Question: Do not prepare bonds payable amortization it has already been answered! Several years ago, Soriano Corporation sold bonds with a face value of $1,000,000 to

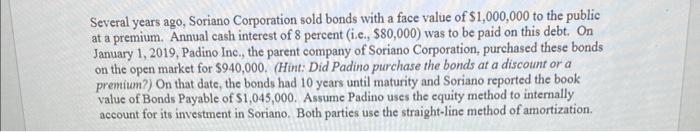

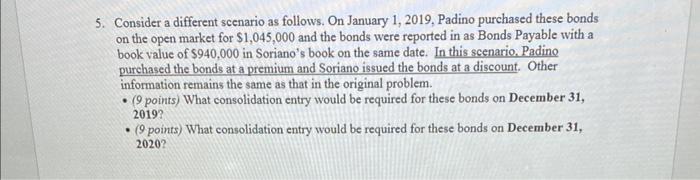

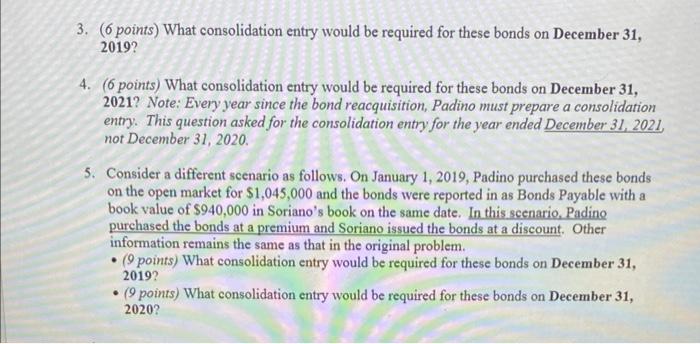

Several years ago, Soriano Corporation sold bonds with a face value of $1,000,000 to the public at a premium. Annual cash interest of 8 percent (i.e., $80,000 ) was to be paid on this debt. On January 1, 2019, Padino Ine., the parent company of Soriano Corporation, purchased these bonds on the open market for $940,000. (Hint: Did Padino purchase the bonds at a discount or a premium?) On that date, the bonds had 10 years until maturity and Soriano reported the book value of Bonds Payable of $1,045,000. Assume Padino uses the equity method to internally account for its investment in Soriano. Both parties use the straight-line method of amortization. 5. Consider a different scenario as follows. On January 1, 2019, Padino purchased these bonds on the open market for $1,045,000 and the bonds were reported in as Bonds Payable with a book value of $940,000 in Soriano's book on the same date. In this scenario. Padine purchased the bonds at a premium and Soriano issued the bonds at a discount. Other information remains the same as that in the original problem. - (9 points) What consolidation entry would be required for these bonds on December 31 , 2019 ? - (9 points) What consolidation entry would be required for these bonds on December 31 , 2020? 3. ( 6 points) What consolidation entry would be required for these bonds on December 31 , 2019? 4. (6 points) What consolidation entry would be required for these bonds on December 31 , 2021? Note: Every year since the bond reacquisition, Padino must prepare a consolidation entry. This question asked for the consolidation entry for the year ended December 31, 2021, not December 31,2020. 5. Consider a different scenario as follows. On January 1, 2019, Padino purchased these bonds on the open market for $1,045,000 and the bonds were reported in as Bonds Payable with a book value of $940,000 in Soriano's book on the same date. In this scenario. Padine purchased the bonds at a premium and Soriano issued the bonds at a discount. Other information remains the same as that in the original problem. - (9 points) What consolidation entry would be required for these bonds on December 31 , 2019 ? - (9 points) What consolidation entry would be required for these bonds on December 31 , 2020 ? Several years ago, Soriano Corporation sold bonds with a face value of $1,000,000 to the public at a premium. Annual cash interest of 8 percent (i.e., $80,000 ) was to be paid on this debt. On January 1, 2019, Padino Ine., the parent company of Soriano Corporation, purchased these bonds on the open market for $940,000. (Hint: Did Padino purchase the bonds at a discount or a premium?) On that date, the bonds had 10 years until maturity and Soriano reported the book value of Bonds Payable of $1,045,000. Assume Padino uses the equity method to internally account for its investment in Soriano. Both parties use the straight-line method of amortization. 5. Consider a different scenario as follows. On January 1, 2019, Padino purchased these bonds on the open market for $1,045,000 and the bonds were reported in as Bonds Payable with a book value of $940,000 in Soriano's book on the same date. In this scenario. Padine purchased the bonds at a premium and Soriano issued the bonds at a discount. Other information remains the same as that in the original problem. - (9 points) What consolidation entry would be required for these bonds on December 31 , 2019 ? - (9 points) What consolidation entry would be required for these bonds on December 31 , 2020? 3. ( 6 points) What consolidation entry would be required for these bonds on December 31 , 2019? 4. (6 points) What consolidation entry would be required for these bonds on December 31 , 2021? Note: Every year since the bond reacquisition, Padino must prepare a consolidation entry. This question asked for the consolidation entry for the year ended December 31, 2021, not December 31,2020. 5. Consider a different scenario as follows. On January 1, 2019, Padino purchased these bonds on the open market for $1,045,000 and the bonds were reported in as Bonds Payable with a book value of $940,000 in Soriano's book on the same date. In this scenario. Padine purchased the bonds at a premium and Soriano issued the bonds at a discount. Other information remains the same as that in the original problem. - (9 points) What consolidation entry would be required for these bonds on December 31 , 2019 ? - (9 points) What consolidation entry would be required for these bonds on December 31 , 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts