Question: DO NOT TYPE ANYTHING IN THE BLUE AREAIII Chapter 4 A. Page 110, problem #4, but substitute the following values Plastic demand for 90 degree

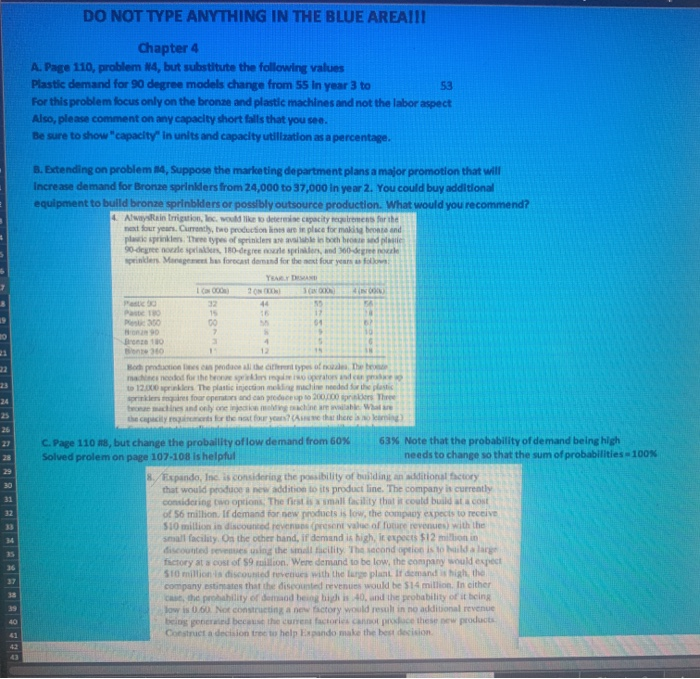

DO NOT TYPE ANYTHING IN THE BLUE AREAIII Chapter 4 A. Page 110, problem #4, but substitute the following values Plastic demand for 90 degree models change from 55 In year 3 to 53 For this problem focus only on the bronze and plastic machines and not the labor aspect Also, please comment on any capacity short falls that you see Be sure to show "capacity in units and capacity utilization as a percentage. B. Extending on problem 14, Suppose the marketing department plans a major promotion that will Increase demand for Bronze sprinkders from 24,000 to 37,000 in year 2. You could buy additional equipment to build bronze sprinbiders or possibly outsource production. What would you recommend? 4. AlwaysRaintriguin, loc. would like to determine capacity forces for the mest four years. Currently, the productions are in place for making bone and plate sprinklers. These types of sprinklers are available in both broneedle 90-degree notes, 180-gesprinkles, and 300-degree prinders Moth forecast demand for the next four years YEARLY DESNO ICO Patie 32 44 Paste 180 15 Ps30 00 64 Hono 2 19 4 Bonto 360 Hochproductions produce all the the types of the minded for the operators and to 12.000 rublers The plastic injection making machine needed for the plastic kemfoor operators and can prep to 2000 Three bronchines and only one in www the capacity for the four years? 12 23 27 C. Page 110 m3, but change the proballity of low demand from 60% 63% Note that the probability of demand being high Solved prolem on page 107-108 Is helpful needs to change so that the sum of probabilities - 100% 8. Expando, Inc. is considering the possibility of building an additional factory that would produce a new addition to its product line. The company is currently considering two options. The first is small facility that it could build at a cost of 56 million. If demand for new products is low, the company expects to receive $10 million in discounted reversent value of future revenues) with the small facility. On the other hand, if demand is high, it expects $12 million in discounted revenues sing the small cility. The second option is to build a large factory at a cost of $9 million. Were demand to be low, the company would expect $10 millions discounted revenues with the large plant If demand is high the company estimates that the discounted revenues would be $14 million. In cither cast, the probability of dead being bich is 40, and the probability of thing low is 0.60. Not constructing a new factory would result in no additional revenue being ponerated because the current factories cannot prace these new products Construct a decision to help Expando make the best decision 40 DO NOT TYPE ANYTHING IN THE BLUE AREAIII Chapter 4 A. Page 110, problem #4, but substitute the following values Plastic demand for 90 degree models change from 55 In year 3 to 53 For this problem focus only on the bronze and plastic machines and not the labor aspect Also, please comment on any capacity short falls that you see Be sure to show "capacity in units and capacity utilization as a percentage. B. Extending on problem 14, Suppose the marketing department plans a major promotion that will Increase demand for Bronze sprinkders from 24,000 to 37,000 in year 2. You could buy additional equipment to build bronze sprinbiders or possibly outsource production. What would you recommend? 4. AlwaysRaintriguin, loc. would like to determine capacity forces for the mest four years. Currently, the productions are in place for making bone and plate sprinklers. These types of sprinklers are available in both broneedle 90-degree notes, 180-gesprinkles, and 300-degree prinders Moth forecast demand for the next four years YEARLY DESNO ICO Patie 32 44 Paste 180 15 Ps30 00 64 Hono 2 19 4 Bonto 360 Hochproductions produce all the the types of the minded for the operators and to 12.000 rublers The plastic injection making machine needed for the plastic kemfoor operators and can prep to 2000 Three bronchines and only one in www the capacity for the four years? 12 23 27 C. Page 110 m3, but change the proballity of low demand from 60% 63% Note that the probability of demand being high Solved prolem on page 107-108 Is helpful needs to change so that the sum of probabilities - 100% 8. Expando, Inc. is considering the possibility of building an additional factory that would produce a new addition to its product line. The company is currently considering two options. The first is small facility that it could build at a cost of 56 million. If demand for new products is low, the company expects to receive $10 million in discounted reversent value of future revenues) with the small facility. On the other hand, if demand is high, it expects $12 million in discounted revenues sing the small cility. The second option is to build a large factory at a cost of $9 million. Were demand to be low, the company would expect $10 millions discounted revenues with the large plant If demand is high the company estimates that the discounted revenues would be $14 million. In cither cast, the probability of dead being bich is 40, and the probability of thing low is 0.60. Not constructing a new factory would result in no additional revenue being ponerated because the current factories cannot prace these new products Construct a decision to help Expando make the best decision 40