Question: Do all problems please => questions 1,2,3 & additional problems 1,2,3(a),3(b),3(c) Before going to Europe on business, a man drove his Rolls Royce to a

Do all problems please => questions 1,2,3 & additional problems 1,2,3(a),3(b),3(c)

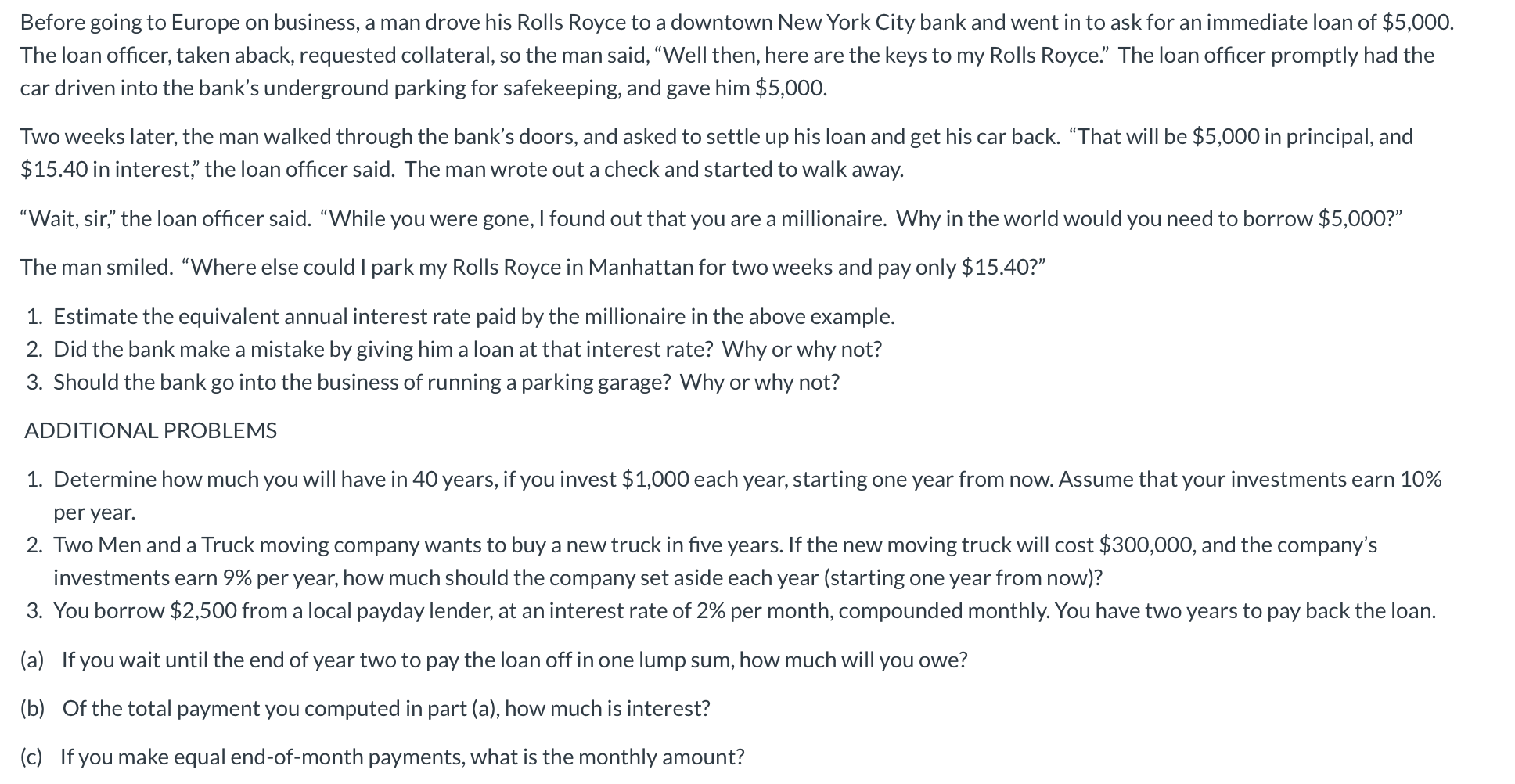

Before going to Europe on business, a man drove his Rolls Royce to a downtown New York City bank and went in to ask for an immediate loan of $5,000. The loan officer, taken aback, requested collateral, so the man said, Well then, here are the keys to my Rolls Royce. The loan officer promptly had the car driven into the bank's underground parking for safekeeping, and gave him $5,000. Two weeks later, the man walked through the bank's doors, and asked to settle up his loan and get his car back. That will be $5,000 in principal, and $15.40 in interest," the loan officer said. The man wrote out a check and started to walk away. "Wait, sir," the loan officer said. While you were gone, I found out that you are a millionaire. Why in the world would you need to borrow $5,000? The man smiled. Where else could I park my Rolls Royce in Manhattan for two weeks and pay only $15.40?" 1. Estimate the equivalent annual interest rate paid by the millionaire in the above example. 2. Did the bank make a mistake by giving him a loan at that interest rate? Why or why not? 3. Should the bank go into the business of running a parking garage? Why or why not? ADDITIONAL PROBLEMS 1. Determine how much you will have in 40 years, if you invest $1,000 each year, starting one year from now. Assume that your investments earn 10% per year. 2. Two Men and a Truck moving company wants to buy a new truck in five years. If the new moving truck will cost $300,000, and the company's investments earn 9% per year, how much should the company set aside each year (starting one year from now)? 3. You borrow $2,500 from a local payday lender, at an interest rate of 2% per month, compounded monthly. You have two years to pay back the loan. (a) If you wait until the end of year two to pay the loan off in one lump sum, how much will you owe? (b) Of the total payment you computed in part (a), how much is interest? (c) If you make equal end-of-month payments, what is the monthly amount? Before going to Europe on business, a man drove his Rolls Royce to a downtown New York City bank and went in to ask for an immediate loan of $5,000. The loan officer, taken aback, requested collateral, so the man said, Well then, here are the keys to my Rolls Royce. The loan officer promptly had the car driven into the bank's underground parking for safekeeping, and gave him $5,000. Two weeks later, the man walked through the bank's doors, and asked to settle up his loan and get his car back. That will be $5,000 in principal, and $15.40 in interest," the loan officer said. The man wrote out a check and started to walk away. "Wait, sir," the loan officer said. While you were gone, I found out that you are a millionaire. Why in the world would you need to borrow $5,000? The man smiled. Where else could I park my Rolls Royce in Manhattan for two weeks and pay only $15.40?" 1. Estimate the equivalent annual interest rate paid by the millionaire in the above example. 2. Did the bank make a mistake by giving him a loan at that interest rate? Why or why not? 3. Should the bank go into the business of running a parking garage? Why or why not? ADDITIONAL PROBLEMS 1. Determine how much you will have in 40 years, if you invest $1,000 each year, starting one year from now. Assume that your investments earn 10% per year. 2. Two Men and a Truck moving company wants to buy a new truck in five years. If the new moving truck will cost $300,000, and the company's investments earn 9% per year, how much should the company set aside each year (starting one year from now)? 3. You borrow $2,500 from a local payday lender, at an interest rate of 2% per month, compounded monthly. You have two years to pay back the loan. (a) If you wait until the end of year two to pay the loan off in one lump sum, how much will you owe? (b) Of the total payment you computed in part (a), how much is interest? (c) If you make equal end-of-month payments, what is the monthly amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts