Question: DIVISION B IS CORRECT BUT THE REST ARE INCORRECT! please show working out! Suppose your firm has decided to use a divisional WACC approach to

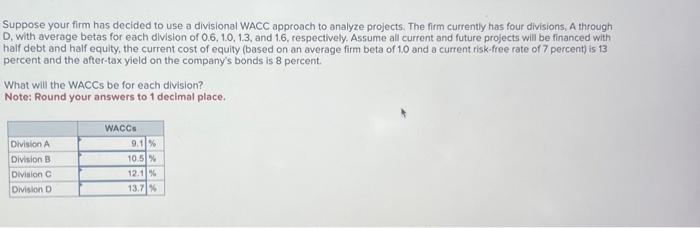

Suppose your firm has decided to use a divisional WACC approach to analyze projects. The firm currently has four divisions, A through D, with average betas for each dlvision of 0.6,1.0,1.3, and 1.6 , sespectively. Assume all current and future projects will be financed with half debt and half equity, the current cost of equity (based on an average firm beta of 1.0 and a current risk-free rate of 7 percent) is 13 percent and the after-tax yield on the company's bonds is 8 percent. What will the WACCs be for each division? Note: Round your answers to 1 decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts