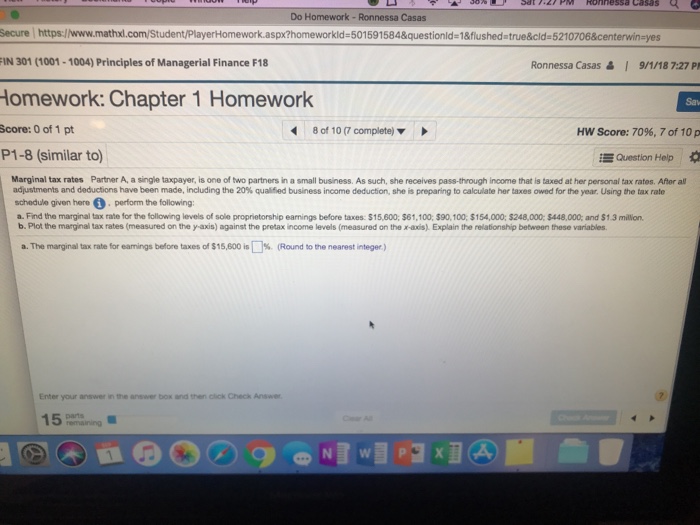

Question: Do Homework - Ronnessa Casas Secure https://www.mathxl.com/Student/PlayerHomework.aspx?homeworkld-501591584&questionld-1&flushed true&cld 5210706¢erwineyes IN 301 (1001-1004) Principles of Managerial Finance F18 Ronnessa Casas I 9/1/18 7:27 P, Homework: Chapter

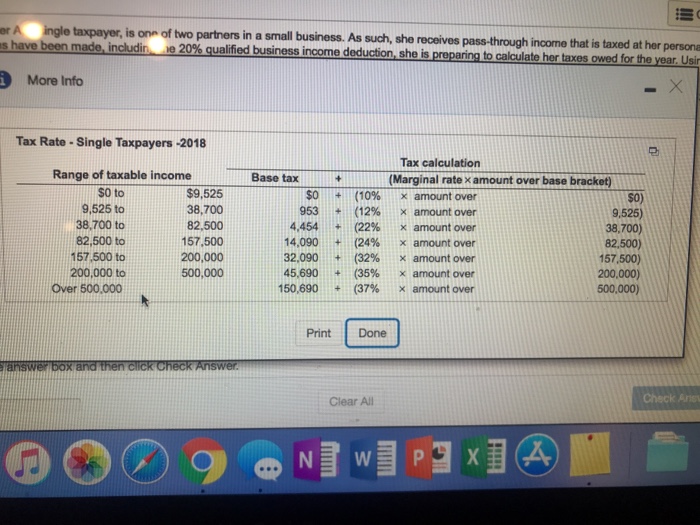

Do Homework - Ronnessa Casas Secure https://www.mathxl.com/Student/PlayerHomework.aspx?homeworkld-501591584&questionld-1&flushed true&cld 5210706¢erwineyes IN 301 (1001-1004) Principles of Managerial Finance F18 Ronnessa Casas I 9/1/18 7:27 P, Homework: Chapter 1 Homework Score: 0 of 1 pt P1-8 (similar to Sav 8cf 10 (7 complete) HW Score: 70%, 7 of 10 p Question Help % Marginal tax rates Partner A, a single taxpayer, is one of two partners in a small business. As such, she receives pass-through income that is taxed at her personal tax rates. Afer all adjustments and deductions have been made, including the 2 % qual ed business rome deduction, she is preparing to ca alate her tadas o edforte yer ut ng to ai per schedule given here .perform the following a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $15,800, $61,100, $90,100, $154,000; $248,000 $448,000: and $1.3 million. b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis). Explain the relationship between these variables a.The marginal tax rate for earrings before taxes of $15,600 is %.(Reund to the nearest integer) Enter your answer in the answer box and then cick Check Answer 15 Pamaning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts