | 128,645,000 |

| Long Term Investments | 194,714,000 |

| Property Plant and Equipment | 33,783,000 |

| Goodwill | 5,717,000 |

| Intangible Assets | 2,298,000 |

| Accumulated Amortization | - |

| Other Assets | 10,162,000 |

| Deferred Long Term Asset Charges | - |

| Total Assets | 375,319,000 |

| Accounts Payable | 74,793,000 |

| Short/Current Long Term Debt | 18,473,000 |

| Other Current Liabilities | 7,548,000 |

| Total Current Liabilities | 100,814,000 |

| Long Term Debt | 97,207,000 |

| Other Liabilities | 40,415,000 |

| Deferred Long Term Liability Charges | 2,836,000 |

| Minority Interest | - |

| Negative Goodwill | - |

| Total Liabilities | 241,272,000 |

| Misc. Stocks Options Warrants | - |

| Redeemable Preferred Stock | - |

| Preferred Stock | - |

| Common Stock | 35,867,000 |

| Retained Earnings | 98,330,000 |

| Treasury Stock | - |

| Capital Surplus | - |

| Other Stockholder Equity | -150,000 |

| Total Stockholder Equity | 134,047,000 |

| Net Tangible Assets | 126,032,000 |

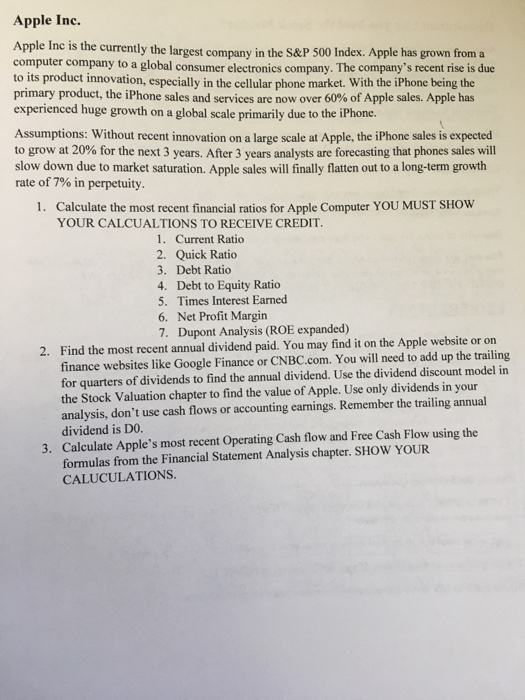

Apple Inc. Apple Inc is the currently the largest company in the S&P 500 Index. Apple has grown from a computer company to a global consumer electronics to its produ primary product, the iPhone sales and services are now over 60% of Apple sales, Apple has experienced huge growth on a global scale primarily due to the iPhone company. The company's recent rise is due ct innovation, especially in the cellular phone market. With the iPhone being the Assumptions: Without recent innovation on a large scale at Apple, the iPhone sales is expected to grow at 20% for the next 3 years. After 3 years analysts are forecasting that phones sales will slow down due to market saturation. Apple sales will finally flatten out to a long-term growth rate of 7% in perpetuity. 1. Calculate the most recent financial ratios for Apple Computer YOU MUST SHOW YOUR CALCUALTIONS TO RECEIVE CREDIT 1. Current Ratio 2. Quick Ratio 3. Debt Ratio 4. Debt to Equity Ratio 5. Times Interest Earned 6. Net Profit Margin 7. Dupont Analysis (ROE expanded) 2. Find the most recent annual dividend paid. You may find it on the Apple website or on finance websites like Google Finance or CNBC.com. You will need to add up the trailing for quarters of dividends to find the annual dividend. Use the dividend discount model in the Stock Valuation chapter to find the value of Apple. Use only dividends in your analysis, don't use cash flows or accounting earnings. Remember the trailing annual dividend is DO. Calculate Apple's most recent Operating Cash flow and Free Cash Flow using the formulas from the Financial Statement Analysis chapter. SHOW YOUR CALUCULATIONS. 3. Apple Inc. Apple Inc is the currently the largest company in the S&P 500 Index. Apple has grown from a computer company to a global consumer electronics to its produ primary product, the iPhone sales and services are now over 60% of Apple sales, Apple has experienced huge growth on a global scale primarily due to the iPhone company. The company's recent rise is due ct innovation, especially in the cellular phone market. With the iPhone being the Assumptions: Without recent innovation on a large scale at Apple, the iPhone sales is expected to grow at 20% for the next 3 years. After 3 years analysts are forecasting that phones sales will slow down due to market saturation. Apple sales will finally flatten out to a long-term growth rate of 7% in perpetuity. 1. Calculate the most recent financial ratios for Apple Computer YOU MUST SHOW YOUR CALCUALTIONS TO RECEIVE CREDIT 1. Current Ratio 2. Quick Ratio 3. Debt Ratio 4. Debt to Equity Ratio 5. Times Interest Earned 6. Net Profit Margin 7. Dupont Analysis (ROE expanded) 2. Find the most recent annual dividend paid. You may find it on the Apple website or on finance websites like Google Finance or CNBC.com. You will need to add up the trailing for quarters of dividends to find the annual dividend. Use the dividend discount model in the Stock Valuation chapter to find the value of Apple. Use only dividends in your analysis, don't use cash flows or accounting earnings. Remember the trailing annual dividend is DO. Calculate Apple's most recent Operating Cash flow and Free Cash Flow using the formulas from the Financial Statement Analysis chapter. SHOW YOUR CALUCULATIONS. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts