Question: do it in excel Undo 118 3 0 1 2 13 14 15 16 17 18 19 20 21 22 23 Clipboard F Font VIX

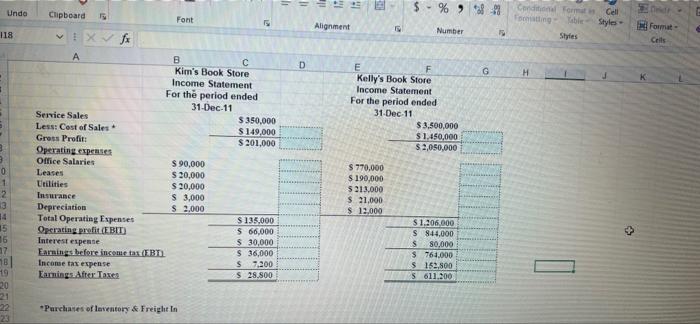

Undo 118 3 0 1 2 13 14 15 16 17 18 19 20 21 22 23 Clipboard F Font VIX A Service Sales Less: Cost of Sales Gross Profit: Operating expenses Office Salaries Leases Utilities Insurance Depreciation Total Operating Expenses Operating profit (EBIT) Interest expense Earnings before income tax (EBT) Income tax expense Earnings After Taxes *Purchases of laventory & Freight In fx B C Kim's Book Store Income Statement For the period ended 31-Dec-11 $ 90,000 $ 20,000 $ 20,000 $ 3,000 $ 2,000 5 $ 350,000 $149,000 $ 201,000 $ 135,000 $ 66,000 $ 30,000 S 36,000 $ 7,200 $ 28,800 D Alignment $%988 Conditional Format in Formatting Table Styles G Number 19 E F H Kelly's Book Store Income Statement For the period ended 31-Dec-11. $770,000 $ 190,000 $213,000 $ 21,000 $ 12,000 1 $3,500,000 $1,450,000 $2,050,000 $1,206,000 S 844,000 S 80,000 $ 764,000 S 152,800 S 611.200. G Cell Styles K Dedr Format- Cells Undo 118 3 0 1 2 13 14 15 16 17 18 19 20 21 22 23 Clipboard F Font VIX A Service Sales Less: Cost of Sales Gross Profit: Operating expenses Office Salaries Leases Utilities Insurance Depreciation Total Operating Expenses Operating profit (EBIT) Interest expense Earnings before income tax (EBT) Income tax expense Earnings After Taxes *Purchases of laventory & Freight In fx B C Kim's Book Store Income Statement For the period ended 31-Dec-11 $ 90,000 $ 20,000 $ 20,000 $ 3,000 $ 2,000 5 $ 350,000 $149,000 $ 201,000 $ 135,000 $ 66,000 $ 30,000 S 36,000 $ 7,200 $ 28,800 D Alignment $%988 Conditional Format in Formatting Table Styles G Number 19 E F H Kelly's Book Store Income Statement For the period ended 31-Dec-11. $770,000 $ 190,000 $213,000 $ 21,000 $ 12,000 1 $3,500,000 $1,450,000 $2,050,000 $1,206,000 S 844,000 S 80,000 $ 764,000 S 152,800 S 611.200. G Cell Styles K Dedr Format- Cells

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts