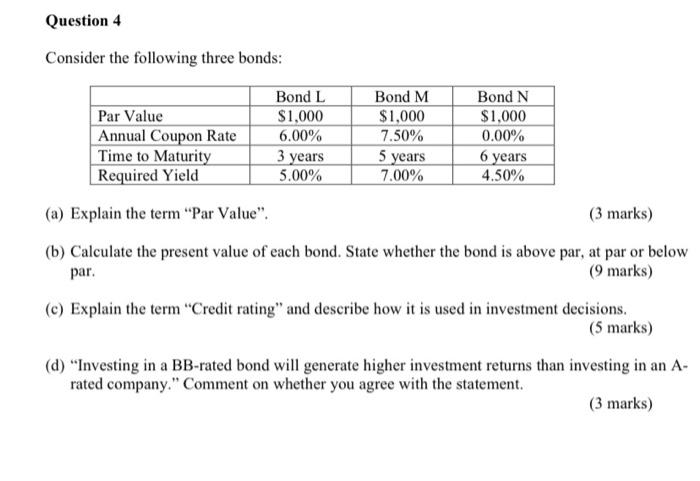

Question: Question 4 Consider the following three bonds: Par Value Annual Coupon Rate Time to Maturity Required Yield Bond L $1,000 6.00% 3 years 5.00% Bond

Question 4 Consider the following three bonds: Par Value Annual Coupon Rate Time to Maturity Required Yield Bond L $1,000 6.00% 3 years 5.00% Bond M $1,000 7.50% 5 years 7.00% Bond N $1,000 0.00% 6 years 4.50% (a) Explain the term "Par Value". (3 marks) (b) Calculate the present value of each bond. State whether the bond is above par, at par or below par. (9 marks) (c) Explain the term "Credit rating and describe how it is used in investment decisions. (5 marks) (d) Investing in a BB-rated bond will generate higher investment returns than investing in an A- rated company." Comment on whether you agree with the statement

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock