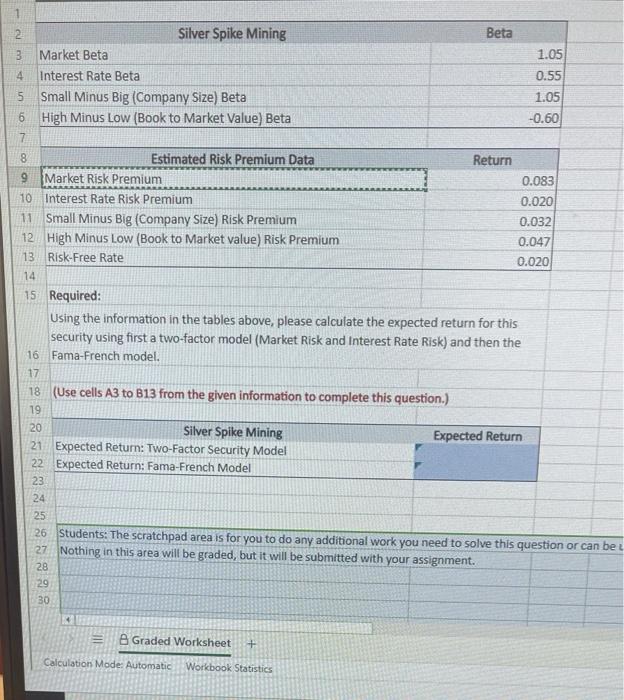

Question: Solve to find the expected return for both options cells B21 & B22. Its important to show the formulas and cells used to find the

1 un 2 Silver Spike Mining Beta 3 Market Beta 1.05 4 Interest Rate Beta 0.55 5 Small Minus Big (Company Size) Beta 1.05 6 High Minus Low (Book to Market Value) Beta -0.60 7 8 Estimated Risk Premium Data Return 9 Market Risk Premium 0.083 10 Interest Rate Risk Premium 0.020 11 Small Minus Big (Company Size) Risk Premium 0.032 12 High Minus Low (Book to Market value) Risk Premium 0.047 13 Risk-Free Rate 0.020 14 15 Required: Using the information in the tables above, please calculate the expected return for this security using first a two-factor model (Market Risk and Interest Rate Risk) and then the 16 Fama-French model. 17 18 (Use cells A3 to 313 from the given information to complete this question.) 19 20 Silver Spike Mining Expected Return 21 Expected Return: Two-Factor Security Model 22 Expected Return: Fama-French Model 23 24 25 26 Students: The scratchpad area is for you to do any additional work you need to solve this question or can be 27 Nothing in this area will be graded, but it will be submitted with your assignment. 28 29 30 B Graded Worksheet + Calculations Mode: Automatic Workbook Statistics

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts