Question: . (Do not include units in your answer. Include negative sign if necessary.) First Bank has a return on assets of 1.5%. It has equity

.

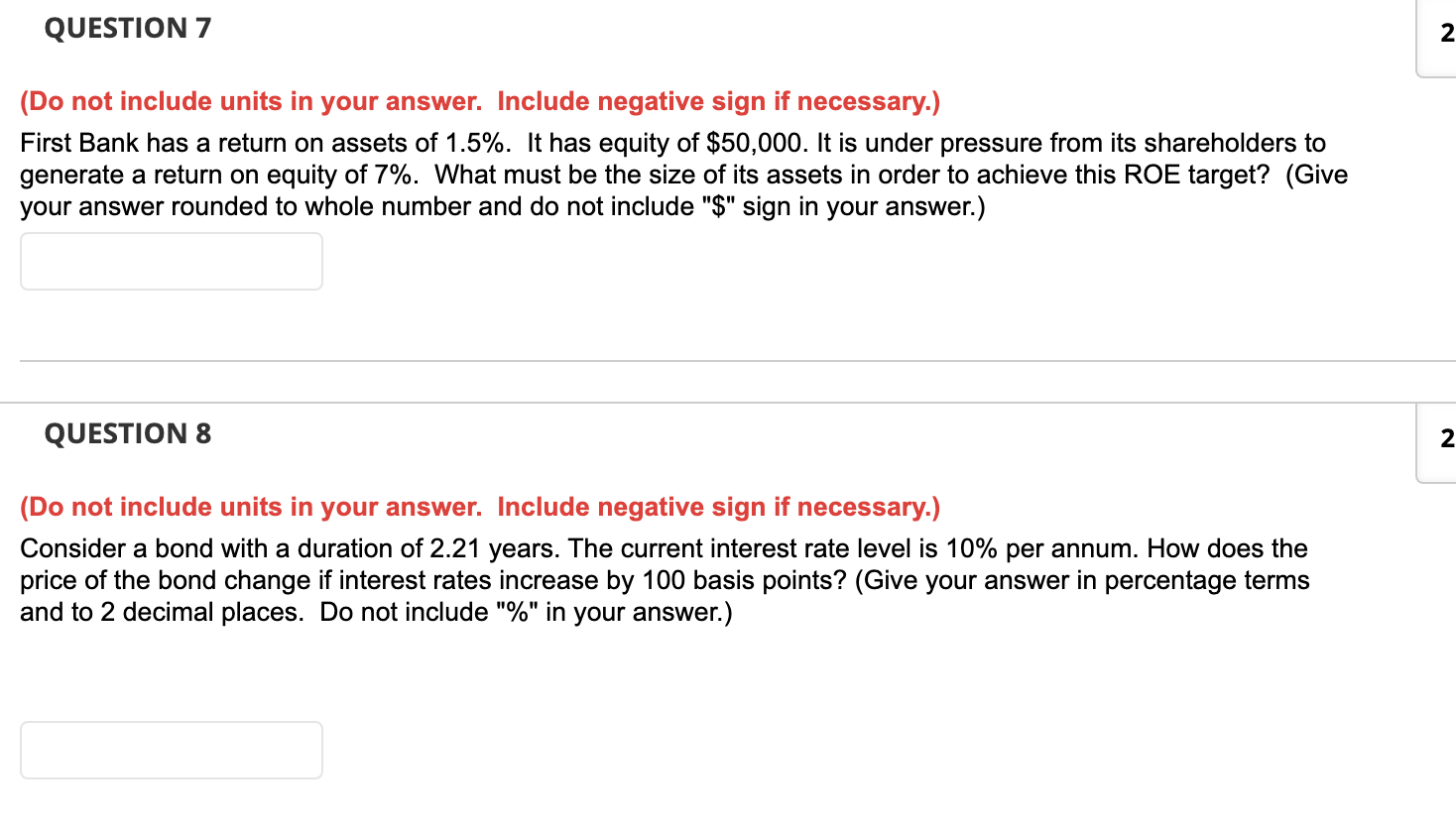

(Do not include units in your answer. Include negative sign if necessary.) First Bank has a return on assets of 1.5%. It has equity of $50,000. It is under pressure from its shareholders to generate a return on equity of 7%. What must be the size of its assets in order to achieve this ROE target? (Give your answer rounded to whole number and do not include "\$" sign in your answer.) QUESTION 8 (Do not include units in your answer. Include negative sign if necessary.) Consider a bond with a duration of 2.21 years. The current interest rate level is 10% per annum. How does the price of the bond change if interest rates increase by 100 basis points? (Give your answer in percentage terms and to 2 decimal places. Do not include "\%" in your answer.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts