Question: do not take the first picture into consideration. only the second one. please show me the way how to solve this problem (en)- In a

do not take the first picture into consideration. only the second one. please show me the way how to solve this problem

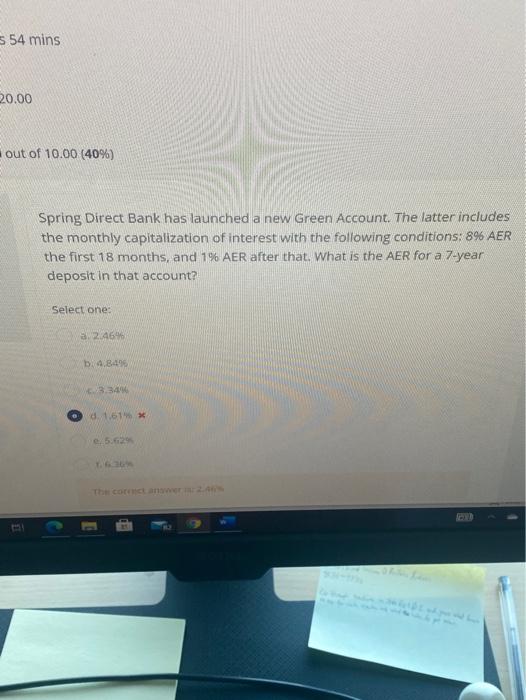

do not take the first picture into consideration. only the second one. please show me the way how to solve this problem(en)- In a given market that meets all CAPM assumptions, there are only two risky assets, A and B, in addition to the risk-free asset. A's expected return is 16%, while B's expected return is 23%. In addition, you know that the standard deviation for A and B is 15% and 27%, respectively, and that the correlation between both assets is 0.48. Lastly, you know that the return on the risk-free asset is 2%, and that the market is in equilibrium. With all this information, you can determine that the weights of A and B in the market portfolio are: Select one: a. WA-88,62%; WB-11.38% b. WA-31.42%; WB-68.58% C.WA-46.57%; WB-53,43% d. WA-7535%; WB-24,65% De WA=22.19% WB-77.81% O f.WA-57.10%: WB-42.90% X The correct answer is WA=75.3599 WB-24.6596 In a given market that meets all CAPM assumptions, there are only two risky assets, A and B, in addition to the risk-free asset. The weights of A and B in the market portfolio are 57.60 and 42.40%, respectively. The risk-free asset offers a 1% return, the market premium is 6%, and the market is in equilibrium. Given all this data, investing 100,000 while obtaining an 200 5 54 mins 220.00 out of 10.00 (40%) Spring Direct Bank has launched a new Green Account. The latter includes the monthly capitalization of interest with the following conditions: 8% AER the first 18 months, and 1% AER after that. What is the AER for a 7-year deposit in that account? Select one: 2.469 4.84 3.39 01.61 E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts