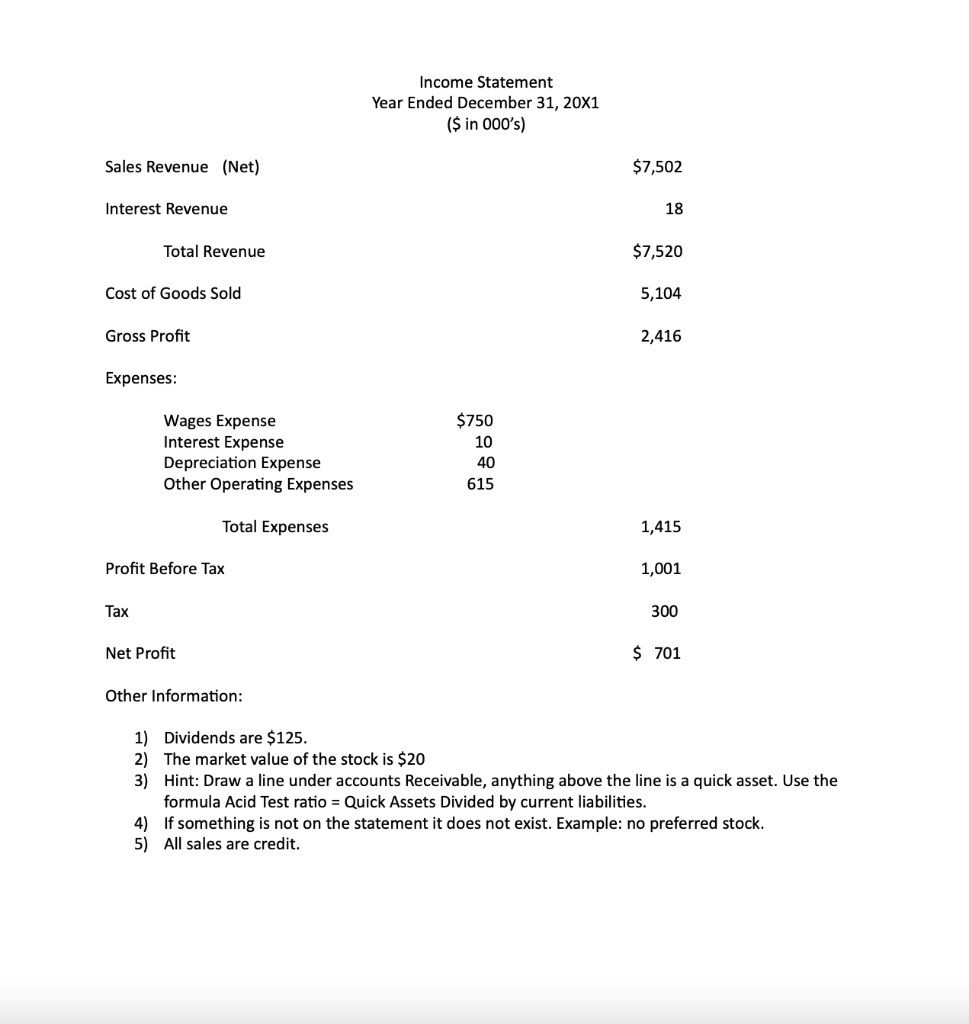

Question: Do a vertical analysis on the income statement. (13 Points) Income Statement Year Ended December 31, 20X1 ($ in 000's) Sales Revenue (Net) $7,502 Interest

- Do a vertical analysis on the income statement. (13 Points)

Income Statement Year Ended December 31, 20X1 ($ in 000's) Sales Revenue (Net) $7,502 Interest Revenue 18 Total Revenue $7,520 Cost of Goods Sold 5,104 Gross Profit 2,416 Expenses: Wages Expense Interest Expense Depreciation Expense Other Operating Expenses $750 10 40 615 Total Expenses 1,415 Profit Before Tax 1,001 Tax 300 Net Profit $ 701 Other Information: 1) Dividends are $125. 2) The market value of the stock is $20 3) Hint: Draw a line under accounts Receivable, anything above the line is a quick asset. Use the formula Acid Test ratio = Quick Assets Divided by current liabilities. 4) If something is not on the statement it does not exist. Example: no preferred stock. 5) All sales are credit. Income Statement Year Ended December 31, 20X1 ($ in 000's) Sales Revenue (Net) $7,502 Interest Revenue 18 Total Revenue $7,520 Cost of Goods Sold 5,104 Gross Profit 2,416 Expenses: Wages Expense Interest Expense Depreciation Expense Other Operating Expenses $750 10 40 615 Total Expenses 1,415 Profit Before Tax 1,001 Tax 300 Net Profit $ 701 Other Information: 1) Dividends are $125. 2) The market value of the stock is $20 3) Hint: Draw a line under accounts Receivable, anything above the line is a quick asset. Use the formula Acid Test ratio = Quick Assets Divided by current liabilities. 4) If something is not on the statement it does not exist. Example: no preferred stock. 5) All sales are credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts