Question: DO NOT ANSWER IN EXCEL PLEASE, THIS IS PAPER TEST Question 1. Answer all parts I. Consider the following three bonds Par Value Coupon Time

DO NOT ANSWER IN EXCEL PLEASE, THIS IS PAPER TEST

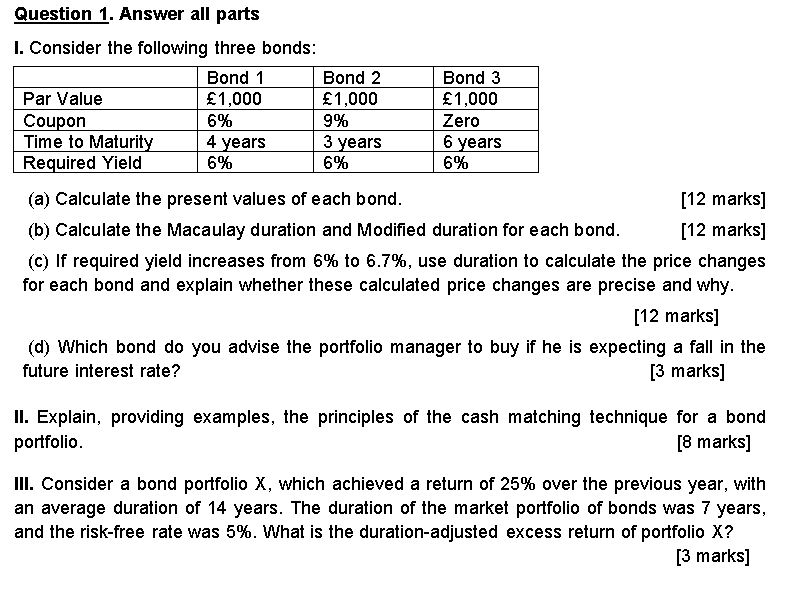

Question 1. Answer all parts I. Consider the following three bonds Par Value Coupon Time to Maturity Required Yield Bond 1 1,000 6% 4 years 6% Bond 2 1,000 9% 3 years 6% Bond 3 1,000 Zero 6 years 6% (a) Calculate the present values of each bond (b) Calculate the Macaulay duration and Modified duration for each bond [12 marks] [12 marks] (c) If required yield increases from 6% to 6.7%, use duration to calculate the price changes for each bond and explain whether these calculated price changes are precise and why [12 marks] (d) Which bond do you advise the portfolio manager to buy if he is expecting a fall in the uture interest rate? [3 marks] II. Explain, providing examples, the principles of the cash matching technique for a bond portfolio [8 marks] Ill. Consider a bond portfolio X, which achieved a return of 25% over the previous year, with an average duration of 14 years. The duration of the market portfolio of bonds was 7 years, and the risk-free rate was 5%. What is the duration-adjusted excess return of portfolio X? [3 marks] Question 1. Answer all parts I. Consider the following three bonds Par Value Coupon Time to Maturity Required Yield Bond 1 1,000 6% 4 years 6% Bond 2 1,000 9% 3 years 6% Bond 3 1,000 Zero 6 years 6% (a) Calculate the present values of each bond (b) Calculate the Macaulay duration and Modified duration for each bond [12 marks] [12 marks] (c) If required yield increases from 6% to 6.7%, use duration to calculate the price changes for each bond and explain whether these calculated price changes are precise and why [12 marks] (d) Which bond do you advise the portfolio manager to buy if he is expecting a fall in the uture interest rate? [3 marks] II. Explain, providing examples, the principles of the cash matching technique for a bond portfolio [8 marks] Ill. Consider a bond portfolio X, which achieved a return of 25% over the previous year, with an average duration of 14 years. The duration of the market portfolio of bonds was 7 years, and the risk-free rate was 5%. What is the duration-adjusted excess return of portfolio X? [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts