Question: do not use excel to answer the following Financial Planning & Control (PMBA 5373) Preferred Stock Valuation Homework #12, 10 points due 5:30 p.m., Monday

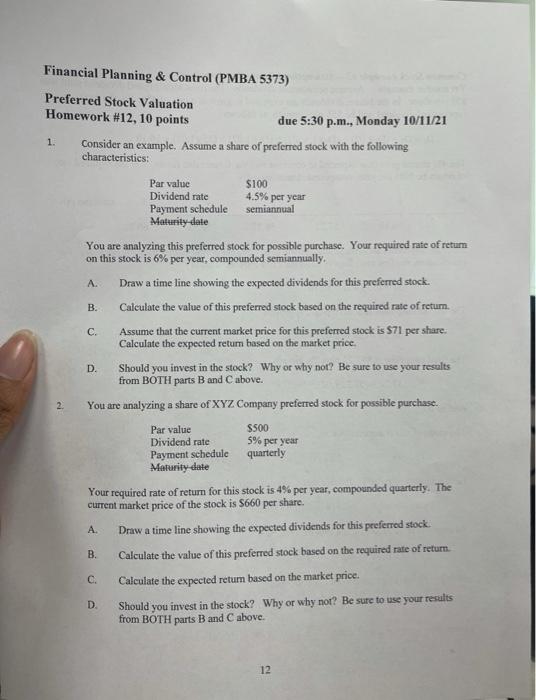

Financial Planning & Control (PMBA 5373) Preferred Stock Valuation Homework #12, 10 points due 5:30 p.m., Monday 10/11/21 Consider an example. Assume a share of preferred stock with the following characteristics: 1. B. 2. Par value $100 Dividend rate 4.5% per year Payment schedule semiannual Maturity-date You are analyzing this preferred stock for possible purchase. Your required rate of return on this stock is 6% per year, compounded semiannually. A. Draw a time line showing the expected dividends for this preferred stock. Calculate the value of this preferred stock based on the required rate of retum. C. Assume that the current market price for this preferred stock is $71 per share. Calculate the expected return based on the market price. D. Should you invest in the stock? Why or why not? Be sure to use your results from BOTH parts B and C above. You are analyzing a share of XYZ Company preferred stock for possible purchase. Par value $500 Dividend rate 5% per year Payment schedule quarterly Maturity dute Your required rate of return for this stock is 4% per year, compounded quarterly. The current market price of the stock is 5660 per share. A Draw a time line showing the expected dividends for this preferred stock B. Calculate the value of this preferred stock based on the required rate of return c. Calculate the expected retum based on the market price. D. Should you invest in the stock? Why or why not? Be sure to use your results from BOTH parts B and C above. 12 Financial Planning & Control (PMBA 5373) Preferred Stock Valuation Homework #12, 10 points due 5:30 p.m., Monday 10/11/21 Consider an example. Assume a share of preferred stock with the following characteristics: 1. B. 2. Par value $100 Dividend rate 4.5% per year Payment schedule semiannual Maturity-date You are analyzing this preferred stock for possible purchase. Your required rate of return on this stock is 6% per year, compounded semiannually. A. Draw a time line showing the expected dividends for this preferred stock. Calculate the value of this preferred stock based on the required rate of retum. C. Assume that the current market price for this preferred stock is $71 per share. Calculate the expected return based on the market price. D. Should you invest in the stock? Why or why not? Be sure to use your results from BOTH parts B and C above. You are analyzing a share of XYZ Company preferred stock for possible purchase. Par value $500 Dividend rate 5% per year Payment schedule quarterly Maturity dute Your required rate of return for this stock is 4% per year, compounded quarterly. The current market price of the stock is 5660 per share. A Draw a time line showing the expected dividends for this preferred stock B. Calculate the value of this preferred stock based on the required rate of return c. Calculate the expected retum based on the market price. D. Should you invest in the stock? Why or why not? Be sure to use your results from BOTH parts B and C above. 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts