Question: Does anyone know how to do this difficult problem, if you know how to solve this please help me, and please step by step that

Does anyone know how to do this difficult problem, if you know how to solve this please help me, and please step by step that i can understand

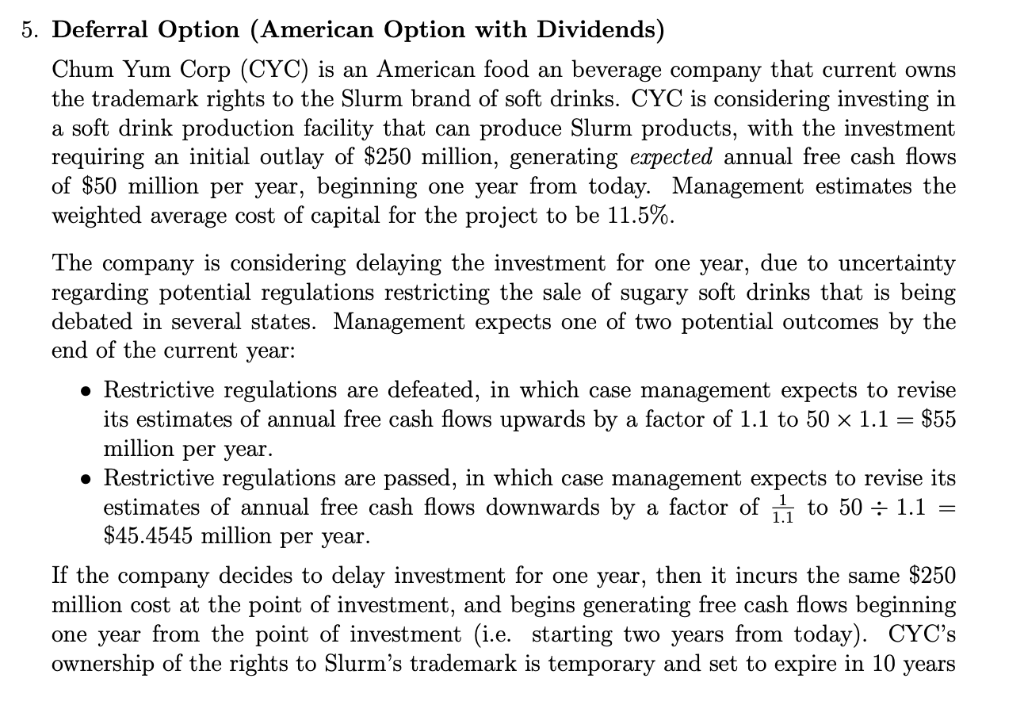

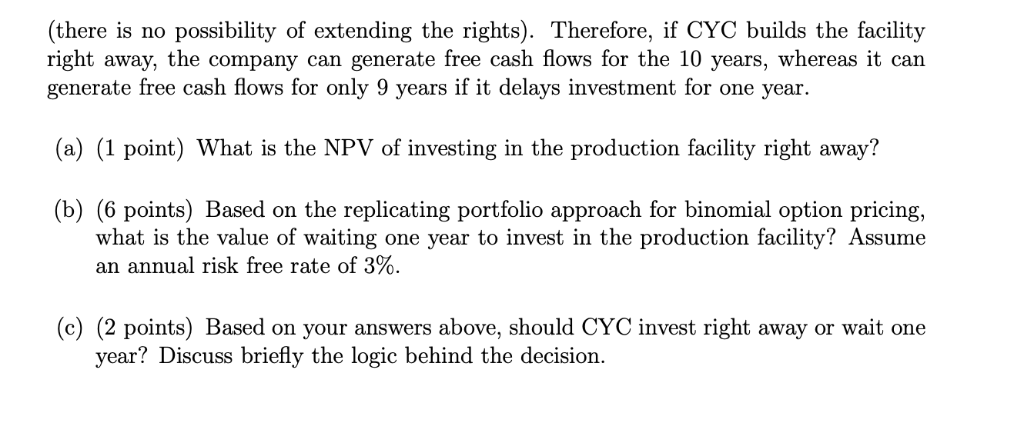

5. Deferral Option (American Option with Dividends) Chum Yum Corp (CYC) is an American food an beverage company that current owns the trademark rights to the Slurm brand of soft drinks. CYC is considering investing in a soft drink production facility that can produce Slurm products, with the investment requiring an initial outlay of $250 million, generating expected annual free cash flows of $50 million per year, beginning one year from today. Management estimates the weighted average cost of capital for the project to be 11.5% 0. The company is considering delaying the investment for one year, due to uncertainty regarding potential regulations restricting the sale of sugary soft drinks that is being debated in several states. Management expects one of two potential outcomes by the end of the current year: o Restrictive regulations are defeated, in which case management expects to revise its estimates of annual free cash flows upwards by a factor of 1.1 to 50 x 1.1 $55 million per year Restrictive regulations are passed, in which case management expects to revise its estimates of annual free cash flows downwards by a factor of 111 to 50 1.1 $45.4545 million per year. If the company decides to delay investment for one year, then it incurs the same S250 million cost at the point of investment, and begins generating free cash flows beginning one year from the point of investment (i.e. starting two years from today). CYC's ownership of the rights to Slurm's trademark is temporary and set to expire in 10 years (there is no possibility of extending the rights). Therefore, if CYC builds the facility right away, the company can generate free cash flows for the 10 years, whereas it can generate free cash flows for only 9 years if it delays investment for one year. (a) (1 point) What is the NPV of investing in the production facility right away? (b) (6 points) Based on the replicating portfolio approach for binomial option pricing, what is the value of waiting one year to invest in the production facility? Assume an annual risk free rate of 3%. (c) (2 points) Based on your answers above, should CYC invest right away or wait one year? Discuss briefly the logic behind the decision. 5. Deferral Option (American Option with Dividends) Chum Yum Corp (CYC) is an American food an beverage company that current owns the trademark rights to the Slurm brand of soft drinks. CYC is considering investing in a soft drink production facility that can produce Slurm products, with the investment requiring an initial outlay of $250 million, generating expected annual free cash flows of $50 million per year, beginning one year from today. Management estimates the weighted average cost of capital for the project to be 11.5% 0. The company is considering delaying the investment for one year, due to uncertainty regarding potential regulations restricting the sale of sugary soft drinks that is being debated in several states. Management expects one of two potential outcomes by the end of the current year: o Restrictive regulations are defeated, in which case management expects to revise its estimates of annual free cash flows upwards by a factor of 1.1 to 50 x 1.1 $55 million per year Restrictive regulations are passed, in which case management expects to revise its estimates of annual free cash flows downwards by a factor of 111 to 50 1.1 $45.4545 million per year. If the company decides to delay investment for one year, then it incurs the same S250 million cost at the point of investment, and begins generating free cash flows beginning one year from the point of investment (i.e. starting two years from today). CYC's ownership of the rights to Slurm's trademark is temporary and set to expire in 10 years (there is no possibility of extending the rights). Therefore, if CYC builds the facility right away, the company can generate free cash flows for the 10 years, whereas it can generate free cash flows for only 9 years if it delays investment for one year. (a) (1 point) What is the NPV of investing in the production facility right away? (b) (6 points) Based on the replicating portfolio approach for binomial option pricing, what is the value of waiting one year to invest in the production facility? Assume an annual risk free rate of 3%. (c) (2 points) Based on your answers above, should CYC invest right away or wait one year? Discuss briefly the logic behind the decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts