Question: Do Homework - HW #7 - Google Chrome X mathxl.com/Student/PlayerHomework.aspx?homeworkld=617356736&questionld=1&flushed=true&cld=6818978¢erwin=yes ACC 231 Uses of Accounting Information | Spring 2022 Nick Csekme 02/05/22 10:20 PM

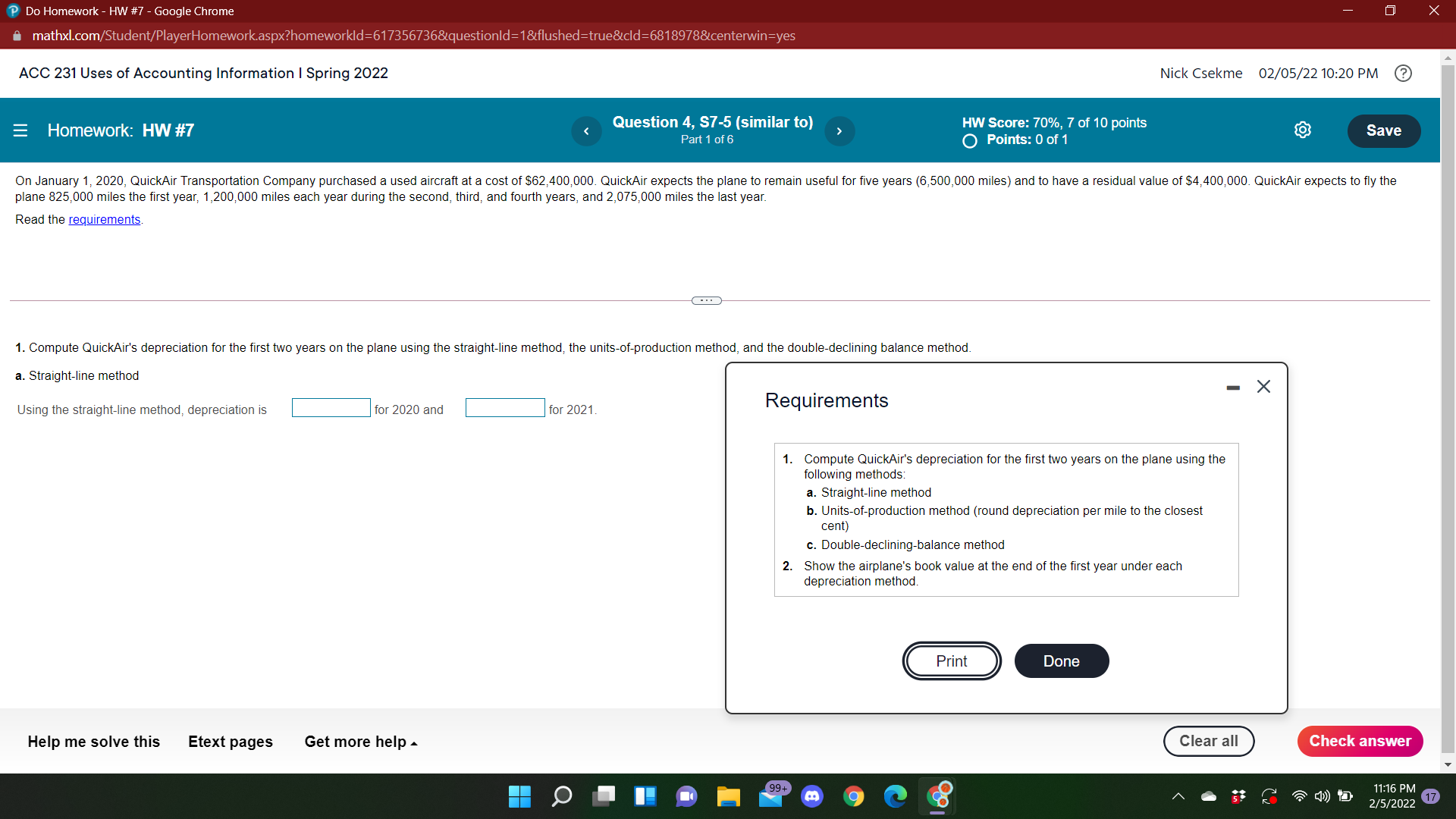

Do Homework - HW #7 - Google Chrome X " mathxl.com/Student/PlayerHomework.aspx?homeworkld=617356736&questionld=1&flushed=true&cld=6818978¢erwin=yes ACC 231 Uses of Accounting Information | Spring 2022 Nick Csekme 02/05/22 10:20 PM E Homework: HW #7 Question 4, $7-5 (similar to) HW Score: 70%, 7 of 10 points Save Part 1 of 6 Points: 0 of 1 On January 1, 2020, QuickAir Transportation Company purchased a used aircraft at a cost of $62,400,000. QuickAir expects the plane to remain useful for five years (6,500,000 miles) and to have a residual value of $4,400,000. QuickAir expects to fly the plane 825,000 miles the first year, 1,200,000 miles each year during the second, third, and fourth years, and 2,075,000 miles the last year. Read the requirements. 1. Compute QuickAir's depreciation for the first two years on the plane using the straight-line method, the units-of-production method, and the double-declining balance method. a. Straight-line method - X Using the straight-line method, depreciation is for 2020 and for 2021 Requirements 1. Compute QuickAir's depreciation for the first two years on the plane using the following methods a. Straight-line method b. Units-of-production method (round depreciation per mile to the closest cent) c. Double-declining-balance method 2. Show the airplane's book value at the end of the first year under each depreciation method. Print Done Help me solve this Etext pages Get more help - Clear all Check answer 99+ m 9 0 5 11:16 PM 2/5/2022 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts