Question: Do exercise 4 only, showing all the calculations please. Compute the return and risk of portfolios made up of the following two seurities if a)

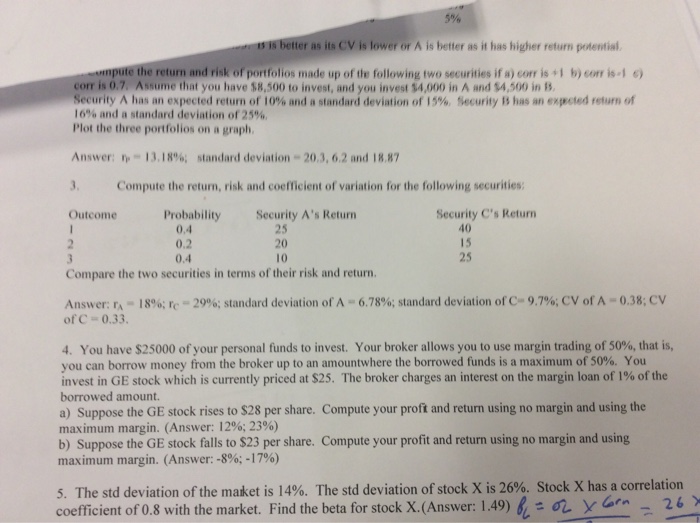

Compute the return and risk of portfolios made up of the following two seurities if a) corr is +1 b) corr is -1 c) corr is 0.7. Assume that you have $8,500 to invest, and you invest $4,000 in A and $4,500 in B. Security A has an expected return of 10% and a standard deviation of 15% Security B has an expected return of 16% and a standard deviation of 25% Plot the three protfollos on a graph. Answer: r_P = 13.18% standard deviation -20.3,6.2 and 18.87 3. Compute the return, risk and coefficient of variation for the following securities: Compare the two securities in terms of their risk and return. Answer: r_A = 18%; r_c = 29%; standard deviation of A = 6.78%; standard deviation of C = 9.7%; Cv of A = 0.38; Cv of C = 0.33 4. You have $25000 of your personal funds to invest. Your broker allows you to use margin trading of 50%. that is, you can borrow money from the broker up to an amountwhere the borrowed funds is a maximum of 50%. You invest in GE stock which is currently priced at $25. The broker charges an interest on the margin loan of 1% of the borrowed amount. a) Suppose the GE stock rises to $28 per share. Compute your proft and return using no margin and using the maximum margin. (Answer: 12%; 23%) b) Suppose the GE stock falls to $23 per share. Compute your profit and return using no margin and using maximum margin. (Answer: -8%: -17%) 5. The std deviation of the ma*et is 14%. The std deviation of stock X is 26%. Stock X has a correlation coefficient of 0.8 with the market. Find the beta for stock X.(Answer: 1.49)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts