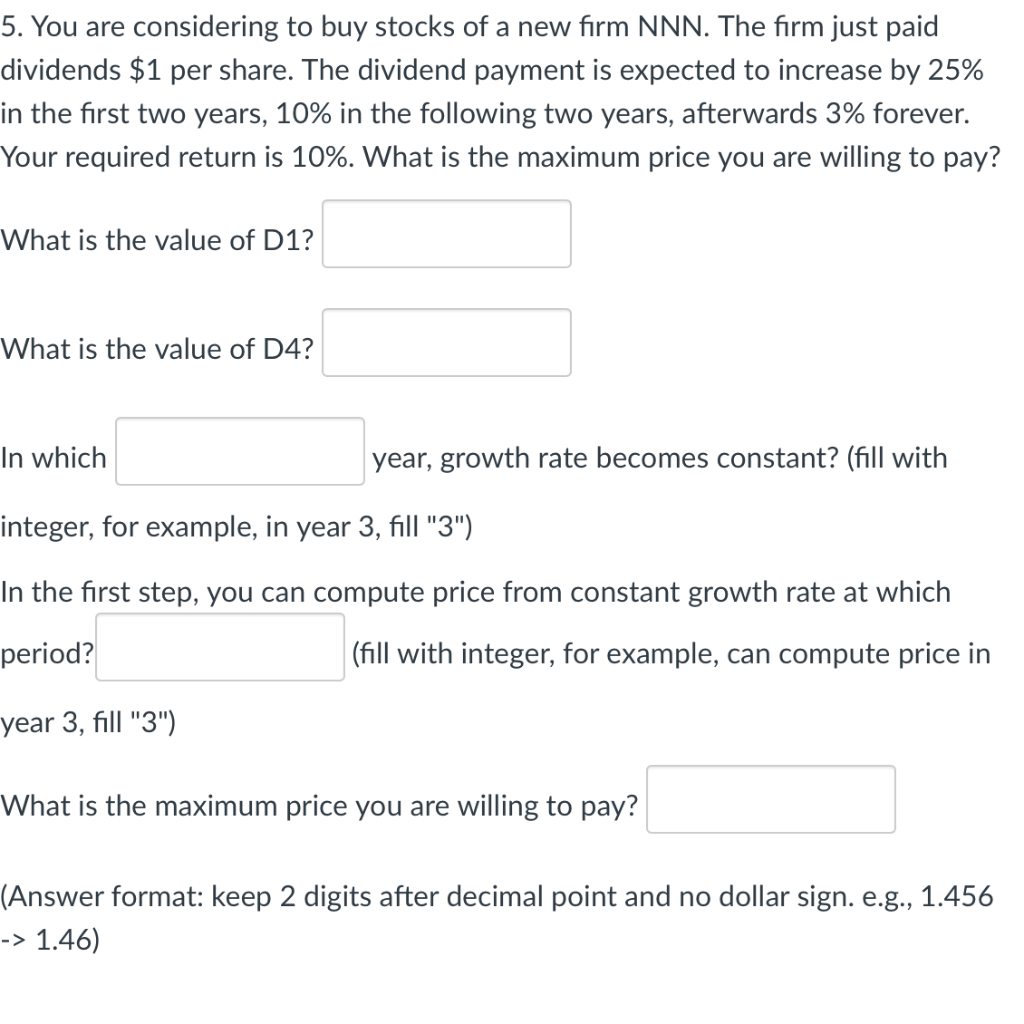

Question: dividends $1 per share. The dividend payment is expected to increase by 25% in the first two years, 10% in the following two years, afterwards

dividends $1 per share. The dividend payment is expected to increase by 25% in the first two years, 10\% in the following two years, afterwards 3% forever. Your required return is 10%. What is the maximum price you are willing to pay? What is the value of D1 ? What is the value of D4? In which year, growth rate becomes constant? (fill with integer, for example, in year 3, fill "3") In the first step, you can compute price from constant growth rate at which period? (fill with integer, for example, can compute price in year 3, fill "3") What is the maximum price you are willing to pay? (Answer format: keep 2 digits after decimal point and no dollar sign. e.g., 1.456 1.46)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts