Question: Do it on this excel template Evaluate the current financial health of the company by presenting your findings of relevant financial information based on a

Do it on this excel template

Do it on this excel template

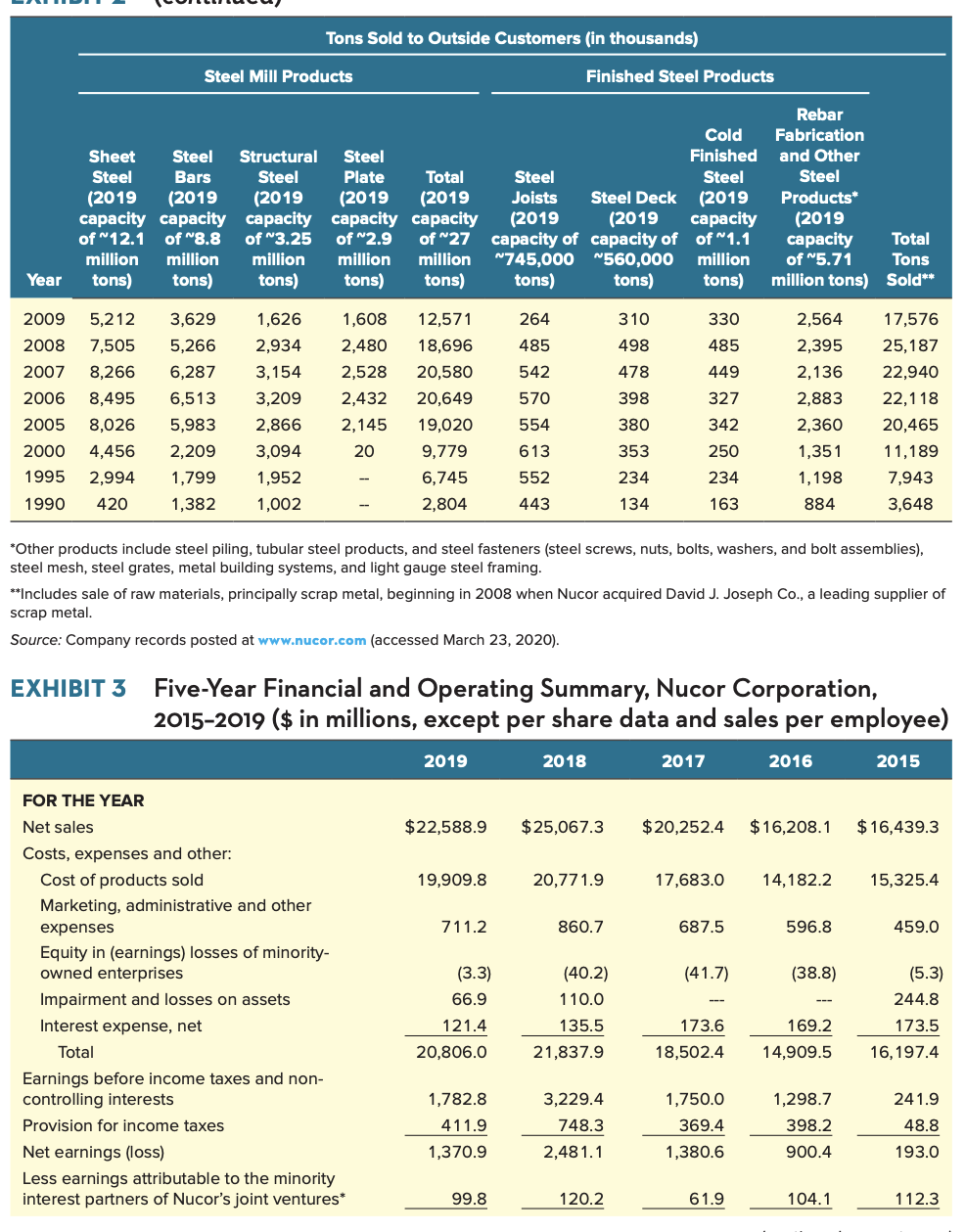

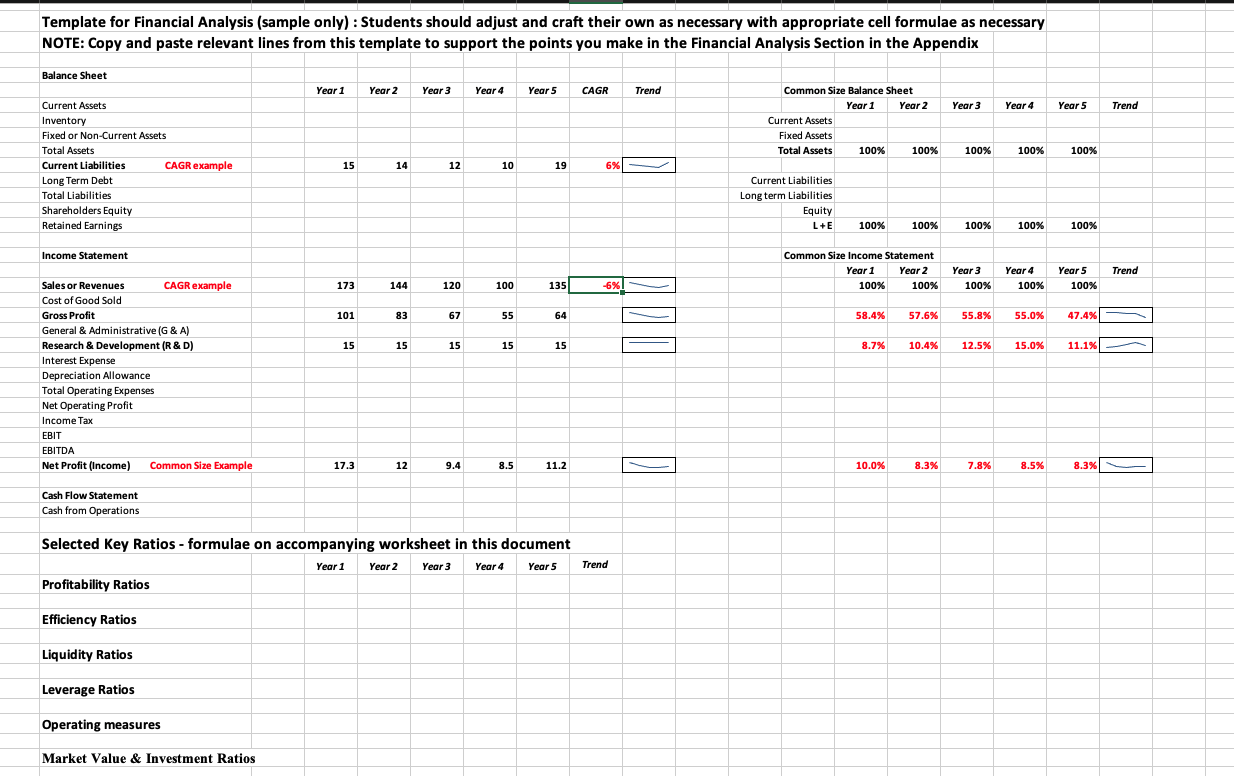

Evaluate the current financial health of the company by presenting your findings of relevant financial information based on a subset of the following: Ratios: 1) liquidity 2) profitability, 3) leverage, 4) efficiency, 5) operating, and 6) market value and investment ratios. (See the template) Also, using trend analysis, and/or common size analysis, and/or longitudinal analysis based on CAGR (Compound Annual Growth Rate see CAGR in Investopedia.com ) to either reinforce staying with the companys status quo or to suggest changes in strategy in light of the results. If applicable, also include competitive financial analysis and/or other relevant financial findings by investigating all quantitative information provided. For each of your calculations or observations note whether a trend is up, down or flat (see template) and note the strategic impact of each finding. A concluding summary statement should address the strategic implications arising from your analysis of the financial health of the company.

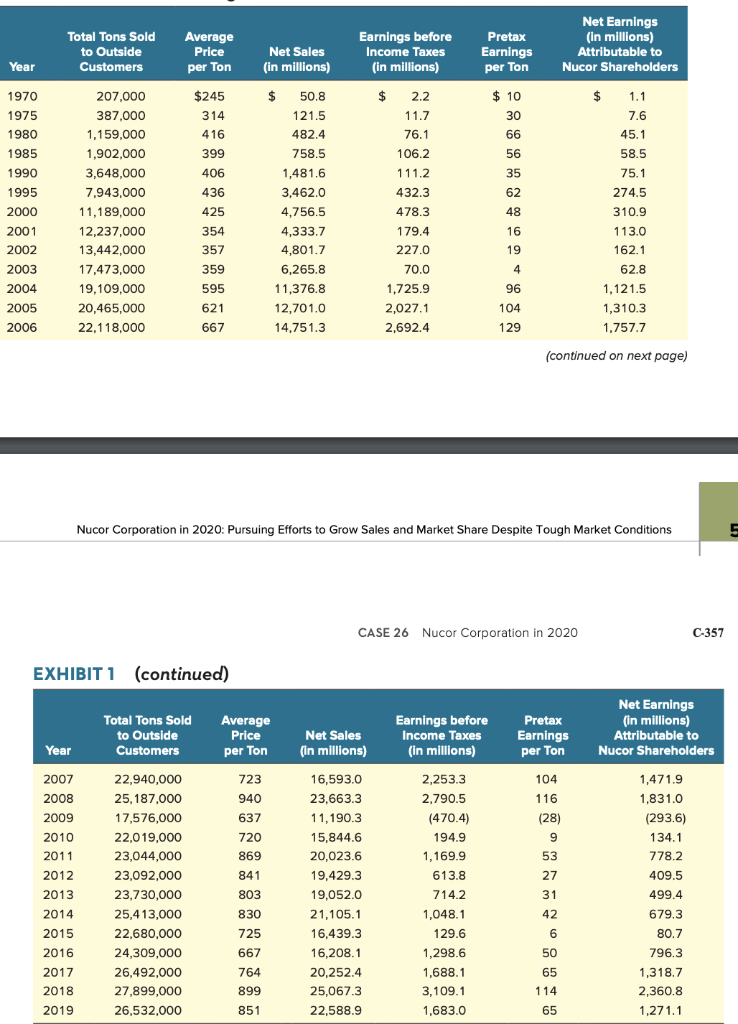

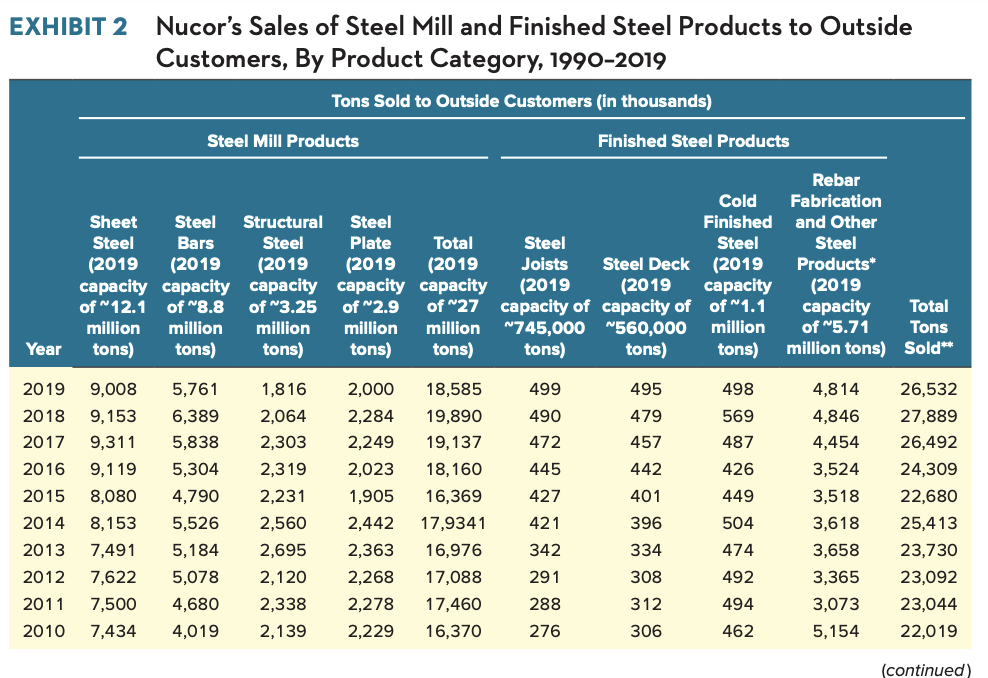

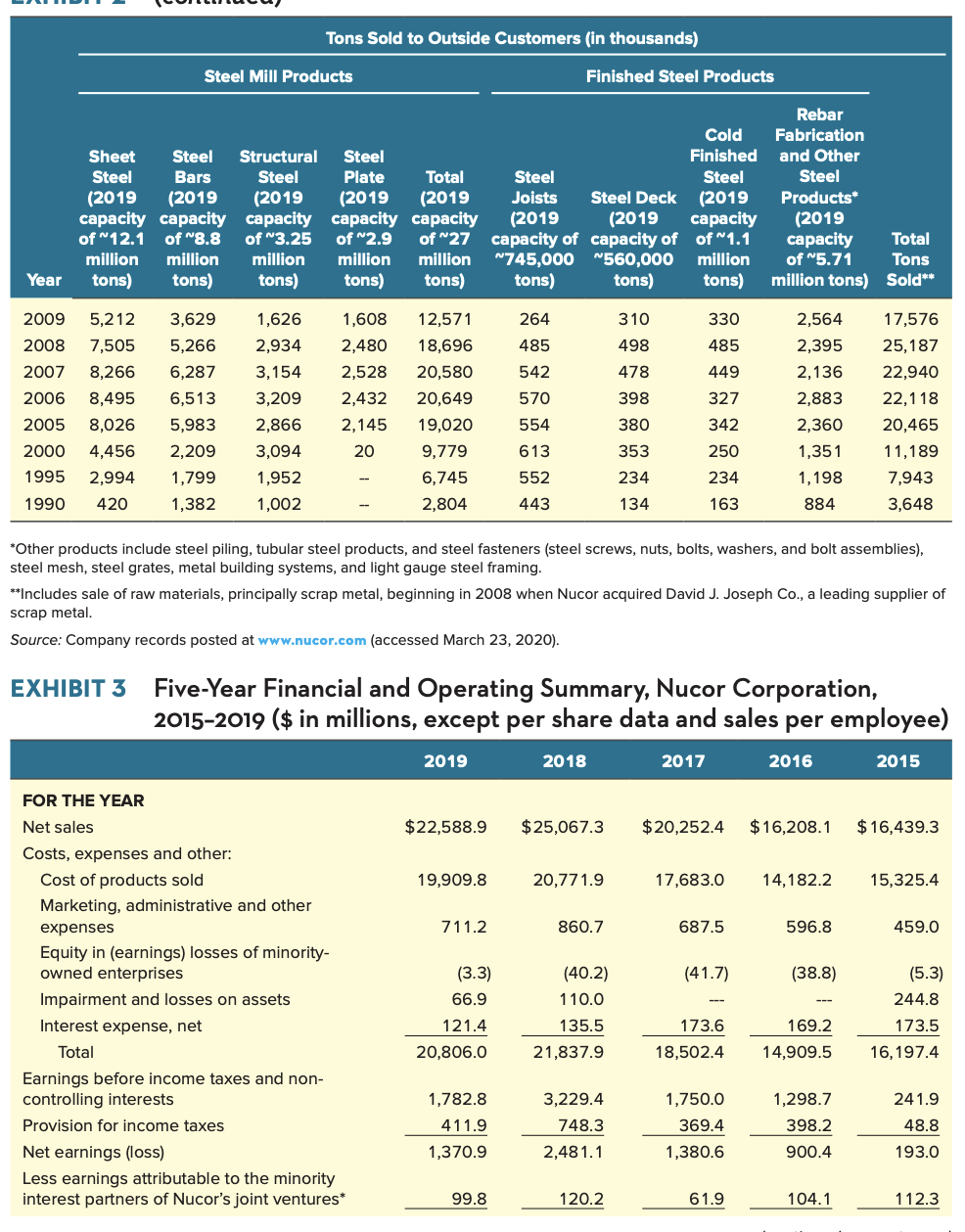

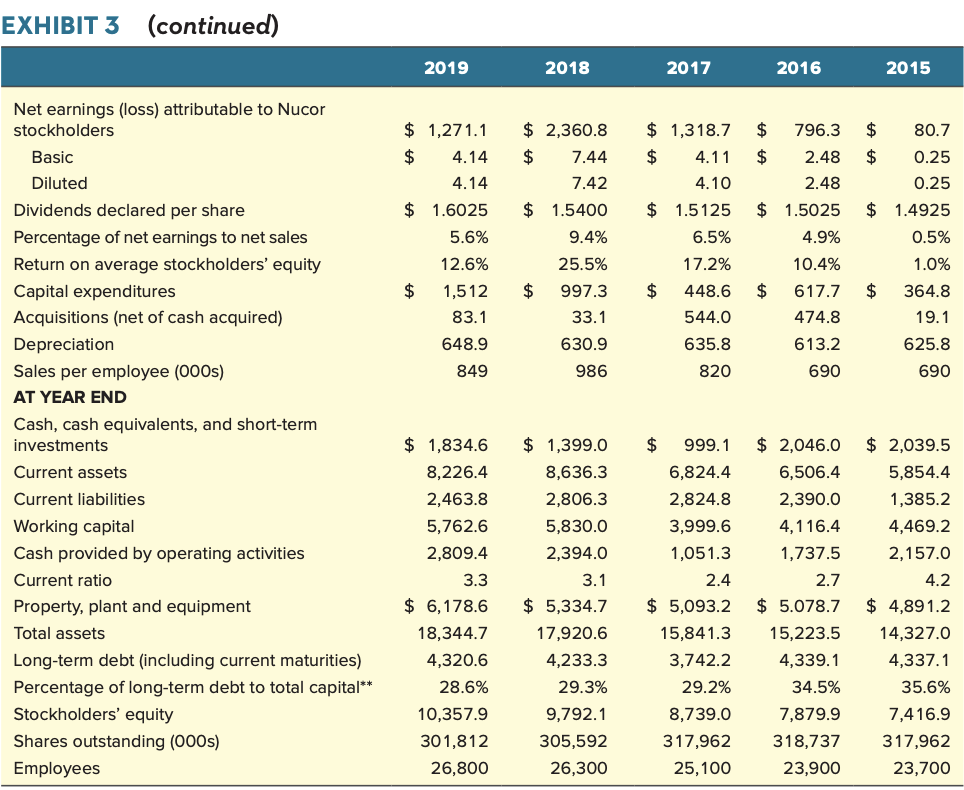

(continued on next page) Nucor Corporation in 2020: Pursuing Efforts to Grow Sales and Market Share Despite Tough Market Conditions CASE 26 Nucor Corporation in 2020 EXHIBIT 1 (continued) EXHIBIT 2 Nucor's Sales of Steel Mill and Finished Steel Products to Outside *Other products include steel piling, tubular steel products, and steel fasteners (steel screws, nuts, bolts, washers, and bolt assemblies), steel mesh, steel grates, metal building systems, and light gauge steel framing. Includes sale of raw materials, principally scrap metal, beginning in 2008 when Nucor acquired David J. Joseph Co., a leading supplier of scrap metal. Source: Company records posted at www.nucor.com (accessed March 23, 2020). EXHIBIT 3 Five-Year Financial and Operating Summary, Nucor Corporation, 2015-2019 (\$ in millions, except per share data and sales per employee) *Other products include steel piling, tubular steel products, and steel fasteners (steel screws, nuts, bolts, washers, and bolt assemblies), steel mesh, steel grates, metal building systems, and light gauge steel framing. Includes sale of raw materials, principally scrap metal, beginning in 2008 when Nucor acquired David J. Joseph Co., a leading supplier of scrap metal. Source: Company records posted at www.nucor.com (accessed March 23, 2020). EXHIBIT 3 Five-Year Financial and Operating Summary, Nucor Corporation, 2015-2019 (\$ in millions, except per share data and sales per employee) EXHIBIT 3 (continued) Template for Financial Analysis (sample only) : Students should adjust and craft their own as necessary with appropriate cell formulae as necessary NOTE: Copy and paste relevant lines from this template to support the points you make in the Financial Analysis Section in the Appendix Balance Sheet \begin{tabular}{|l|l|l|l|l|l|l|} \hline Year 1 & Year 2 & Year 3 & Year 4 & Year 5 & CAGR & Trend \\ \hline \end{tabular} Current Assets Inventory Fixed or Non-Current Assets Total Assets Current Liabilities CAGR example Long Term Debt \begin{tabular}{|l|} \hline Total Liabilities \\ Shareholders Equity \end{tabular} Retained Earnings Income Statement Sales or Revenues CAGR example Cost of Good Sold Gross Profit General \& Administrative (G \& A) Research \& Development (R \& D) Interest Expense Depreciation Allowance Total Operating Expenses Net Operating Profit Income Tax EBIT EBITDA Net Profit (Income) Common Size Example Cash Flow Statement Cash from Operations Selected Key Ratios - formulae on accompanying worksheet in this document Profitability Ratio Efficiency Ratios Liquidity Ratios Leverage Ratios Operating measures Market Value \& Investment Ratios (continued on next page) Nucor Corporation in 2020: Pursuing Efforts to Grow Sales and Market Share Despite Tough Market Conditions CASE 26 Nucor Corporation in 2020 EXHIBIT 1 (continued) EXHIBIT 2 Nucor's Sales of Steel Mill and Finished Steel Products to Outside *Other products include steel piling, tubular steel products, and steel fasteners (steel screws, nuts, bolts, washers, and bolt assemblies), steel mesh, steel grates, metal building systems, and light gauge steel framing. Includes sale of raw materials, principally scrap metal, beginning in 2008 when Nucor acquired David J. Joseph Co., a leading supplier of scrap metal. Source: Company records posted at www.nucor.com (accessed March 23, 2020). EXHIBIT 3 Five-Year Financial and Operating Summary, Nucor Corporation, 2015-2019 (\$ in millions, except per share data and sales per employee) *Other products include steel piling, tubular steel products, and steel fasteners (steel screws, nuts, bolts, washers, and bolt assemblies), steel mesh, steel grates, metal building systems, and light gauge steel framing. Includes sale of raw materials, principally scrap metal, beginning in 2008 when Nucor acquired David J. Joseph Co., a leading supplier of scrap metal. Source: Company records posted at www.nucor.com (accessed March 23, 2020). EXHIBIT 3 Five-Year Financial and Operating Summary, Nucor Corporation, 2015-2019 (\$ in millions, except per share data and sales per employee) EXHIBIT 3 (continued) Template for Financial Analysis (sample only) : Students should adjust and craft their own as necessary with appropriate cell formulae as necessary NOTE: Copy and paste relevant lines from this template to support the points you make in the Financial Analysis Section in the Appendix Balance Sheet \begin{tabular}{|l|l|l|l|l|l|l|} \hline Year 1 & Year 2 & Year 3 & Year 4 & Year 5 & CAGR & Trend \\ \hline \end{tabular} Current Assets Inventory Fixed or Non-Current Assets Total Assets Current Liabilities CAGR example Long Term Debt \begin{tabular}{|l|} \hline Total Liabilities \\ Shareholders Equity \end{tabular} Retained Earnings Income Statement Sales or Revenues CAGR example Cost of Good Sold Gross Profit General \& Administrative (G \& A) Research \& Development (R \& D) Interest Expense Depreciation Allowance Total Operating Expenses Net Operating Profit Income Tax EBIT EBITDA Net Profit (Income) Common Size Example Cash Flow Statement Cash from Operations Selected Key Ratios - formulae on accompanying worksheet in this document Profitability Ratio Efficiency Ratios Liquidity Ratios Leverage Ratios Operating measures Market Value \& Investment Ratios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts