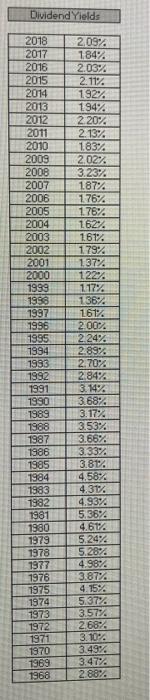

Question: Dividend Yields 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996

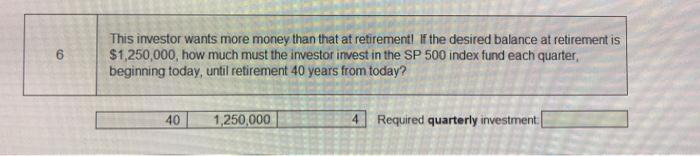

Dividend Yields 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1933 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 1974 1973 1972 1971 1970 1969 1968 2094 1.84% 2.0374 2.11% 192% 194% 2207 2.13% 1.83% 2.02% 3.23% 187% 176% 176% 162% 161% 179% 137% 12224 1.17% 136% 161% 2007 2247 2.89% 2.70% 2.84% 3.14% 3.6874 3.17% 3.53% 3.66% 3.33% 3.81. 4.5874 4.31. 4.9374 5.3644 4.61%. 5.24% 5.2894 4.98%. 3.87% 4.1574 518722 3.57% 2.684 3.104 3.49% 347 2 88% 6 This investor wants more money than that at retirement the desired balance at retirement is $1,250,000, how much must the investor invest in the SP 500 index fund each quarter, beginning today, until retirement 40 years from today? 40 1,250,000 4. Required quarterly investment Dividend Yields 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1933 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 1974 1973 1972 1971 1970 1969 1968 2094 1.84% 2.0374 2.11% 192% 194% 2207 2.13% 1.83% 2.02% 3.23% 187% 176% 176% 162% 161% 179% 137% 12224 1.17% 136% 161% 2007 2247 2.89% 2.70% 2.84% 3.14% 3.6874 3.17% 3.53% 3.66% 3.33% 3.81. 4.5874 4.31. 4.9374 5.3644 4.61%. 5.24% 5.2894 4.98%. 3.87% 4.1574 518722 3.57% 2.684 3.104 3.49% 347 2 88% 6 This investor wants more money than that at retirement the desired balance at retirement is $1,250,000, how much must the investor invest in the SP 500 index fund each quarter, beginning today, until retirement 40 years from today? 40 1,250,000 4. Required quarterly investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts