Question: do the first 1 or 2 if you can Gross $15 900 -0- 1. On November 1, Casey's Snowboards signed a $12,000, 90-day, 5% note

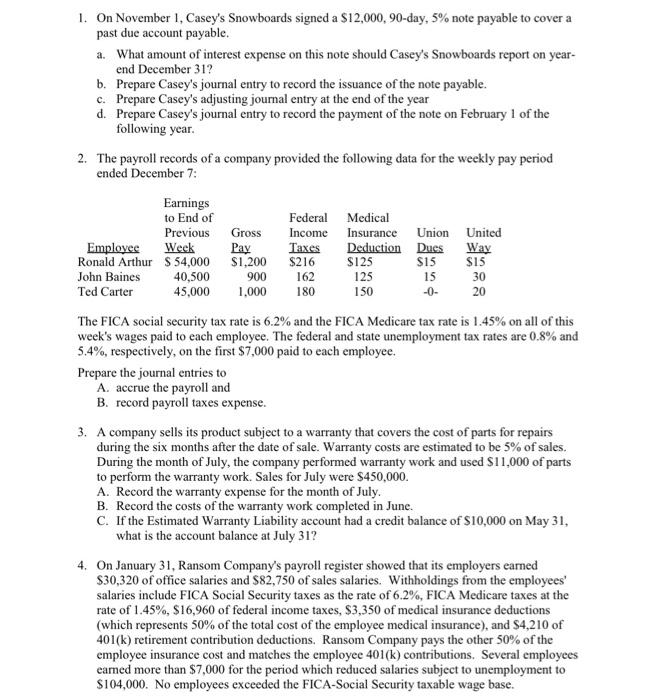

Gross $15 900 -0- 1. On November 1, Casey's Snowboards signed a $12,000, 90-day, 5% note payable to cover a past due account payable. a. What amount of interest expense on this note should Casey's Snowboards report on year- end December 31? b. Prepare Casey's journal entry to record the issuance of the note payable. c. Prepare Casey's adjusting journal entry at the end of the year d. Prepare Casey's journal entry to record the payment of the note on February 1 of the following year. 2. The payroll records of a company provided the following data for the weekly pay period ended December 7: Earnings to End of Federal Medical Previous Income Insurance Union United Employee Week Pay Taxes Deduction Dues Way Ronald Arthur S 54,000 $1,200 $216 $125 $15 John Baines 40,500 162 125 15 30 Ted Carter 45,000 1,000 180 150 20 The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to A. accrue the payroll and B. record payroll taxes expense. 3. A company sells its product subject to a warranty that covers the cost of parts for repairs during the six months after the date of sale. Warranty costs are estimated to be 5% of sales. During the month of July, the company performed warranty work and used $11,000 of parts to perform the warranty work. Sales for July were $450,000 A. Record the warranty expense for the month of July. B. Record the costs of the warranty work completed in June. C. If the Estimated Warranty Liability account had a credit balance of $10,000 on May 31, what is the account balance at July 31? 4. On January 31, Ransom Company's payroll register showed that its employers earned $30,320 of office salaries and $82,750 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes as the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $16,960 of federal income taxes, $3,350 of medical insurance deductions (which represents 50% of the total cost of the employee medical insurance), and $4,210 of 401(k) retirement contribution deductions. Ransom Company pays the other 50% of the employee insurance cost and matches the employee 401(k) contributions. Several employees earned more than $7,000 for the period which reduced salaries subject to unemployment to $104,000. No employees exceeded the FICA-Social Security taxable wage base. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts