Question: Do exactly like the example. do all the steps and explain answer What is the price of a European put option on a non-dividend paying

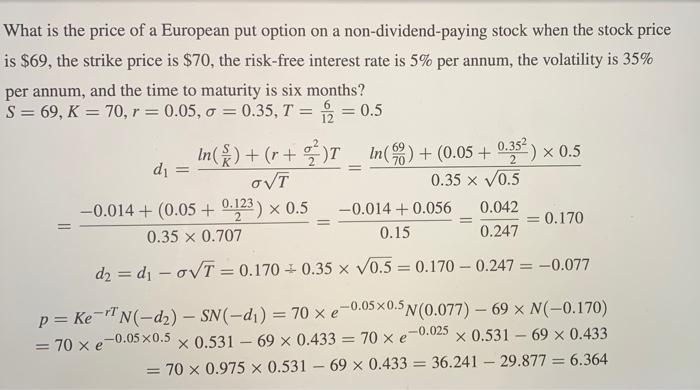

What is the price of a European put option on a non-dividend paying stock when the stock price is $69, the strike price is $70, the risk-free interest rate is 5% per annum, the volatility is 35% per annum, and the time to maturity is six months? S= 69, K = 70, r = 0.05, o = 0.35, T = = 0.5 In(s) + (r+)T_Inn) + (0.05 + 0,352 ) 0.5 di = NT 0.35 x 0.5 -0.014 + (0.05 + 0.123) 0.5 -0.014 + 0.056 0.042 = 0.170 0.35 x 0.707 0.15 0.247 d2 = d - 0VT = 0.170 + 0.35 x 10.5 = 0.170 - 0.247 = -0.077 p= Ke-YT N(-d2) - SN(-d) = 70 x e-0.05x0.5 N(0.077) 69 x N(-0.170) = 70 X e-0.05x0.5 x 0.531 - 69 x 0.433 = 70 x e-0.025 x 0.531 - 69 x 0.433 70 x 0.975 x 0.531 - 69 x 0.433 = 36.241 - 29.877 = 6.364 Problem 6: What is the price of a European put option on a non-dividend-paying stock when the stock price is $68, the strike price is $70, the risk-free interest rate is 6% per annum, the volatility is 35% per annum, and the time to maturity is six months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts