Question: do all the ratiosi need practical work. dont put the instruction please. if you need data get from internet but do the all ratios please

do all the ratiosi need practical work. dont put the instruction please. if you need data get from internet but do the all ratios please

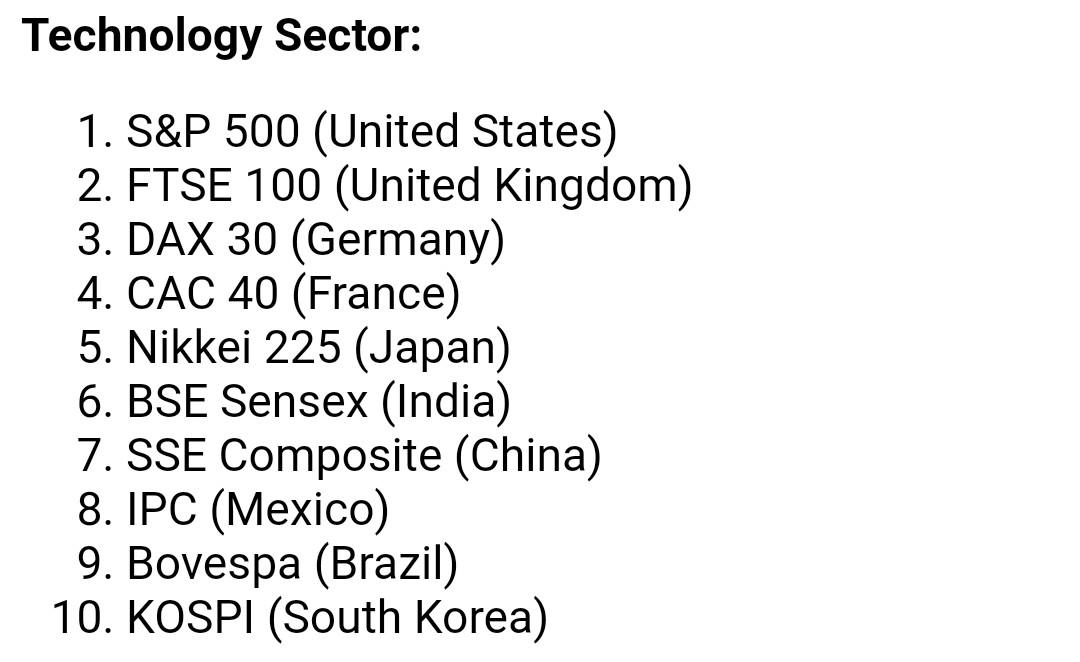

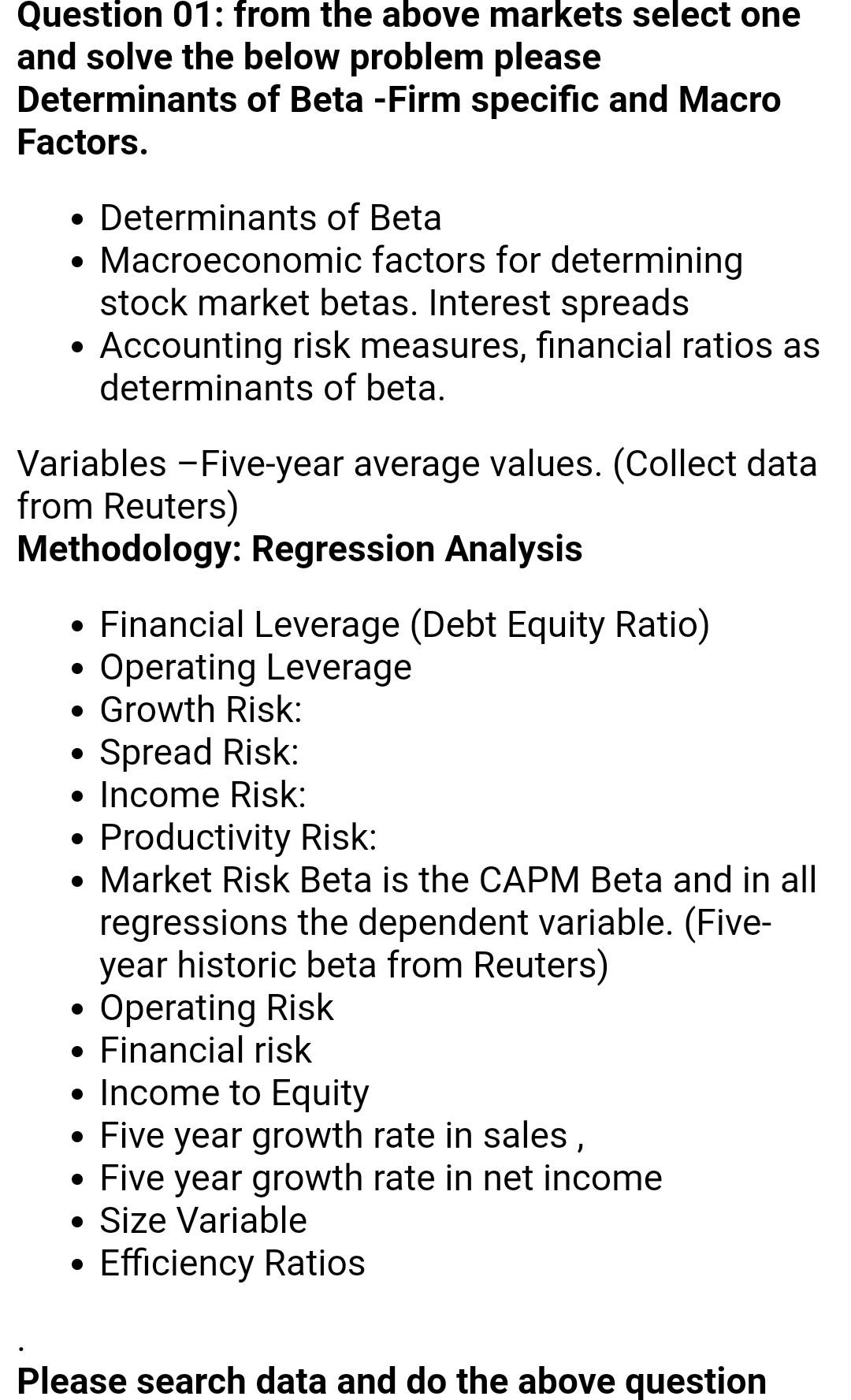

Technology Sector: 1. S\&P 500 (United States) 2. FTSE 100 (United Kingdom) 3. DAX 30 (Germany) 4. CAC 40 (France) 5. Nikkei 225 (Japan) 6. BSE Sensex (India) 7. SSE Composite (China) 8. IPC (Mexico) 9. Bovespa (Brazil) 10. KOSPI (South Korea) Question 01: from the above markets select one and solve the below problem please Determinants of Beta -Firm specific and Macro Factors. - Determinants of Beta - Macroeconomic factors for determining stock market betas. Interest spreads - Accounting risk measures, financial ratios as determinants of beta. Variables -Five-year average values. (Collect data from Reuters) Methodology: Regression Analysis - Financial Leverage (Debt Equity Ratio) - Operating Leverage - Growth Risk: - Spread Risk: - Income Risk: - Productivity Risk: - Market Risk Beta is the CAPM Beta and in all regressions the dependent variable. (Fiveyear historic beta from Reuters) - Operating Risk - Financial risk - Income to Equity - Five year growth rate in sales, - Five year growth rate in net income - Size Variable - Efficiency Ratios Please search data and do the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts