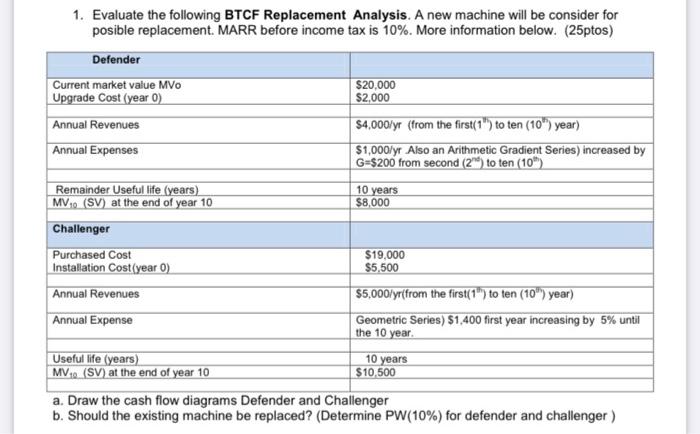

Question: DO BY HAND. NO EXCEL 1. Evaluate the following BTCF Replacement Analysis. A new machine will be consider for posible replacement. MARR before income tax

1. Evaluate the following BTCF Replacement Analysis. A new machine will be consider for posible replacement. MARR before income tax is 10%. More information below. (25ptos) Defender Current market value MVO $20,000 Upgrade Cost (year o) $2,000 Annual Revenues $4,000/yr (from the first(1") to ten (10") year) Annual Expenses $1,000/yr Also an Arithmetic Gradient Series) increased by G=$200 from second (214) to ten (10) Remainder Useful life (years) 10 years MV,0 (SV) at the end of year 10 $8,000 Challenger Purchased Cost $19.000 Installation Cost(year 0) $5,500 Annual Revenues $5,000/yr(from the first(1) to ten (10") year) Annual Expense Geometric Series) $1,400 first year increasing by 5% until the 10 year Useful life (years) 10 years MV., (SV) at the end of year 10 $10,500 a. Draw the cash flow diagrams Defender and Challenger b. Should the existing machine be replaced? (Determine PW(10%) for defender and challenger )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts