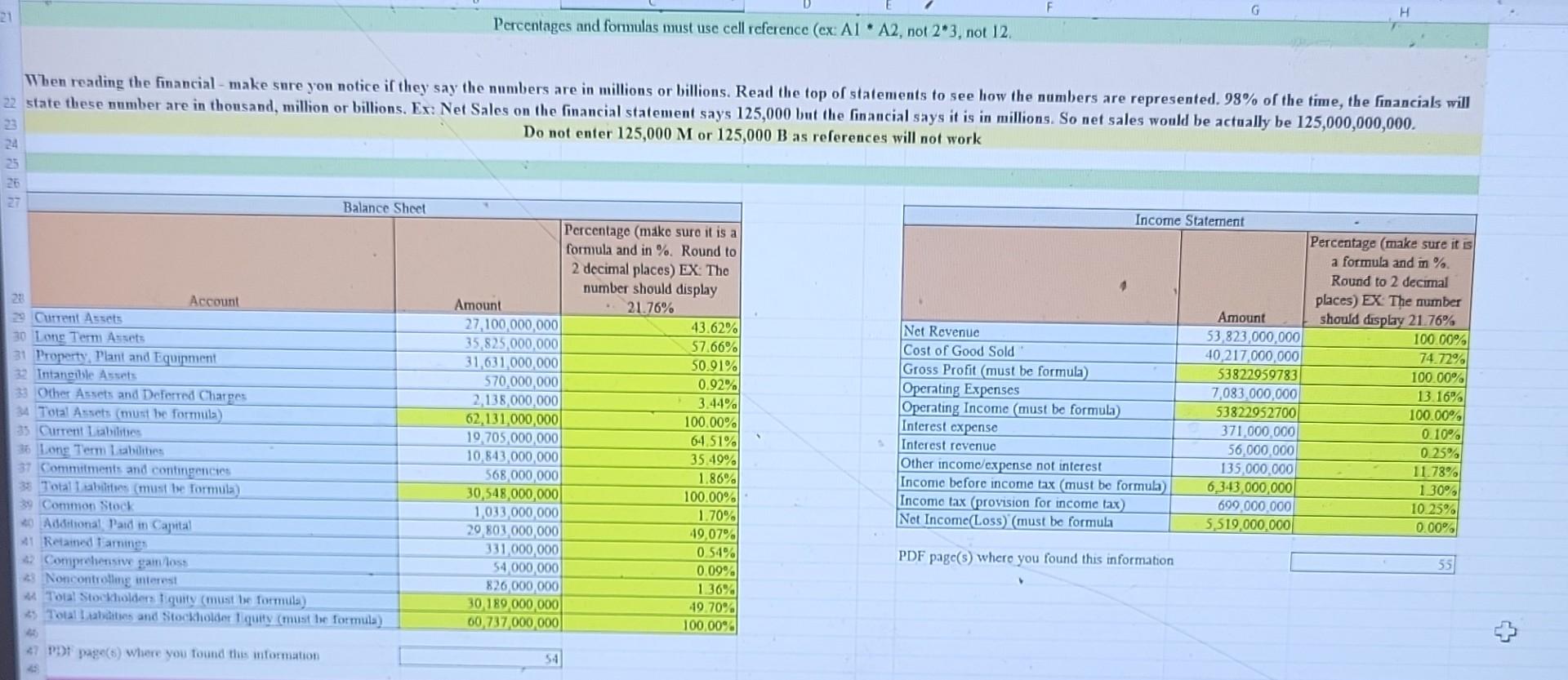

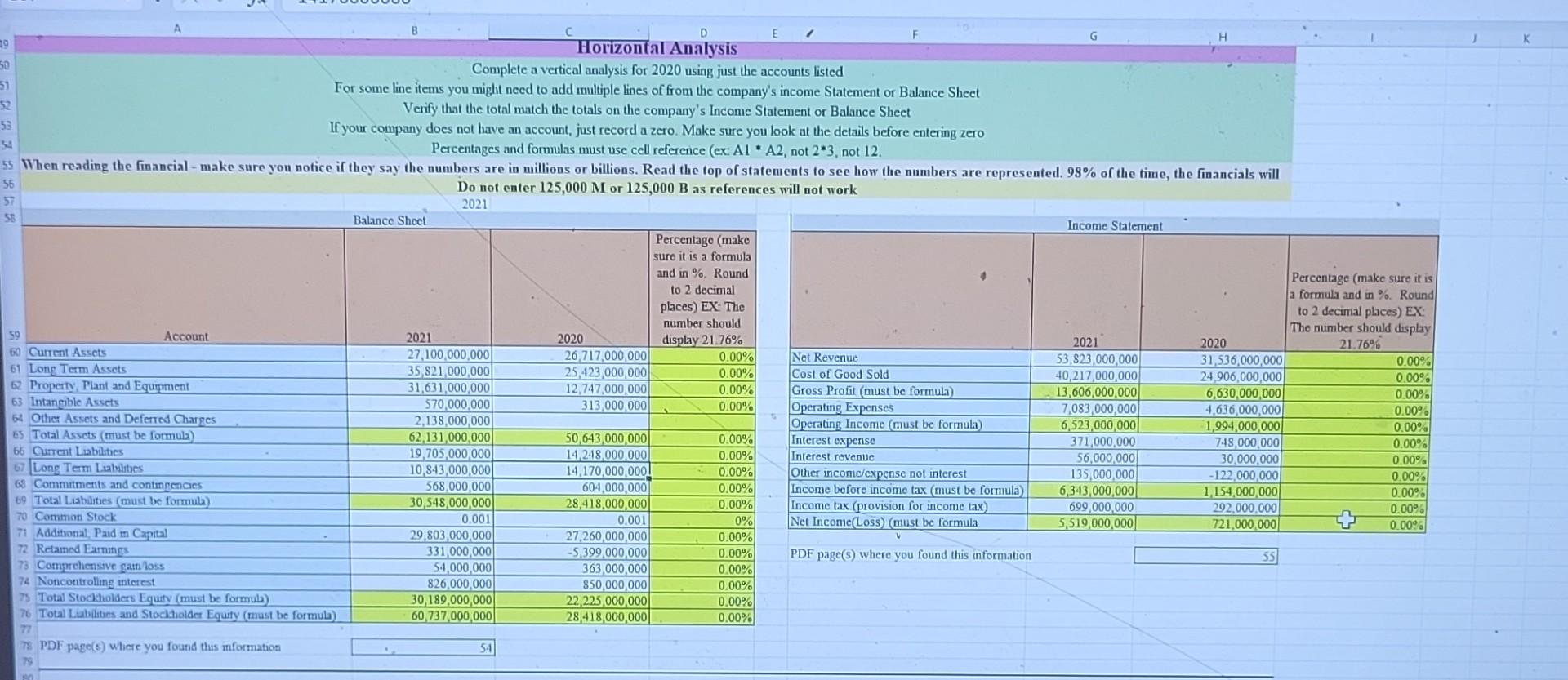

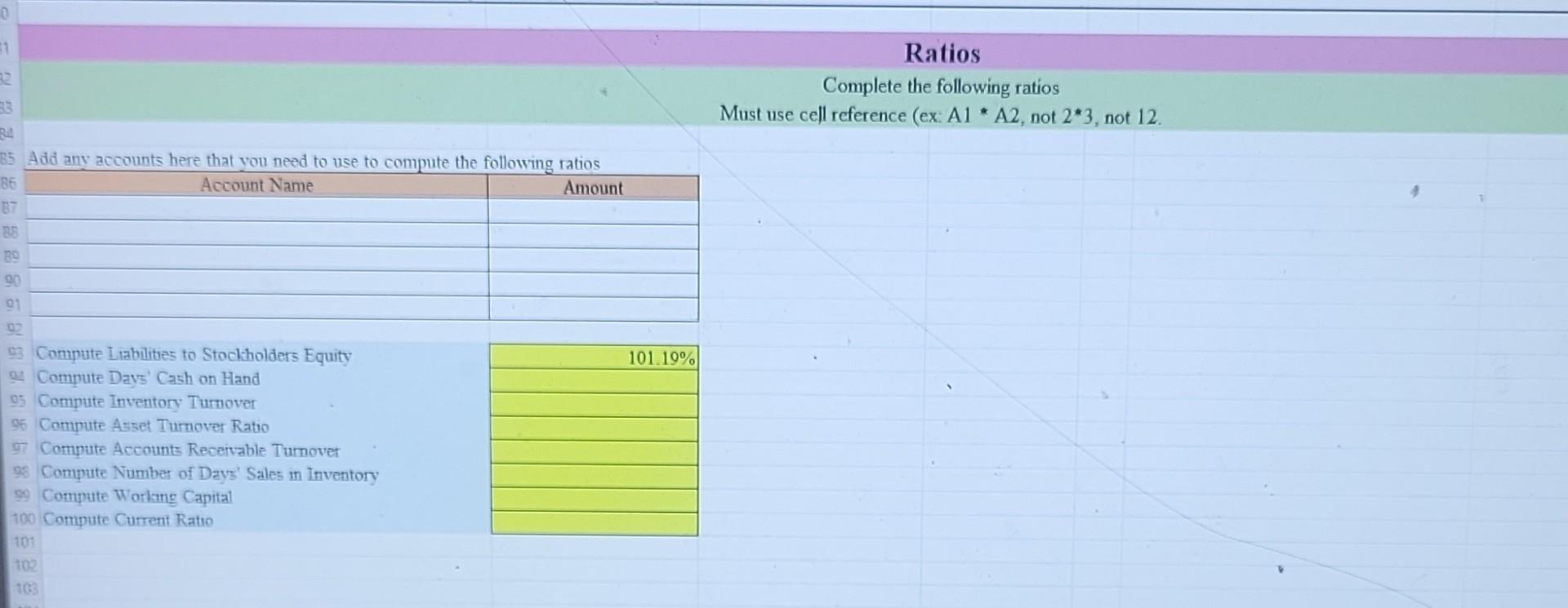

Question: Do not enter 125,000M or 125,000B as references will not work PDF page(s) where you found this information 55 Add any accounts here that you

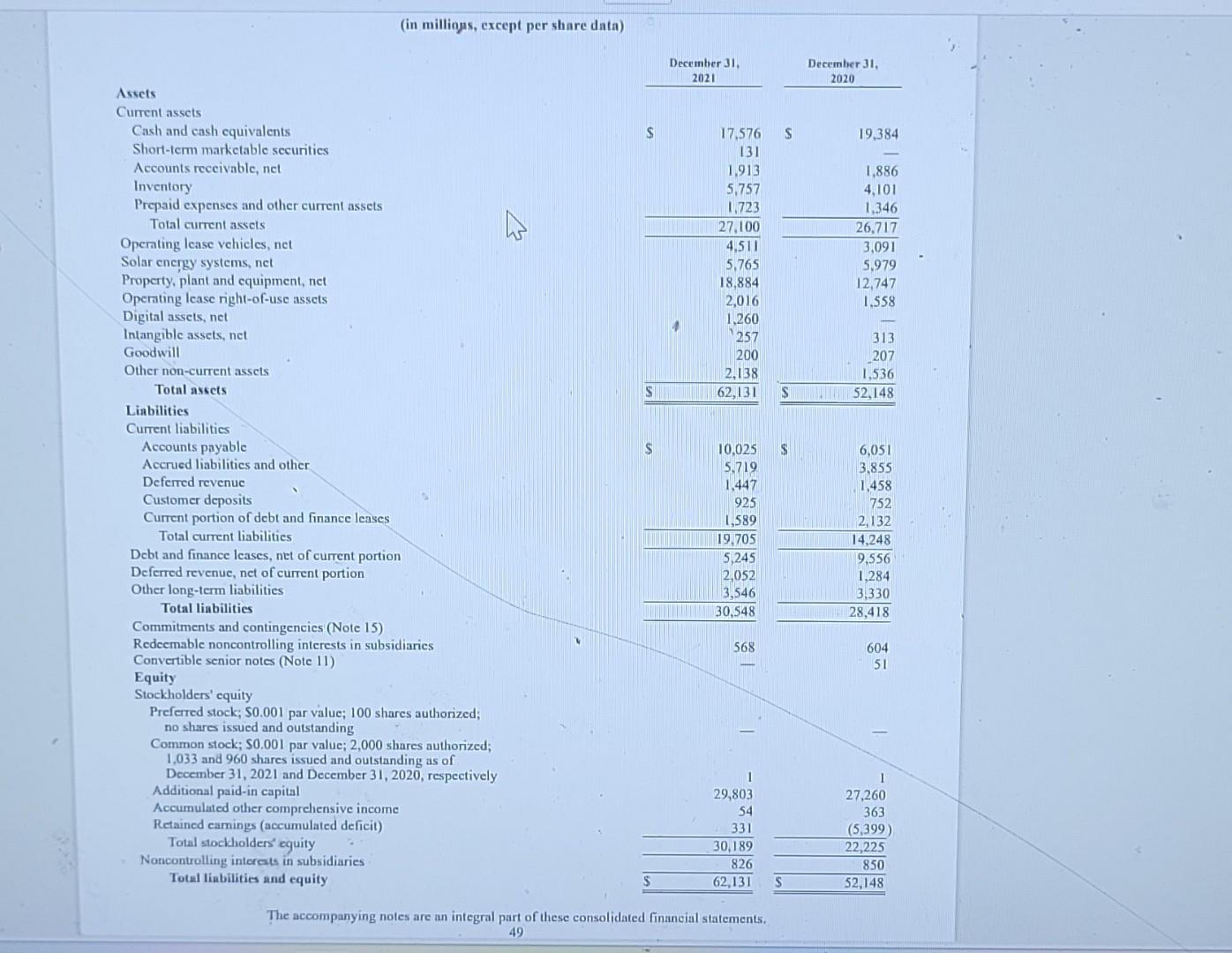

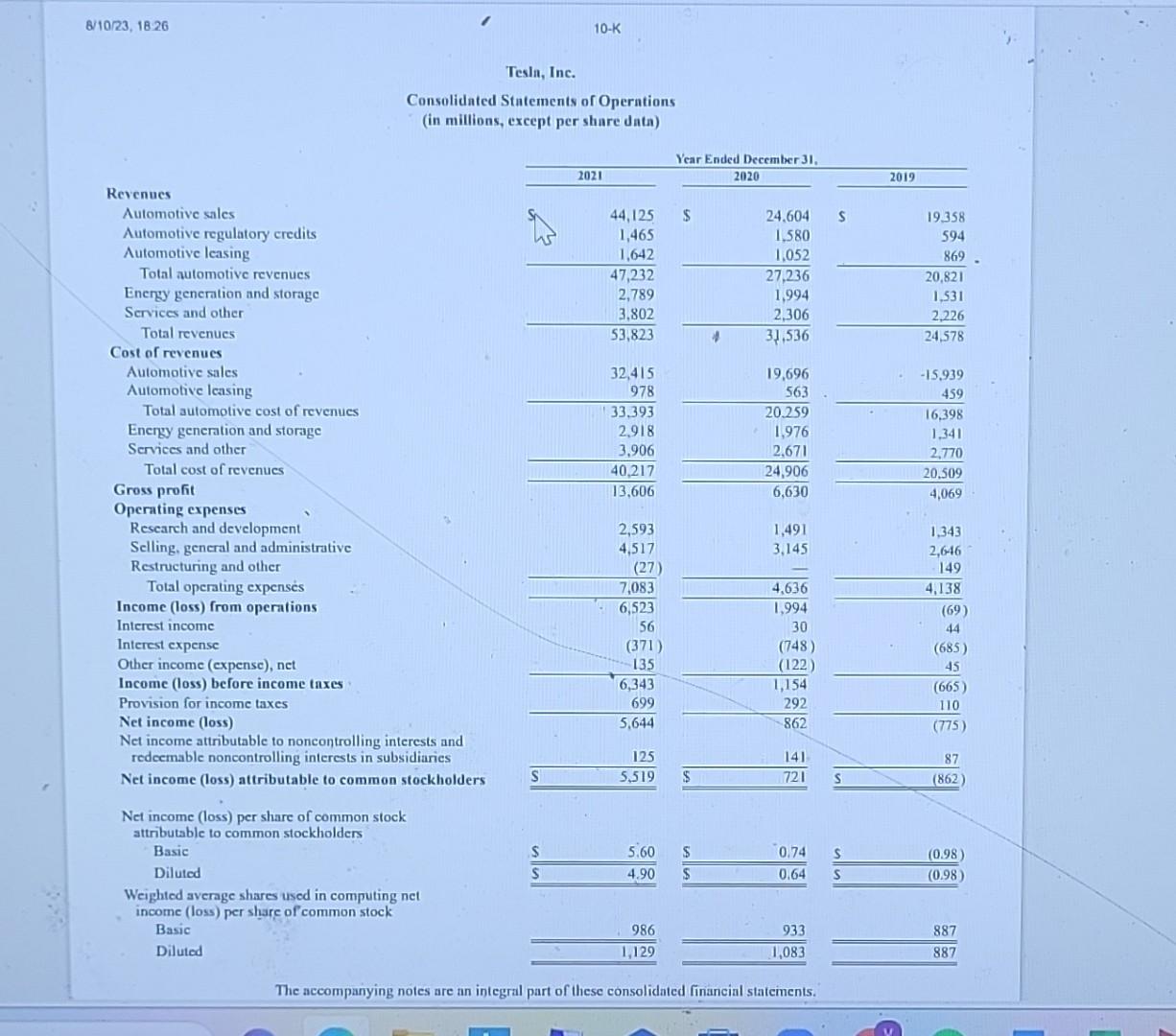

Do not enter 125,000M or 125,000B as references will not work PDF page(s) where you found this information 55 Add any accounts here that you need to use to compute the following ratios 8/10/23,18.26 Tesla, Inc. Consolidated Statements of Operations (in millions, except per share data) Year Ended December 31 . Revenues Automotive sales Automotive regulatory credits Automotive leasing Total automotive revenues Energy generation and storage Services and other Total revenues Cost of revenues Automotive sales Automotive leasing Total automotive cost of revenues Energy generation and storage Services and other Total cost of revenues Gross profit Operating expenses Research and development Selling, general and administrative Restructuring and other Total operating expenss Income (loss) from operations Interest income Interest expense Other income (expense), net Income (loss) before income taxes Provision for income taxes Net income (loss) Net income attributable to noncontrolling interests and redecmable noncontrolling interests in subsidiaries Net income (loss) attributable to common stockholders Net income (loss) per share of common stock attributable to common stockholders Basic Diluted Weighted average shares used in computing net income (loss) per share of common stock Basic Diluted \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{2021} \\ \hline S. & 44,125 \\ \hline & 1,465 \\ \hline & 1,642 \\ \hline & 47,232 \\ \hline & 2,789 \\ \hline & 3,802 \\ \hline & 53,823 \\ \hline & 32,415 \\ \hline & 978 \\ \hline & 33,393 \\ \hline & 2,918 \\ \hline & 3,906 \\ \hline & 40,217 \\ \hline & 13,606 \\ \hline & 2,593 \\ \hline & 4,517 \\ \hline & (27) \\ \hline & 7,083 \\ \hline & 6,523 \\ \hline & 56 \\ \hline & (371) \\ \hline & -135 \\ \hline & 6,343 \\ \hline & 699 \\ \hline & 5,644 \\ \hline & 125 \\ \hline s & 5,519 \\ \hline \end{tabular} \begin{tabular}{lr} $ & 5.60 \\ \hline 5 & 4.90 \\ \hline \end{tabular} 9861,129 \begin{tabular}{rr} & 2020 \\ \hline$ & 24,604 \\ & 1,580 \\ & 1,052 \\ & 27,236 \\ & 1,994 \\ & 2,306 \\ & 31,536 \end{tabular} 19,696 19,69656320.2591,9762,67124,9066,630 1,491 3,145 1,4913,1454,6361,99430(748)(122)1,154292862 \begin{tabular}{ll} $ & 0.74 \\ \hline$ & 0.64 \\ \hline \end{tabular} 9331,083 2019 S 19,358 594 59486920,8211,5312,22624,578 15,93945916,3981,3412,77020,5094,069 1,3432,6461494,138(69)44(685)45(665)110(775) \begin{tabular}{ll} s & (0.98) \\ \hline \hlines & (0.98) \\ \hline \hline \end{tabular} 887887 The accompanying notes are an integral part of these consolidated financial statements. (in milliogs, except per share data) Do not enter 125,000M or 125,000B as references will not work PDF page(s) where you found this information 55 Add any accounts here that you need to use to compute the following ratios 8/10/23,18.26 Tesla, Inc. Consolidated Statements of Operations (in millions, except per share data) Year Ended December 31 . Revenues Automotive sales Automotive regulatory credits Automotive leasing Total automotive revenues Energy generation and storage Services and other Total revenues Cost of revenues Automotive sales Automotive leasing Total automotive cost of revenues Energy generation and storage Services and other Total cost of revenues Gross profit Operating expenses Research and development Selling, general and administrative Restructuring and other Total operating expenss Income (loss) from operations Interest income Interest expense Other income (expense), net Income (loss) before income taxes Provision for income taxes Net income (loss) Net income attributable to noncontrolling interests and redecmable noncontrolling interests in subsidiaries Net income (loss) attributable to common stockholders Net income (loss) per share of common stock attributable to common stockholders Basic Diluted Weighted average shares used in computing net income (loss) per share of common stock Basic Diluted \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{2021} \\ \hline S. & 44,125 \\ \hline & 1,465 \\ \hline & 1,642 \\ \hline & 47,232 \\ \hline & 2,789 \\ \hline & 3,802 \\ \hline & 53,823 \\ \hline & 32,415 \\ \hline & 978 \\ \hline & 33,393 \\ \hline & 2,918 \\ \hline & 3,906 \\ \hline & 40,217 \\ \hline & 13,606 \\ \hline & 2,593 \\ \hline & 4,517 \\ \hline & (27) \\ \hline & 7,083 \\ \hline & 6,523 \\ \hline & 56 \\ \hline & (371) \\ \hline & -135 \\ \hline & 6,343 \\ \hline & 699 \\ \hline & 5,644 \\ \hline & 125 \\ \hline s & 5,519 \\ \hline \end{tabular} \begin{tabular}{lr} $ & 5.60 \\ \hline 5 & 4.90 \\ \hline \end{tabular} 9861,129 \begin{tabular}{rr} & 2020 \\ \hline$ & 24,604 \\ & 1,580 \\ & 1,052 \\ & 27,236 \\ & 1,994 \\ & 2,306 \\ & 31,536 \end{tabular} 19,696 19,69656320.2591,9762,67124,9066,630 1,491 3,145 1,4913,1454,6361,99430(748)(122)1,154292862 \begin{tabular}{ll} $ & 0.74 \\ \hline$ & 0.64 \\ \hline \end{tabular} 9331,083 2019 S 19,358 594 59486920,8211,5312,22624,578 15,93945916,3981,3412,77020,5094,069 1,3432,6461494,138(69)44(685)45(665)110(775) \begin{tabular}{ll} s & (0.98) \\ \hline \hlines & (0.98) \\ \hline \hline \end{tabular} 887887 The accompanying notes are an integral part of these consolidated financial statements. (in milliogs, except per share data)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts