Question: Do not post handwritten work! Show typed explanations and work calculations. Blossom Clark opened Blossom's Cleaning Service on July 1, 2022. During July, the following

Do not post handwritten work! Show typed explanations and work calculations.

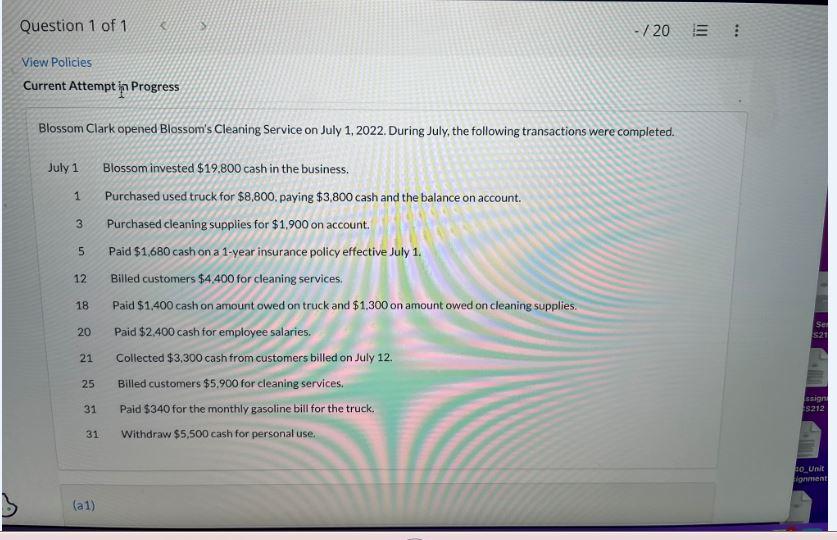

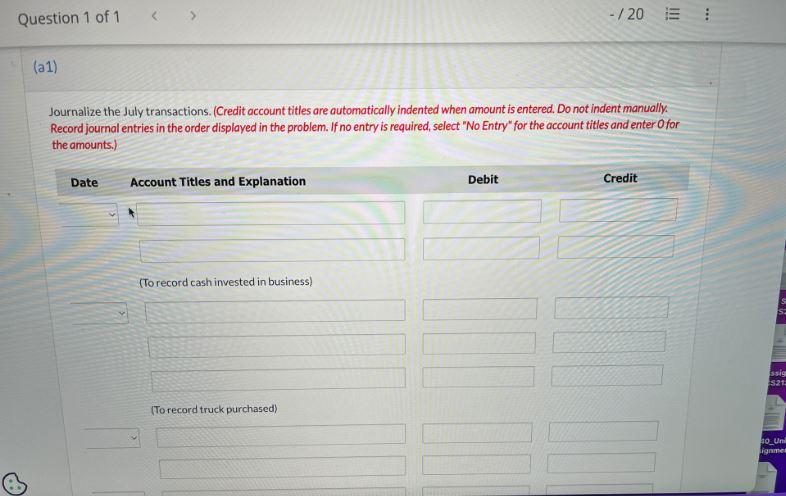

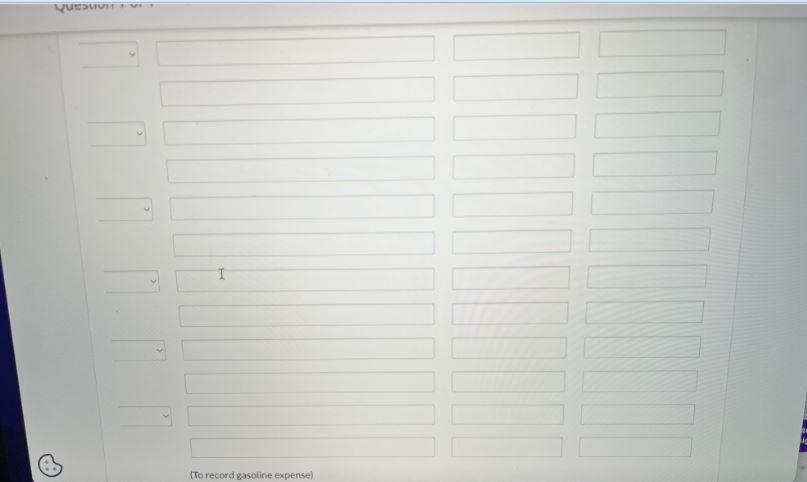

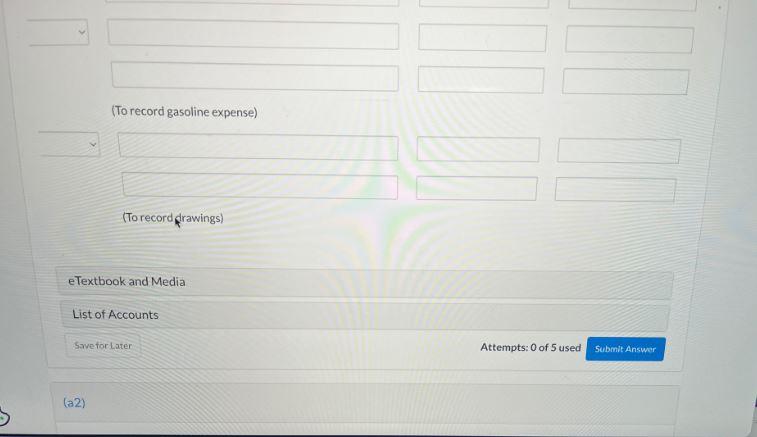

Blossom Clark opened Blossom's Cleaning Service on July 1, 2022. During July, the following transactions were completed. July 1 Blossom invested $19,800 cash in the business. 1 Purchased used truck for $8,800, paying $3,800 cash and the balance on account. 3 Purchased cleaning supplies for $1,900 on account. 5 Paid $1,680 cash on a 1 -year insurance policy effective July 1. 12. Billed customers $4,400 for cleaning services. 18 Paid $1,400 cash on amount owed on truck and $1,300 on amount owed on cleaning supplies. 20 Paid $2,400 cash for employee salaries. 21 Collected $3,300 cash from customers billed on July 12. 25 Billed customers $5.900 for cleaning services. 31 Paid $340 for the monthly gasoline bill for the truck. 31. Withdraw $5,500 cash for personal use. Journalize the July transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order displayed in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (To record truck purchased) (To record gasoline expense) (To record drawings) eTextbook and Media List of Accounts Save for later Attempts: 0 of 5 used Submit Answer (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts