Question: do not use excel 1. Windsor Co. is a global manufacturer of printing and imaging equipment. It is now considering the purchase and installation of

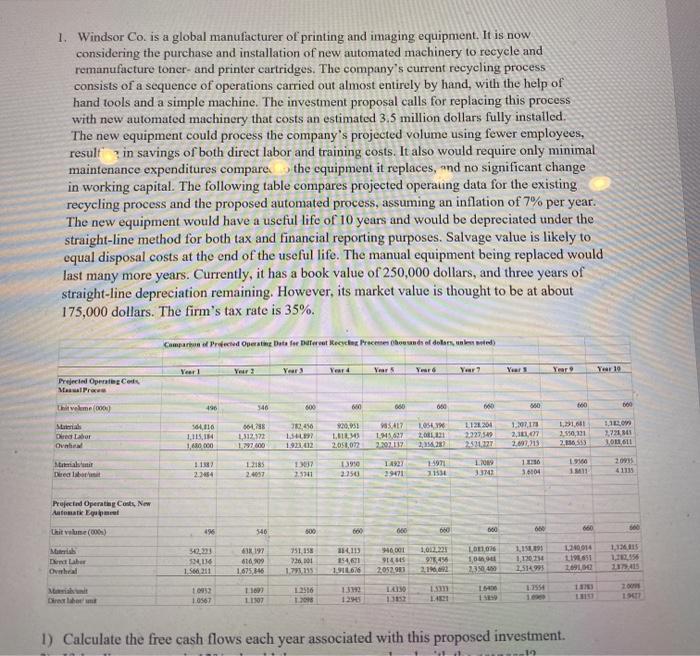

1. Windsor Co. is a global manufacturer of printing and imaging equipment. It is now considering the purchase and installation of new automated machinery to recycle and remanufacture toner- and printer cartridges. The company's current recycling process consists of a sequence of operations carried out almost entirely by hand, with the help of hand tools and a simple machine. The investment proposal calls for replacing this process with new automated machinery that costs an estimated 3.5 million dollars fully installed. The new equipment could process the company's projected volume using fewer employees, result in savings of both direct labor and training costs. It also would require only minimal maintenance expenditures compare the equipment it replaces, and no significant change in working capital. The following table compares projected operaung data for the existing recycling process and the proposed automated process, assuming an inflation of 7% per year. The new equipment would have a useful life of 10 years and would be depreciated under the straight-line method for both tax and financial reporting purposes. Salvage value is likely to equal disposal costs at the end of the useful life. The manual equipment being replaced would last many more years. Currently, it has a book value of 250,000 dollars, and three years of straight-line depreciation remaining. However, its market value is thought to be at about 175,000 dollars. The firm's tax rate is 35%. Compare Pre Operation Data fee Datert Reese Prechod of dollars, weet Year Year Year Years Years Year Year 19 Prejected Opel Cors MalPro hvolume 0000 490 546 fo 600 050 600 Die Labor Ovn 564110 1.115,11 1000 56128 1,312 372 19000 32.450 1.52 1921012 20,953 LIL 2.051.0 93417 1637 1054 20131 2112 1121201 2,227.540 1.2017 2,11, 27092015 1.11.11 2.950,131 2136353 1,120 3.71 300 611 Material Derealba 12185 2.4057 1307 2.5911 13950 2250 14922 29471 15971 7153 1.2009 3310 1 116 3.6104 1.900 1411 20 41135 2.3454 Projected Operations, New Automatique 196 600 000 660 600 3 51221 2016 1.566,211 Dend Laber Ovrha 63% 197 61609 1.675146 751.158 26.01 1.77.115 14.11 154,61 1.9166 NOOGI 9:44 2.052.000 1,012.221 97455 2.1962 LO 10 23 1,136115 156 115191 1190 2:51499 1.2001 L1965 2010 E hit 11 16400 12516 0952 10567 110 L1807 1312 12 LANO 11152 14 19 1) Calculate the free cash flows each year associated with this proposed investment. 19 1. Windsor Co. is a global manufacturer of printing and imaging equipment. It is now considering the purchase and installation of new automated machinery to recycle and remanufacture toner- and printer cartridges. The company's current recycling process consists of a sequence of operations carried out almost entirely by hand, with the help of hand tools and a simple machine. The investment proposal calls for replacing this process with new automated machinery that costs an estimated 3.5 million dollars fully installed. The new equipment could process the company's projected volume using fewer employees, result in savings of both direct labor and training costs. It also would require only minimal maintenance expenditures compare the equipment it replaces, and no significant change in working capital. The following table compares projected operaung data for the existing recycling process and the proposed automated process, assuming an inflation of 7% per year. The new equipment would have a useful life of 10 years and would be depreciated under the straight-line method for both tax and financial reporting purposes. Salvage value is likely to equal disposal costs at the end of the useful life. The manual equipment being replaced would last many more years. Currently, it has a book value of 250,000 dollars, and three years of straight-line depreciation remaining. However, its market value is thought to be at about 175,000 dollars. The firm's tax rate is 35%. Compare Pre Operation Data fee Datert Reese Prechod of dollars, weet Year Year Year Years Years Year Year 19 Prejected Opel Cors MalPro hvolume 0000 490 546 fo 600 050 600 Die Labor Ovn 564110 1.115,11 1000 56128 1,312 372 19000 32.450 1.52 1921012 20,953 LIL 2.051.0 93417 1637 1054 20131 2112 1121201 2,227.540 1.2017 2,11, 27092015 1.11.11 2.950,131 2136353 1,120 3.71 300 611 Material Derealba 12185 2.4057 1307 2.5911 13950 2250 14922 29471 15971 7153 1.2009 3310 1 116 3.6104 1.900 1411 20 41135 2.3454 Projected Operations, New Automatique 196 600 000 660 600 3 51221 2016 1.566,211 Dend Laber Ovrha 63% 197 61609 1.675146 751.158 26.01 1.77.115 14.11 154,61 1.9166 NOOGI 9:44 2.052.000 1,012.221 97455 2.1962 LO 10 23 1,136115 156 115191 1190 2:51499 1.2001 L1965 2010 E hit 11 16400 12516 0952 10567 110 L1807 1312 12 LANO 11152 14 19 1) Calculate the free cash flows each year associated with this proposed investment. 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts