Question: Do it on excel or word. so I can understand. Will give positive feedback if you do well Sam Ltd operates a factory which consists

Do it on excel or word. so I can understand. Will give positive feedback if you do well

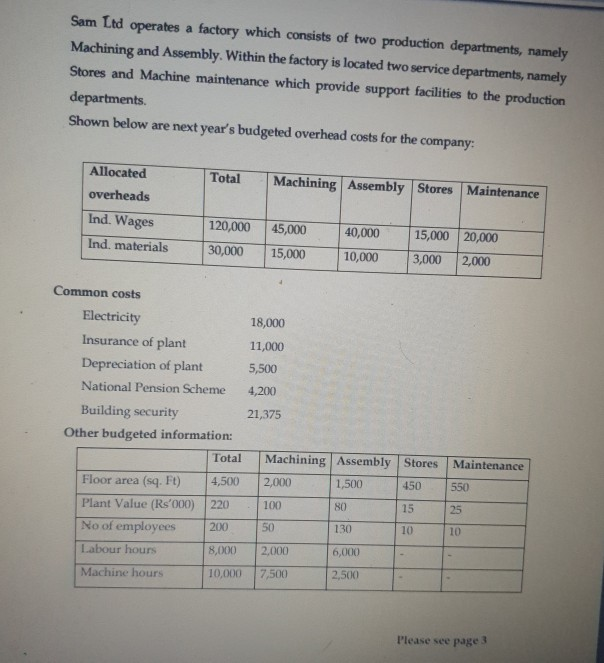

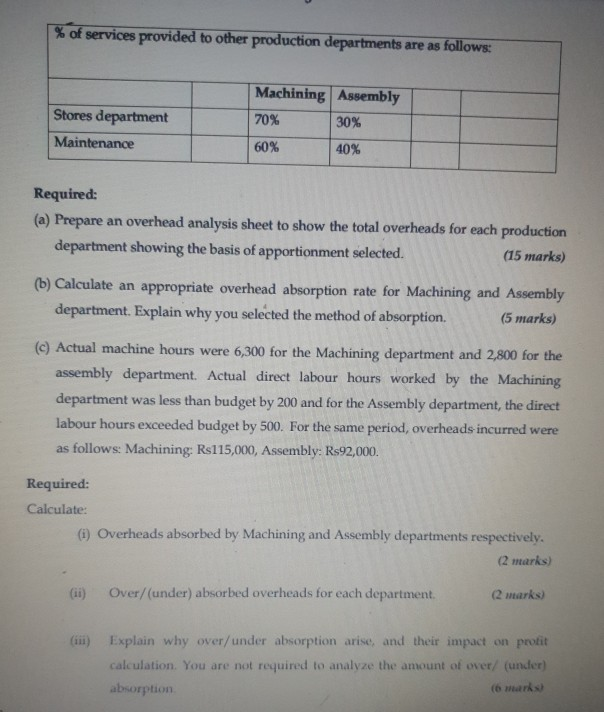

Sam Ltd operates a factory which consists of two production departments, namely Machining and Assembly. Within the factory is located two service departments, namely Stores and Machine maintenance which provide support facilities to the production departments. Shown below are next year's budgeted overhead costs for the company: Total Machining Assembly Stores Maintenance Allocated overheads Ind. Wages Ind. materials 120,000 40,000 45,000 15,000 30,000 15,000 20,000 3,000 2,000 10,000 Common costs Electricity 18,000 Insurance of plant 11,000 Depreciation of plant 5,500 National Pension Scheme 4,200 Building security 21,375 Other budgeted information: Total Machining Assembly Stores Floor area (sq. Ft) 4,500 2,000 1,500 450 Plant Value (Rs'000) 220 100 80 15 No of employees 200 50 130 10 Labour hours 8,000 2,000 6,000 Machine hours 10,000 7,500 2,500 Maintenance 550 25 10 Please see page 3 % of services provided to other production departments are as follows: Machining Assembly 70% 30% Stores department Maintenance 60% 40% Required: (a) Prepare an overhead analysis sheet to show the total overheads for each production department showing the basis of apportionment selected. (15 marks) (b) Calculate an appropriate overhead absorption rate for Machining and Assembly department. Explain why you selected the method of absorption. (5 marks) (c) Actual machine hours were 6,300 for the Machining department and 2,800 for the assembly department. Actual direct labour hours worked by the Machining department was less than budget by 200 and for the Assembly department, the direct labour hours exceeded budget by 500. For the same period, overheads incurred were as follows: Machining: Rs115,000, Assembly: Rs92,000. Required: Calculate: (i) Overheads absorbed by Machining and Assembly departments respectively. (2 marks) Over/(under) absorbed overheads for each department (2 marks) (iii) Explain why over/under absorption arise, and their impact on protit calculation. You are not required to analyze the amount of over/ (under) absorption (6 marks Sam Ltd operates a factory which consists of two production departments, namely Machining and Assembly. Within the factory is located two service departments, namely Stores and Machine maintenance which provide support facilities to the production departments. Shown below are next year's budgeted overhead costs for the company: Total Machining Assembly Stores Maintenance Allocated overheads Ind. Wages Ind. materials 120,000 40,000 45,000 15,000 30,000 15,000 20,000 3,000 2,000 10,000 Common costs Electricity 18,000 Insurance of plant 11,000 Depreciation of plant 5,500 National Pension Scheme 4,200 Building security 21,375 Other budgeted information: Total Machining Assembly Stores Floor area (sq. Ft) 4,500 2,000 1,500 450 Plant Value (Rs'000) 220 100 80 15 No of employees 200 50 130 10 Labour hours 8,000 2,000 6,000 Machine hours 10,000 7,500 2,500 Maintenance 550 25 10 Please see page 3 % of services provided to other production departments are as follows: Machining Assembly 70% 30% Stores department Maintenance 60% 40% Required: (a) Prepare an overhead analysis sheet to show the total overheads for each production department showing the basis of apportionment selected. (15 marks) (b) Calculate an appropriate overhead absorption rate for Machining and Assembly department. Explain why you selected the method of absorption. (5 marks) (c) Actual machine hours were 6,300 for the Machining department and 2,800 for the assembly department. Actual direct labour hours worked by the Machining department was less than budget by 200 and for the Assembly department, the direct labour hours exceeded budget by 500. For the same period, overheads incurred were as follows: Machining: Rs115,000, Assembly: Rs92,000. Required: Calculate: (i) Overheads absorbed by Machining and Assembly departments respectively. (2 marks) Over/(under) absorbed overheads for each department (2 marks) (iii) Explain why over/under absorption arise, and their impact on protit calculation. You are not required to analyze the amount of over/ (under) absorption (6 marksStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts