Question: do it correctly please!!! everything is there. what more info do you meed ?? everything is there!!!!!!! dont say you need more info. it is

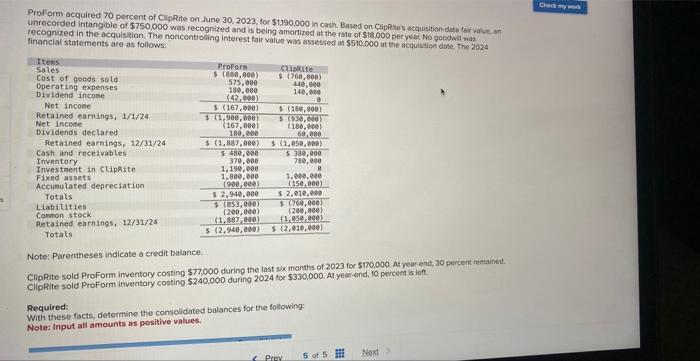

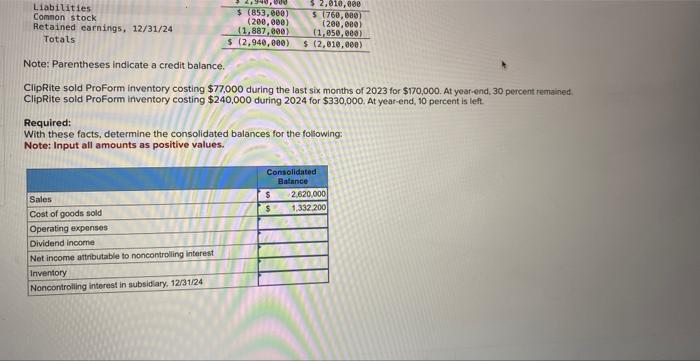

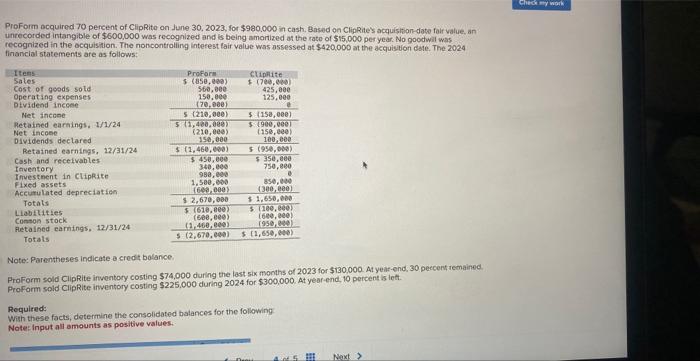

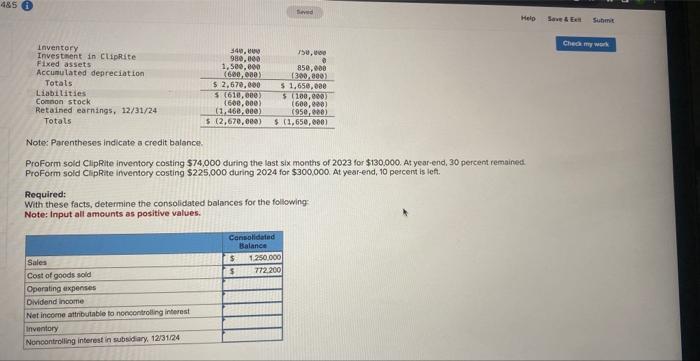

Proform acquired 70 percent of ClipRite on June 30,2023 , for $1,190,000 in cash. Based on ClipRites acquisitian-dste far value, an unrecorded intangible of $750,000 was recognized and is being amortized at the tate of $18,000 per year No gocdwat was recognized in the acquisition. The noncontrolling interest fair value was assessed at $510,000 at the acquisitien dote. The 2024 financial stotements are as follows: Note: Parentheses indicate a credit balance. ClipRite sold ProForm inventory costing $77,000 during the last six months of 2023 for $170,000. At yearend, 30 percent remained. ClipRite sold Proform inventory costing $240,000 during 2024 for $330,000. At year-end, 10 percent is left. Required: With these facts, determine the consolidated balances for the following: Note: Input all amounts as positive values. Note: Parentheses indicate a credit balance. Proform sold ClipRite inventory costing $74,000 duting the last six months of 2023 for $130,000. At year-end, 30 percent remained. Proform sold ClipRite inventory costing $225,000 during 2024 for $300,000. At year-end, 10 petcent is ief. Required: With these facts, determine the consolidated balances for the following Note: Input all amounts as positive values. Note: Parentheses indicate a credit balance. ClipRite sold Proform inventory costing $77,000 during the last six, months of 2023 for $170,000. At yeat-end, 30 percent remained. ClipRite sold Proform inventory costing $240,000 during 2024 for $330,000, At year-end, 10 percent is left. Required: With these facts, determine the consolidated balances for the following: Note: Input all amounts as positive values. Proform acquired 70 percent of ClipRite on June 30,2023 , for $980.000 in cash, Based on ClipRites acquistitan-date falr value, an unrecorded intangible of $600,000 was recognized and is being amortized at the rato of $15,000 per year. No goodwil was recognized in the ocquisition. The noncontralling interest fair value was assessed at $420,000 at the acquistion date. The 2024 financial statements are as follows: Note: Porentheses indicate a credit bolance: ProForm sold ClipRite inventory costing $74,000 during the last six months of 2023 for $130,000. At year-end, 30 peccent remained. Required: Wish these facts, determine the consolidated balances for the following Noter Input all amounts as positive values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts