Question: Dividends per share Lightfoot Inc., a software development firm, has stock outstanding as follows: 40,000 shares of cumulative preferred 1% stock, $120 par and

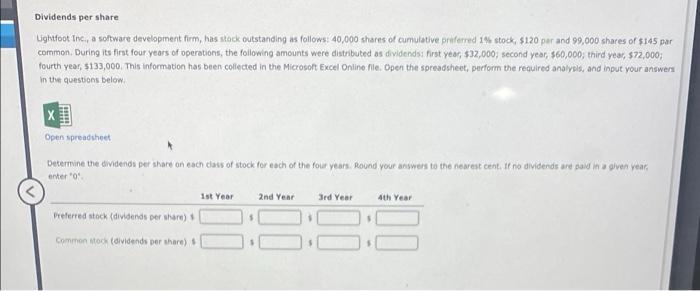

Dividends per share Lightfoot Inc., a software development firm, has stock outstanding as follows: 40,000 shares of cumulative preferred 1% stock, $120 par and 99,000 shares of $145 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $32,000; second year, $60,000; third year, $72,000; fourth year, $133,000. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Determine the dividends per share on each class of stock for each of the four years. Round your answers to the nearest cent. If no dividends are paid in a given year, enter "0" Preferred stock (dividends per share) $ Common stock (dividends per share) $ 1st Year 2nd Year 3rd Year 4th Year The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: Preferred 1% Stock, $50 par (100,000 shares authorized, 79,400 shares issued) Paid-In Capital in Excess of Par-Preferred Stock Common Stock, $3 par (5,000,000 shares authorized, 2,100,000 shares issued) Paid-in Capital in Excess of Par-Common Stock Retained Earnings $3,970,000 150,860 6,300,000 1,260,000 33,959,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Issued 518,800 shares of common stock at $7, receiving cash. b. Issued 9,800 shares of preferred 1% stock at $61. c. Purchased 48,300 shares of treasury common for $7 per share. d. Sold 19,500 shares of treasury common for $9 per share. e. Sold 5,000 shares of treasury common for $6 per share. 1. Declared cash dividends of $0.50 per share on preferred stock and $0.08 per share on common stock. g. Paid the cash dividends.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Calculation of dividend on cumulative preferred stock DIVIDEND 1cumulatuve pref... View full answer

Get step-by-step solutions from verified subject matter experts