Question: Do not copy and paste solution from other resouces because the numbers are different. Do not copy and paste solution from other resouces because the

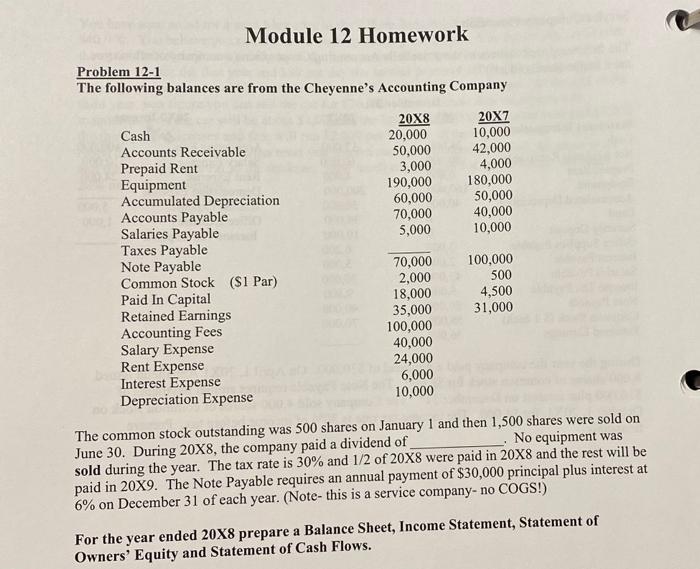

Module 12 Homework Problem 12-1 The following balances are from the Cheyenne's Accounting Company 20X8 20X7 Cash 20,000 10,000 Accounts Receivable 50,000 42,000 Prepaid Rent 3,000 4,000 Equipment 190,000 180,000 Accumulated Depreciation 60,000 50,000 Accounts Payable 70,000 40,000 Salaries Payable 5,000 10,000 Taxes Payable Note Payable 70,000 100,000 Common Stock ($1 Par) 2,000 Paid In Capital 18,000 4,500 Retained Earnings 35,000 31,000 Accounting Fees 100,000 Salary Expense 40,000 Rent Expense 24,000 Interest Expense Depreciation Expense 10,000 500 6,000 The common stock outstanding was 500 shares on January 1 and then 1,500 shares were sold on June 30. During 20X8, the company paid a dividend of No equipment was sold during the year. The tax rate is 30% and 1/2 of 20X8 were paid in 20X8 and the rest will be paid in 20X9. The Note Payable requires an annual payment of $30,000 principal plus interest at 6% on December 31 of each year. (Note- this is a service company- no COGS!) For the year ended 20X8 prepare a Balance Sheet, Income Statement, Statement of Owners' Equity and Statement of Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts