Question: do not use excel 1. Windsor Co. is a global manufacturer of printing and imaging equipment. It is now considering the purchase and installation of

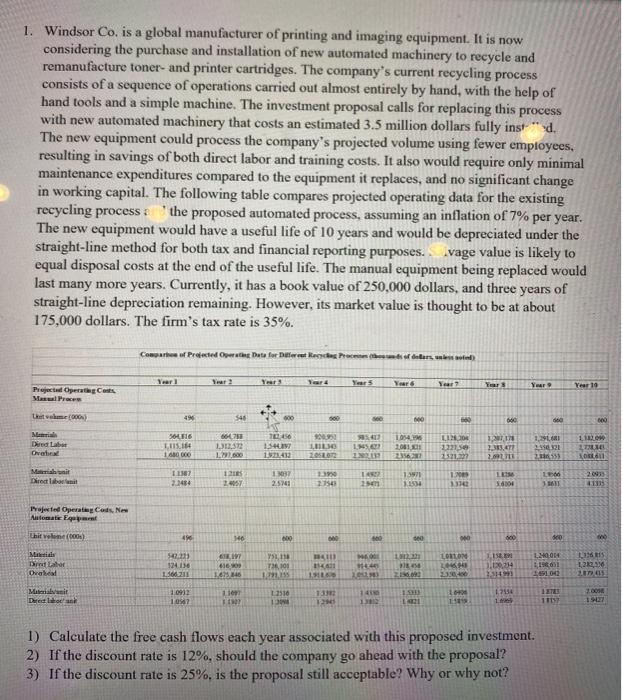

1. Windsor Co. is a global manufacturer of printing and imaging equipment. It is now considering the purchase and installation of new automated machinery to recycle and remanufacture toner- and printer cartridges. The company's current recycling process consists of a sequence of operations carried out almost entirely by hand, with the help of hand tools and a simple machine. The investment proposal calls for replacing this process with new automated machinery that costs an estimated 3.5 million dollars fully inst" d. The new equipment could process the company's projected volume using fewer employees, resulting in savings of both direct labor and training costs. It also would require only minimal maintenance expenditures compared to the equipment it replaces, and no significant change in working capital. The following table compares projected operating data for the existing recycling process the proposed automated process, assuming an inflation of 7% per year. The new equipment would have a useful life of 10 years and would be depreciated under the straight-line method for both tax and financial reporting purposes. vage value is likely to equal disposal costs at the end of the useful life. The manual equipment being replaced would last many more years. Currently, it has a book value of 250,000 dollars, and three years of straight-line depreciation remaining. However, its market value is thought to be at about 175,000 dollars. The firm's tax rate is 35%. Cowgath of Prested Open Data for free Kee Promoters Year Tars Year Year 19 Project OpergCents Meus Process (0) 496 546 500 NO 660 60 Dured Lab Ova 56476 LIISI 1680000 06-07 2.32 L29.000 56 1.54419 1143 LO ZOST 1054 10811 2356 10 2221 2312 10 LE 2.692 23 Madait Direct labout 1136 2.3484 1. LE 20913 125 ZOST 103 2514 1 2.750 1397 105 25 0001 leted Operaeg Cods, New Automatique thit vele (0) 140 000 000 ON 00 000 LORON 11615 Miles Di Labor Dabeat 50.213 174.130 L560211 CV 616 1.6.146 151111 T101 1192195 1411 10 11 LISEN 1.09.24 L2:04 1980 1.610 2333 230 Malmbrunit Duelon Le 131 17114 3510 13 14 110932 1057 1.4 14 11 111 1) Calculate the free cash flows each year associated with this proposed investment. 2) If the discount rate is 12%, should the company go ahead with the proposal? 3) If the discount rate is 25%, is the proposal still acceptable? Why or why not? 1. Windsor Co. is a global manufacturer of printing and imaging equipment. It is now considering the purchase and installation of new automated machinery to recycle and remanufacture toner- and printer cartridges. The company's current recycling process consists of a sequence of operations carried out almost entirely by hand, with the help of hand tools and a simple machine. The investment proposal calls for replacing this process with new automated machinery that costs an estimated 3.5 million dollars fully inst" d. The new equipment could process the company's projected volume using fewer employees, resulting in savings of both direct labor and training costs. It also would require only minimal maintenance expenditures compared to the equipment it replaces, and no significant change in working capital. The following table compares projected operating data for the existing recycling process the proposed automated process, assuming an inflation of 7% per year. The new equipment would have a useful life of 10 years and would be depreciated under the straight-line method for both tax and financial reporting purposes. vage value is likely to equal disposal costs at the end of the useful life. The manual equipment being replaced would last many more years. Currently, it has a book value of 250,000 dollars, and three years of straight-line depreciation remaining. However, its market value is thought to be at about 175,000 dollars. The firm's tax rate is 35%. Cowgath of Prested Open Data for free Kee Promoters Year Tars Year Year 19 Project OpergCents Meus Process (0) 496 546 500 NO 660 60 Dured Lab Ova 56476 LIISI 1680000 06-07 2.32 L29.000 56 1.54419 1143 LO ZOST 1054 10811 2356 10 2221 2312 10 LE 2.692 23 Madait Direct labout 1136 2.3484 1. LE 20913 125 ZOST 103 2514 1 2.750 1397 105 25 0001 leted Operaeg Cods, New Automatique thit vele (0) 140 000 000 ON 00 000 LORON 11615 Miles Di Labor Dabeat 50.213 174.130 L560211 CV 616 1.6.146 151111 T101 1192195 1411 10 11 LISEN 1.09.24 L2:04 1980 1.610 2333 230 Malmbrunit Duelon Le 131 17114 3510 13 14 110932 1057 1.4 14 11 111 1) Calculate the free cash flows each year associated with this proposed investment. 2) If the discount rate is 12%, should the company go ahead with the proposal? 3) If the discount rate is 25%, is the proposal still acceptable? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts