Question: Documents X New chat X Assignments: X M Question 5 - X M Tax Structuring organizat x @ Home - Goog X ; 2.22 -

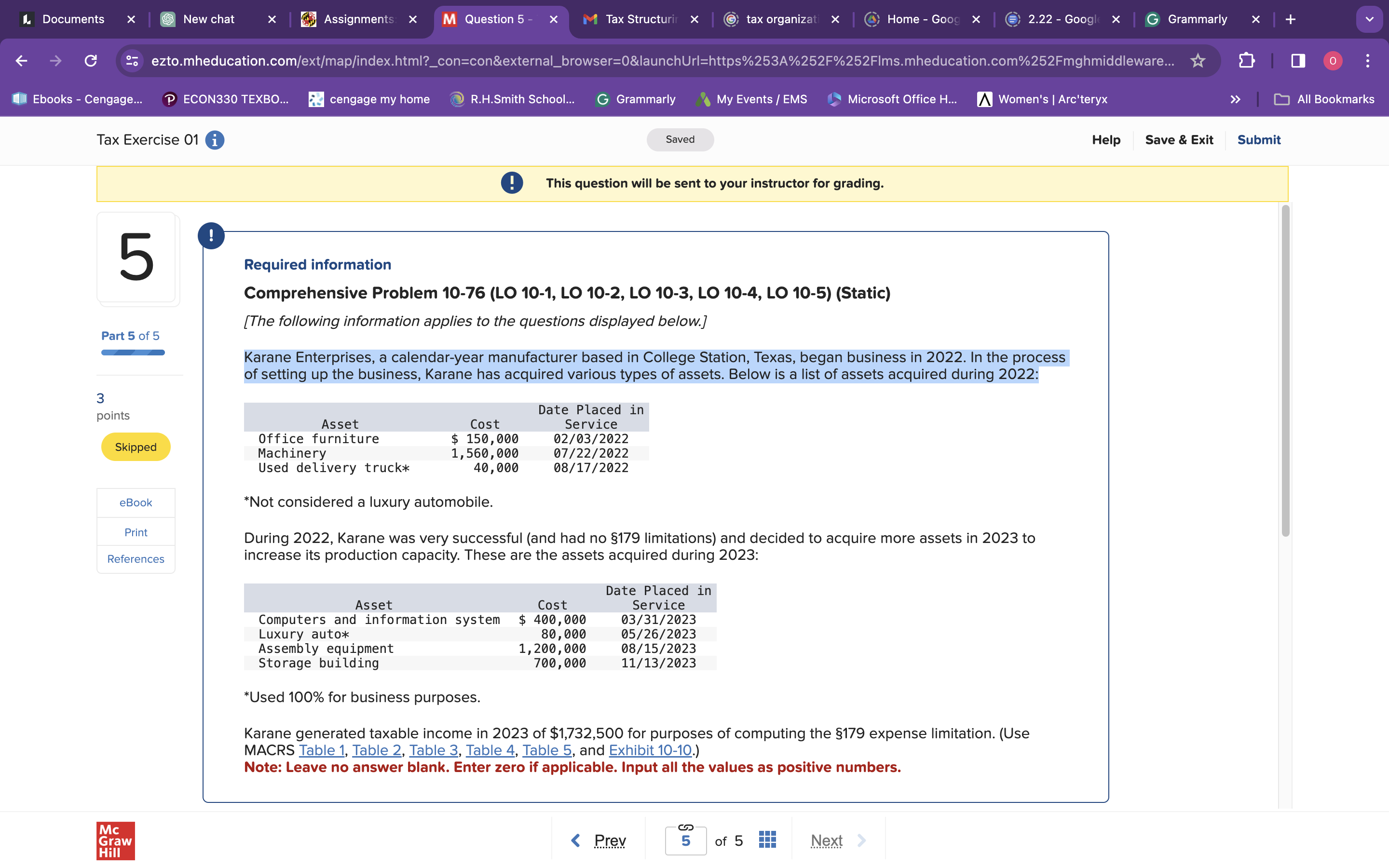

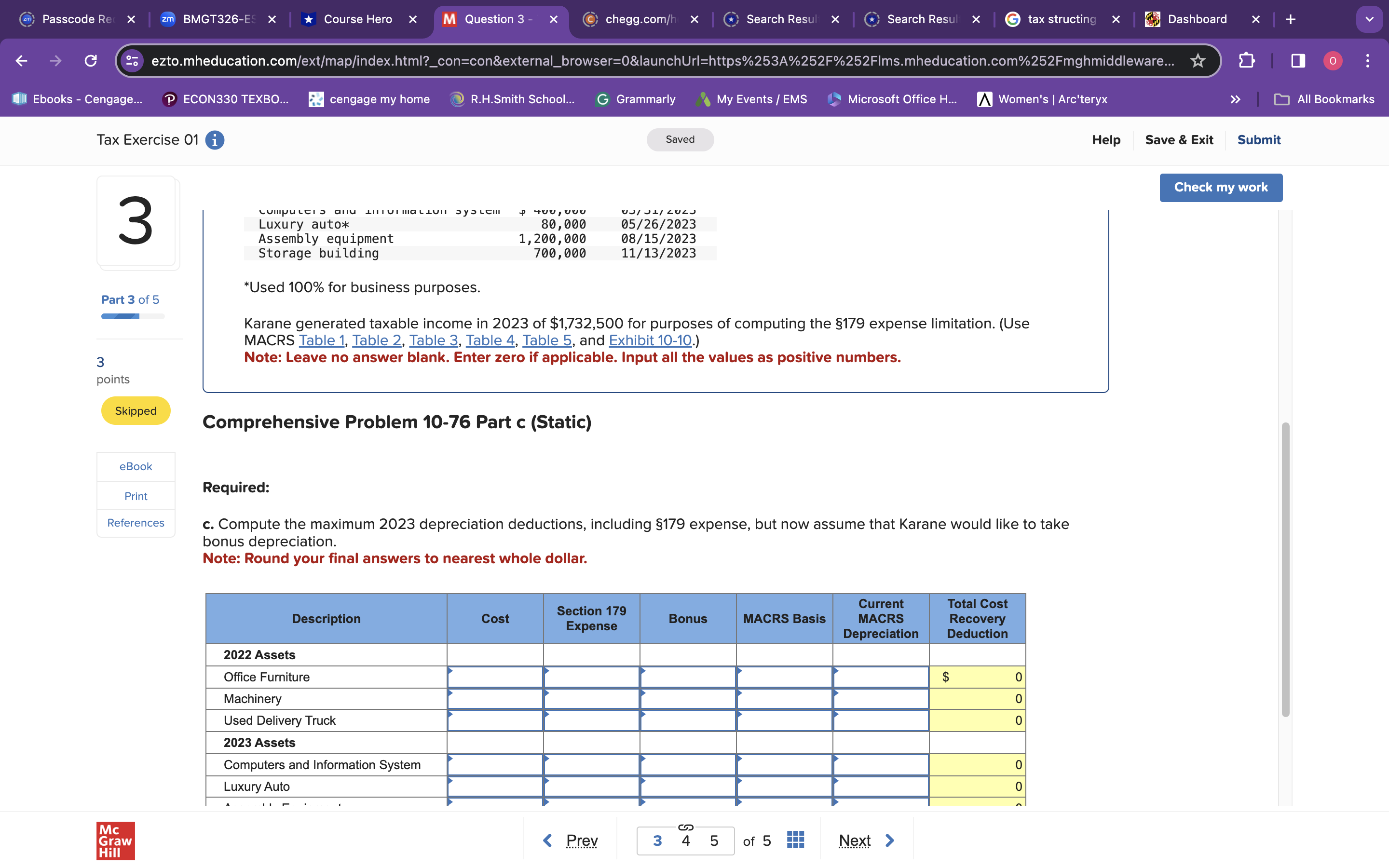

Documents X New chat X Assignments: X M Question 5 - X M Tax Structuring organizat x @ Home - Goog X ; 2.22 - Googl X G Grammarly X + C 20 ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252FIms.mheducation.com%252Fmghmiddleware... : Ebooks - Cengage... P ECON330 TEXBO... cengage my home R.H.Smith School.. G Grammarly My Events / EMS Microsoft Office H... A Women's | Arc'teryx > > All Bookmarks Tax Exercise 01 i Saved Help Save & Exit Submit This question will be sent to your instructor for grading. 5 Required information Comprehensive Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10-4, LO 10-5) (Static) The following information applies to the questions displayed below.] Part 5 of 5 Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2022. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2022: 3 points Date Placed in Asset Cost Service Office furniture Skipped $ 150, 000 02/03/2022 Machinery 1, 560, 000 07/22/2022 Used delivery truck* 40, 000 08/17/2022 eBook *Not considered a luxury automobile. Print During 2022, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2023 to References increase its production capacity. These are the assets acquired during 2023: Date Placed in Asset Cost Service Computers and information system $ 400, 000 31/2023 Luxury auto* 80, 000 05/26/2023 Assembly equipment 1, 200, 000 08/15/2023 Storage building 700, 000 11/13/2023 *Used 100% for business purposes. Karane generated taxable income in 2023 of $1,732,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Exhibit 10-10. Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Mc Graw > All Bookmarks Tax Exercise 01 i Saved Help Save & Exit Submit Check my work 3 LUIIIPULEIS allu LILIVITALIUNI SYSLEI 400, UVU Luxury auto* 80, 000 05/26/2023 Assembly equipment 1, 200, 000 08/15/2023 Storage building 700, 000 11/13/2023 *Used 100% for business purposes. Part 3 of 5 Karane generated taxable income in 2023 of $1,732,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Exhibit 10-10.) 3 Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. points Skipped Comprehensive Problem 10-76 Part c (Static) eBook Required: Print References c. Compute the maximum 2023 depreciation deductions, including $179 expense, but now assume that Karane would like to take bonus depreciation. Note: Round your final answers to nearest whole dollar. Current Total Cost Description Cost Section 179 Bonus MACRS Basis MACRS Recovery Expense Depreciation Deduction 2022 Assets Office Furniture $ 0 Machinery 0 Used Delivery Truck 2023 Assets Computers and Information System 0 Luxury Auto Mc Graw Hill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts