Question: Do questions 2, 7, and 8. Replace any '9' in all questions with a 7. a. What is the net ADR yield on rooms delivered

Do questions 2, 7, and 8. Replace any '9' in all questions with a 7.

Do questions 2, 7, and 8. Replace any '9' in all questions with a 7.

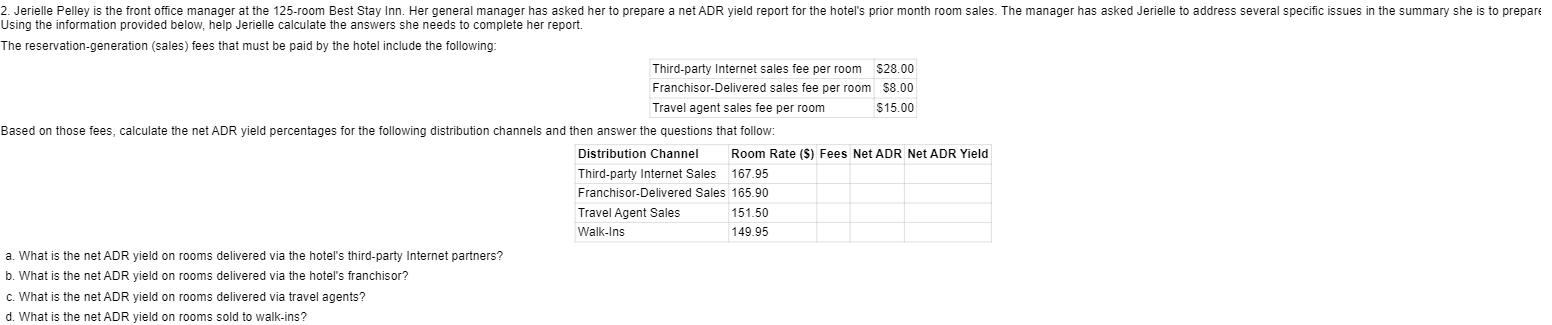

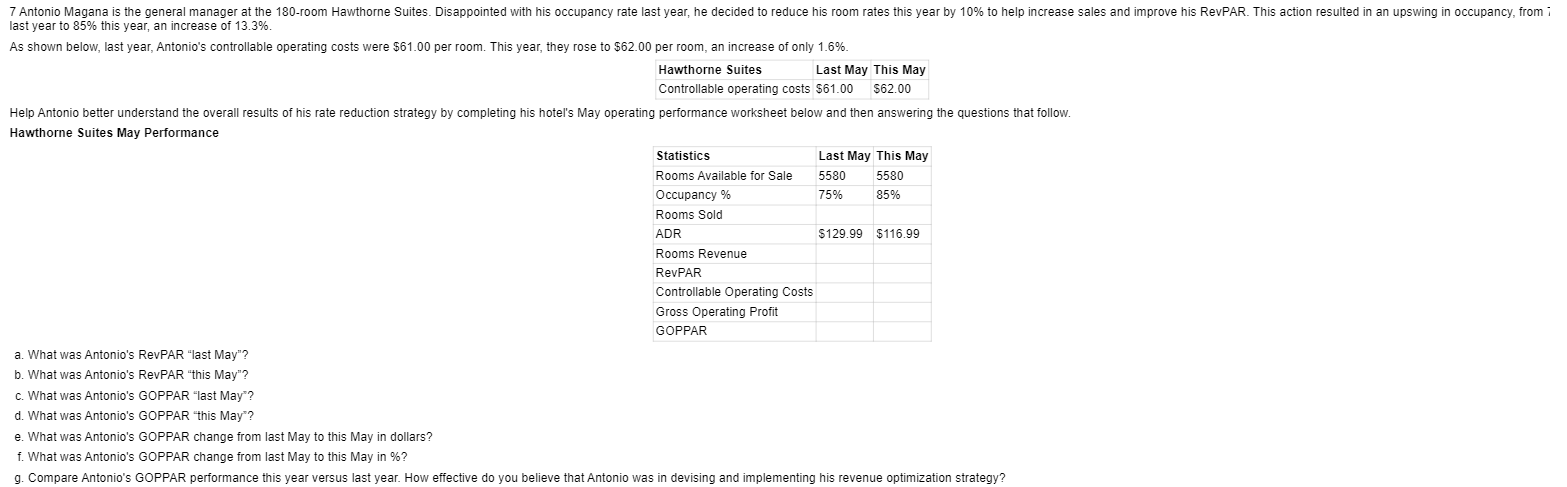

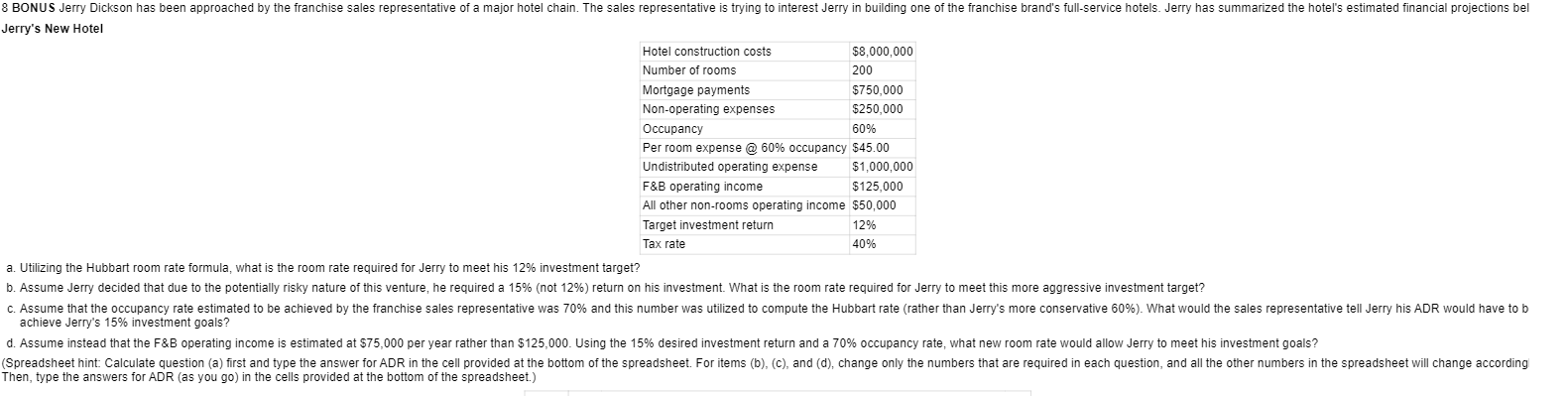

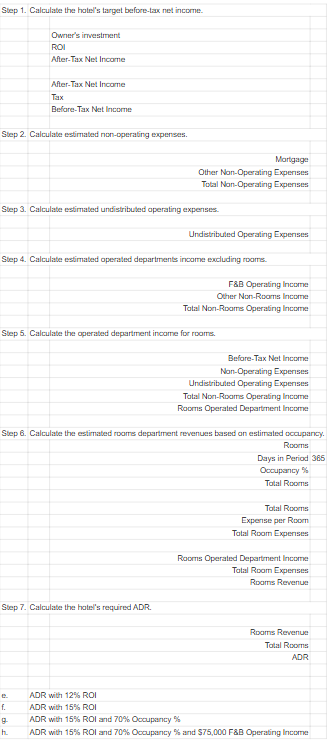

a. What is the net ADR yield on rooms delivered via the hotel's third-party Internet partners? b. What is the net ADR yield on rooms delivered via the hotel's franchisor? c. What is the net ADR yield on rooms delivered via travel agents? d. What is the net ADR yield on rooms sold to walk-ins? a. What was Antonio's RevPAR "last May"? b. What was Antonio's RevPAR "this May"? c. What was Antonio's GOPPAR "last May"? d. What was Antonio's GOPPAR "this May"? e. What was Antonio's GOPPAR change from last May to this May in dollars? f. What was Antonio's GOPPAR change from last May to this May in \%? g. Compare Antonio's GOPPAR performance this year versus last year. How effective do you believe that Antonio was in devising and implementing his revenue optimization strategy? Jerry's New Hotel \begin{tabular}{|l|l|} \hline Hotel construction costs & $8,000,000 \\ \hline Number of rooms & 200 \\ \hline Mortgage payments & $750,000 \\ \hline Non-operating expenses & $250,000 \\ \hline Occupancy & 60% \\ \hline Per room expense @ 60\% occupancy & $45.00 \\ \hline Undistributed operating expense & $1,000,000 \\ \hline F\&B operating income & $125,000 \\ \hline All other non-rooms operating income & $50,000 \\ \hline Target investment return & 12% \\ \hline Tax rate & 40% \\ \hline \end{tabular} a. Utilizing the Hubbart room rate formula, what is the room rate required for Jerry to meet his 12% investment target? achieve Jerry's 15% investment goals? Then, type the answers for ADR (as you g0 ) in the cells provided at the bottom of the spreadsheet.) Sbep 1. Calculate the hatel's target before-tax net incorne. a. What is the net ADR yield on rooms delivered via the hotel's third-party Internet partners? b. What is the net ADR yield on rooms delivered via the hotel's franchisor? c. What is the net ADR yield on rooms delivered via travel agents? d. What is the net ADR yield on rooms sold to walk-ins? a. What was Antonio's RevPAR "last May"? b. What was Antonio's RevPAR "this May"? c. What was Antonio's GOPPAR "last May"? d. What was Antonio's GOPPAR "this May"? e. What was Antonio's GOPPAR change from last May to this May in dollars? f. What was Antonio's GOPPAR change from last May to this May in \%? g. Compare Antonio's GOPPAR performance this year versus last year. How effective do you believe that Antonio was in devising and implementing his revenue optimization strategy? Jerry's New Hotel \begin{tabular}{|l|l|} \hline Hotel construction costs & $8,000,000 \\ \hline Number of rooms & 200 \\ \hline Mortgage payments & $750,000 \\ \hline Non-operating expenses & $250,000 \\ \hline Occupancy & 60% \\ \hline Per room expense @ 60\% occupancy & $45.00 \\ \hline Undistributed operating expense & $1,000,000 \\ \hline F\&B operating income & $125,000 \\ \hline All other non-rooms operating income & $50,000 \\ \hline Target investment return & 12% \\ \hline Tax rate & 40% \\ \hline \end{tabular} a. Utilizing the Hubbart room rate formula, what is the room rate required for Jerry to meet his 12% investment target? achieve Jerry's 15% investment goals? Then, type the answers for ADR (as you g0 ) in the cells provided at the bottom of the spreadsheet.) Sbep 1. Calculate the hatel's target before-tax net incorne

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts