Question: do not use excel use AW method and show all steps for thump up. 4. (20 points) A machine purchased 3 years ago for $140,000

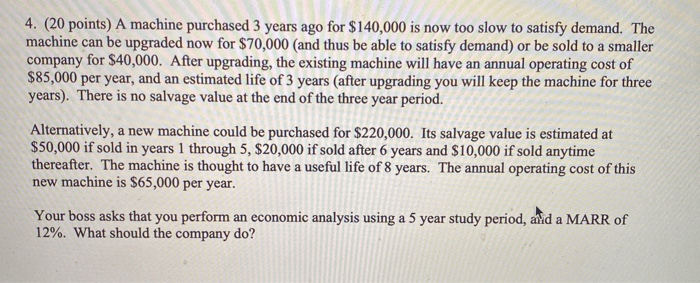

4. (20 points) A machine purchased 3 years ago for $140,000 is now too slow to satisfy demand. The machine can be upgraded now for $70,000 (and thus be able to satisfy demand) or be sold to a smaller company for $40,000. After upgrading, the existing machine will have an annual operating cost of $85,000 per year, and an estimated life of 3 years (after upgrading you will keep the machine for three years). There is no salvage value at the end of the three year period. Alternatively, a new machine could be purchased for $220,000. Its salvage value is estimated at $50,000 if sold in years 1 through 5, $20,000 if sold after 6 years and $10,000 if sold anytime thereafter. The machine is thought to have a useful life of 8 years. The annual operating cost of this new machine is $65,000 per year. Your boss asks that you perform an economic analysis using a 5 year study period, aid a MARR of 12%. What should the company do

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts