Question: Do exactly like the example problem below. do the charts and all the steps for a like and good commect. explain the answer as well.

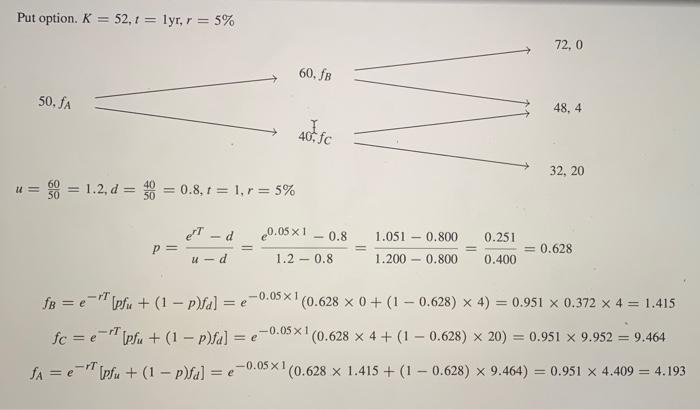

Put option. K 52,1 = lyr, r = 5% 72.0 60, B 50, fa 48,4 40.fc 32, 20 u = = 1.2, d = 40 = 0.8,1 = 1, r = 5% PPT - d 0.251 P= 20.05x1 - 0.8 1.2 - 0.8 1.051 - 0.800 1.200 - 0.800 0.628 ud 0.400 fB = e-pfu + (1 - p)fal = e-0.05 XI (0.628 x 0+ (1 - 0.628) X 4) = 0.951 x 0.372 x 4 = 1.415 fc = e-Tipfu + (1 - p)fa] = e-0.05(0.628 x 4 + (1 0.628) 20) = 0.951 X 9.952 = 9.464 SA = e-pfu + (1 - p)] = e -0.05 x 1 (0.628 x 1.415 + (1 - 0.628) x 9.464) = 0.951 X 4.409 = 4.193 I Problem 4: A stock price is currently $100. Over each of the next two six-month periods it is expected to go up by 10% or down by 10%. The risk-free interest rate is 8% per annum with continuous compounding. What is the value of a one-year European put option with a strike price of $100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts