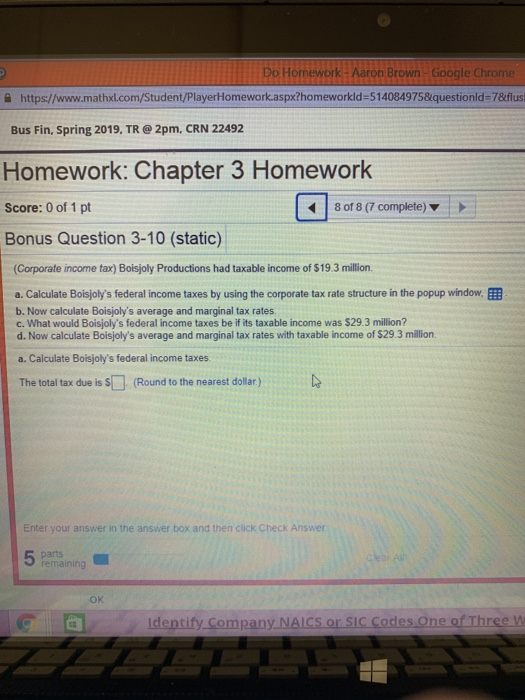

Question: Do Homework-Aaron Brown-Google Chrome https://www.mathxl.com/Student/PlayerHomework.aspx?homeworkId-514084975&questionid-7&flusi Bus Fin, Spring 2019, TR@ 2pm, CRN 22492 Homework: Chapter 3 Homework Score: 0 of 1 pt 80t 8 (7

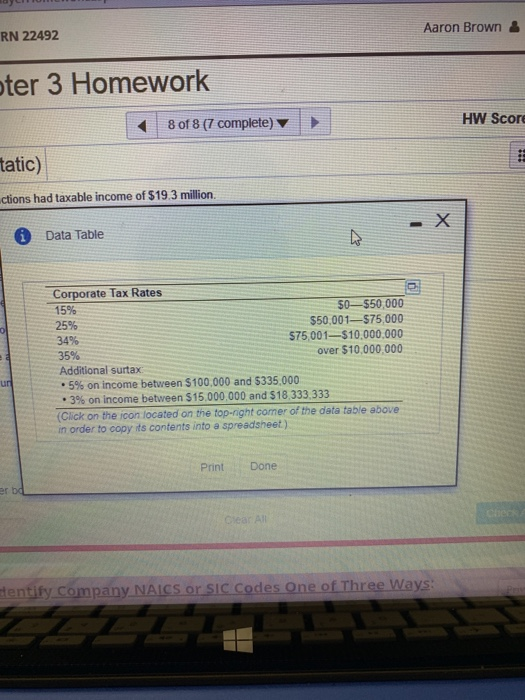

Do Homework-Aaron Brown-Google Chrome https://www.mathxl.com/Student/PlayerHomework.aspx?homeworkId-514084975&questionid-7&flusi Bus Fin, Spring 2019, TR@ 2pm, CRN 22492 Homework: Chapter 3 Homework Score: 0 of 1 pt 80t 8 (7 complete) Bonus Question 3-10 (static) (Corporate income tax) Boisjoly Productions had taxable income of $19.3 million. a. Calculate Boisjoly's federal income taxes by using the corporate tax rate structure in the popup window, b. Now calculate Boisjoly's average and marginal tax rates c. What would Boisjoly's federal income taxes be if its taxable income was $29.3 million? d. Now calculate Boisjoly's average and marginal tax rates with taxable income of $29.3 million. a. Calculate Boisjoly's federal income taxes The total tax due is S(Round to the nearest dollar) Enter your answer in the answer box and then click Check Answer remaining OK dentify Company NAICS or Sic Codes one of Three M RN 22492 Aaron Brown ter 3 Homework | 80f 8 (7 complete) HW Scor tatic) ctions had taxable income of $19.3 million Data Table Corporate Tax Rates 15% 25% 34% 35% Additional surtax $0-$50,000 $50,001--$75,000 S75,001-$10,000,000 over $10.000,000 5% on income between $100,000 and S335.000 +3% on income between S 15 000 000 and $18333333 (Click on the icon located on the top-right comer of the data table above in order to copy its contents into a spreadsheet) Print Done ten ntity company NAICS or sic Codes One of Three Ways

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts