Question: Dividends Problem 2 Delta Corp. has 2 equal shareholders. Able & Body. Delta & Able & Body are all cash method calendar year taxpayers. On

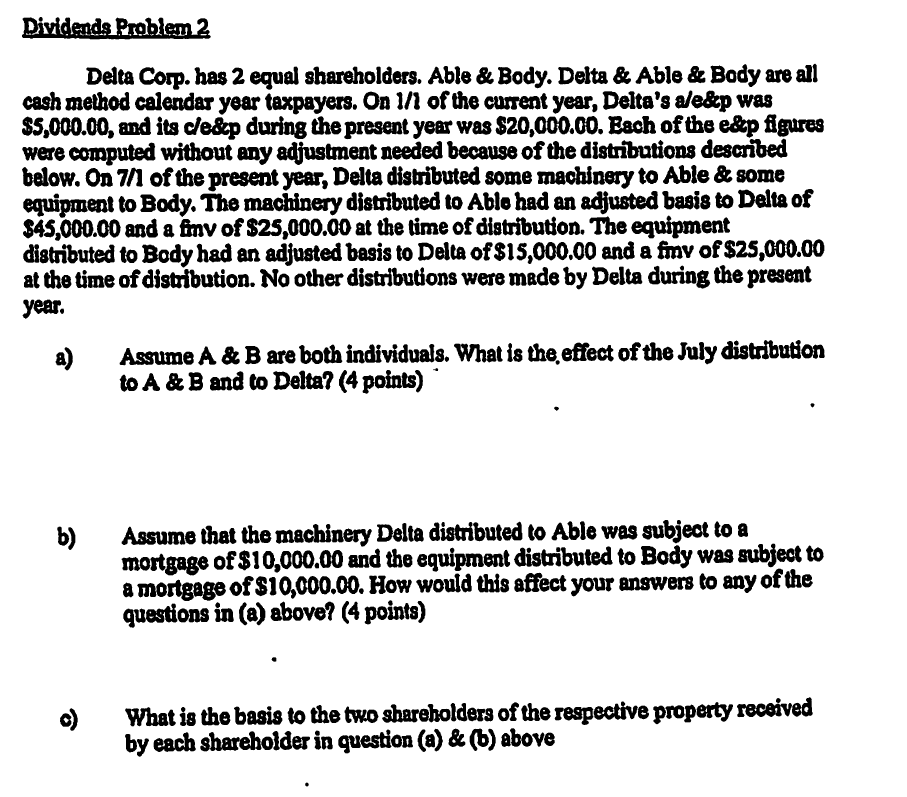

Dividends Problem 2 Delta Corp. has 2 equal shareholders. Able & Body. Delta & Able & Body are all cash method calendar year taxpayers. On 1/1 of the current year, Delta's a/exp was $5,000.00, and its cledep during the present year was $20,000.00. Each of the exp figures were computed without any adjustment needed because of the distributions described below. On 7/1 of the present year, Delta distributed some machinery to Able & some equipment to Body. The machinery distributed to Able had an adjusted basis to Delta of $45,000.00 and a finv of $25,000.00 at the time of distribution. The equipment distributed to Body had an adjusted basis to Delta of $15,000.00 and a fmy of $25,000.00 at the time of distribution. No other distributions were made by Delta during the present year. a) Assume A & B are both individuals. What is the effect of the July distribution to A & B and to Delta? (4 points) b ) Assume that the machinery Delta distributed to Able was subject to a mortgage of $10,000.00 and the equipment distributed to Body was subject to a mortgage of $10,000.00. How would this affect your answers to any of the questions in (a) above? (4 points) What is the basis to the two shareholders of the respective property received by each shareholder in question (a) & (b) above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts