Question: Do not key in using percentages. Example: 34.16851% correct to 4 decimal places is 0.3417. bond value=1000 (20 marks) The U.S. Treasury note yield curve

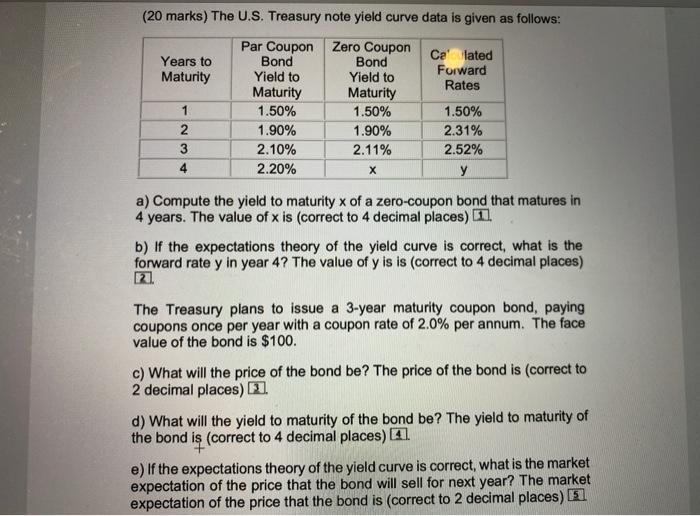

(20 marks) The U.S. Treasury note yield curve data is given as follows: Years to Maturity Celated Forward Rates 1 2 3 4 Par Coupon Bond Yield to Maturity 1.50% 1.90% 2.10% 2.20% Zero Coupon Bond Yield to Maturity 1.50% 1.90% 2.11% 1.50% 2.31% 2.52% y a) Compute the yield to maturity x of a zero-coupon bond that matures in 4 years. The value of x is (correct to 4 decimal places) 1. b) If the expectations theory of the yield curve is correct, what is the forward rate y in year 4? The value of y is is correct to 4 decimal places) The Treasury plans to issue a 3-year maturity coupon bond, paying coupons once per year with a coupon rate of 2.0% per annum. The face value of the bond is $100. c) What will the price of the bond be? The price of the bond is (correct to 2 decimal places) 2 d) What will the yield to maturity of the bond be? The yield to maturity of the bond is (correct to 4 decimal places) A. e) If the expectations theory of the yield curve is correct, what is the market expectation of the price that the bond will sell for next year? The market expectation of the price that the bond is (correct to 2 decimal places) (20 marks) The U.S. Treasury note yield curve data is given as follows: Years to Maturity Celated Forward Rates 1 2 3 4 Par Coupon Bond Yield to Maturity 1.50% 1.90% 2.10% 2.20% Zero Coupon Bond Yield to Maturity 1.50% 1.90% 2.11% 1.50% 2.31% 2.52% y a) Compute the yield to maturity x of a zero-coupon bond that matures in 4 years. The value of x is (correct to 4 decimal places) 1. b) If the expectations theory of the yield curve is correct, what is the forward rate y in year 4? The value of y is is correct to 4 decimal places) The Treasury plans to issue a 3-year maturity coupon bond, paying coupons once per year with a coupon rate of 2.0% per annum. The face value of the bond is $100. c) What will the price of the bond be? The price of the bond is (correct to 2 decimal places) 2 d) What will the yield to maturity of the bond be? The yield to maturity of the bond is (correct to 4 decimal places) A. e) If the expectations theory of the yield curve is correct, what is the market expectation of the price that the bond will sell for next year? The market expectation of the price that the bond is (correct to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts