Question: Do Homework Chad Rocha Google Chrome m https/Mww.mathxl.com/student/playerHomework.aspxmhomework ld-3828839998questionld 8&flushed false&cld-41007698centerwin yes FIN3220-005 Homework: HW of CH11 Save T8 of 14 (8 complete) Score: 0

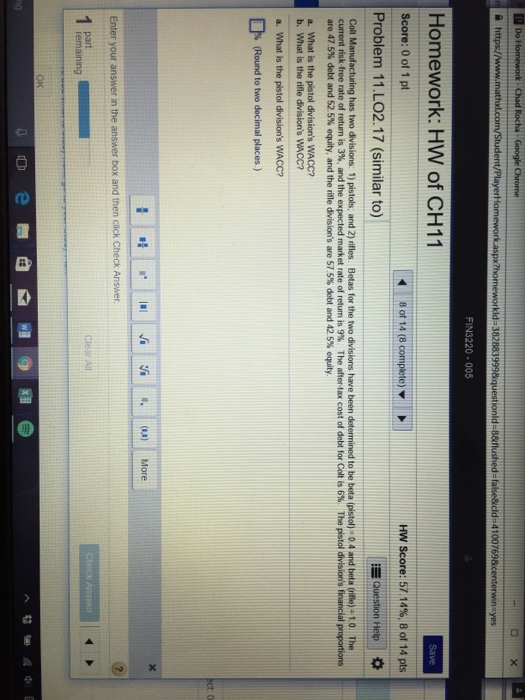

Do Homework Chad Rocha Google Chrome m https/Mww.mathxl.com/student/playerHomework.aspxmhomework ld-3828839998questionld 8&flushed false&cld-41007698centerwin yes FIN3220-005 Homework: HW of CH11 Save T8 of 14 (8 complete) Score: 0 of 1 pt HW Score: 57.14%, 8 of 14 pts Problem 11 LO2.17 (similar to) Question Help Colt Manufacturing has two divisions: 1) pistols. and 2)rifles. Betas for the two divisions have been determined to be beta (pistol) 0.4 and beta (rifle) a 1,0. The current risk-free rate of return is 3%, and the expected market rate of return is 9%. The aftertax cost of debt for Colt is 6% The pstol division's financial proportions are 47.5% debt and 52.5% equity, and the rifle division's are 57.5% debt and 425% equity a. What is the pistol division's WACC? b. What is the rifle division's WACC? a. What is the pistol division's WACC? D (Round to two decimal places.) I H Vi ll. (IU) More Enter your answer in the answer box and then click Check Answer emaining a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts