Question: Take m e t o the text Anna, Paul and John formed a l i m i t e d liability partnership i n 2

Take the text

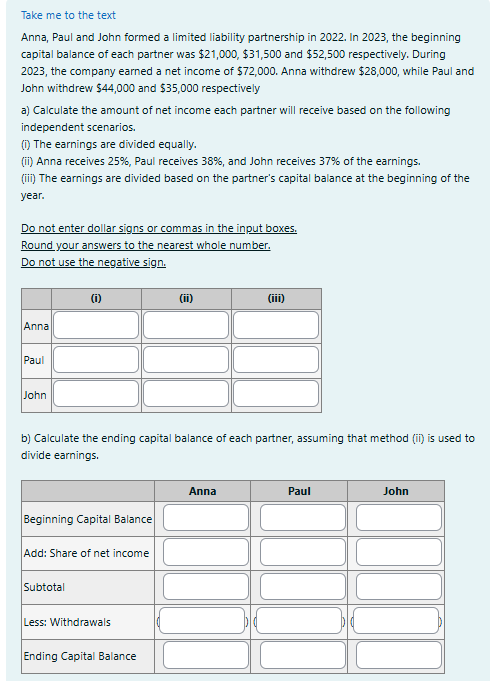

Anna, Paul and John formed a liability partnership the beginning

capital balance each partner was $$ and $ respectively. During

the company earned a net income $ Anna withdrew $ while Paul and

John withdrew $ and $ respectively

Paul receives and John receives the earnings.

The earnings are divided based the partner's capital balance the beginning the

year.

not enter dollar signs commas the input boxes.

Round your answers the nearest whole number.

not use the negative sign.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock