Question: Do not prepare bonds payable amortization it has already been answered! Several years ago, Soriano Corporation sold bonds with a face value of $1,000,000 to

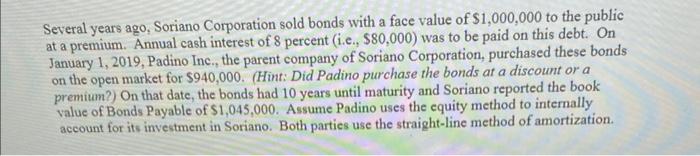

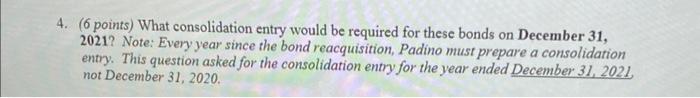

Several years ago, Soriano Corporation sold bonds with a face value of $1,000,000 to the public at a premium. Annual cash interest of 8 percent (i.e., $80,000 ) was to be paid on this debt. On January 1, 2019, Padino Ine., the parent company of Soriano Corporation, purchased these bonds on the open market for $940,000. (Hint: Did Padino purchase the bonds at a discount or a premium?) On that date, the bonds had 10 years until maturity and Soriano reported the book value of Bonds Payable of $1,045,000. Assume Padino uses the equity method to internally account for its investment in Soriano. Both partics use the straight-line method of amortization. 4. ( 6 points) What consolidation entry would be required for these bonds on December 31 , 2021? Note: Every year since the bond reacquisition, Padino must prepare a consolidation entry. This question asked for the consolidation entry for the year ended December 31, 2021. not December 31,2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts