Question: Yates Inc. is currently an all equity firm, but the company can borrow at 7.7 percent interest. The company currently has one million shares

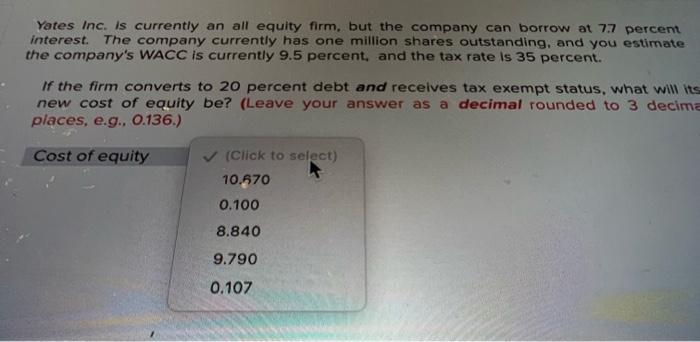

Yates Inc. is currently an all equity firm, but the company can borrow at 7.7 percent interest. The company currently has one million shares outstanding, and you estimate the company's WACC is currently 9.5 percent, and the tax rate is 35 percent. If the firm converts to 20 percent debt and receives tax exempt status, what will its new cost of equity be? (Leave your answer as a decimal rounded to 3 decima places, e.g., 0.136.) Cost of equity (Click to select) 10.670 0.100 8.840 9.790 0.107

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided ... View full answer

Get step-by-step solutions from verified subject matter experts