Question: do it asap please Take me to the text or Anna, Paul and John formed a limited liability partnership in 2019. In 2020, the beginning

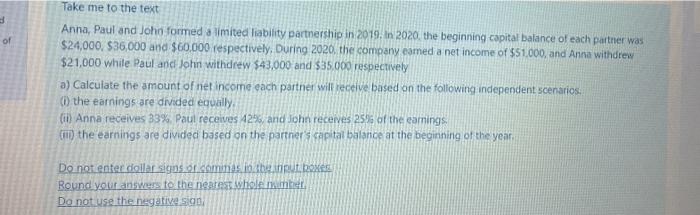

Take me to the text or Anna, Paul and John formed a limited liability partnership in 2019. In 2020, the beginning capital balance of each partner was $24,000, $36,000 and $60.000 respectively. During 2020, the company eamed a net income of $51.000, and Anna withdrew $21,000 white Paul and John withdrew 543,000 and $35.000 respectively a) Calculate the amount of net income each partner will receive based on the following independent scenarios, (1) the earnings are divided equally (ii) Anna receives 83% Paul receives 42%, and John receives 259 of the earnings C) the earnings are divided based on the partner's capitat balance at the beginning of the year, Do not enter dollar signs or coming to the boxes Round your answers to the nearest Winner Do not use the negative sig

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts