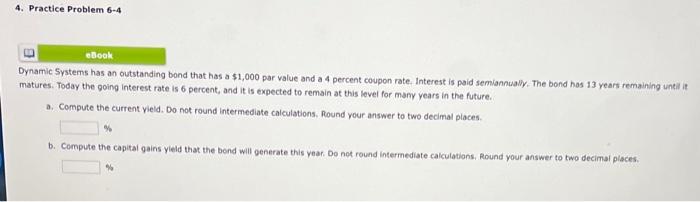

Question: does anyone know how to do this? Dynamic Systems has an outstanding bond that has a $1,000 par value and a 4 percent coupon rate.

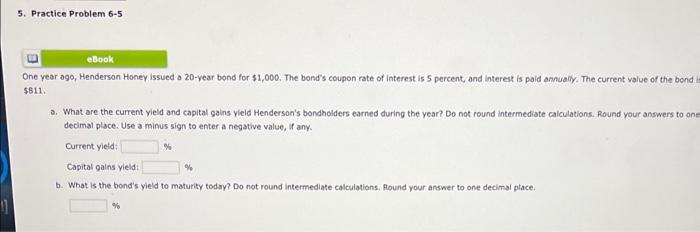

Dynamic Systems has an outstanding bond that has a $1,000 par value and a 4 percent coupon rate. Interest is paid semiannualy. The bond has 13 years remaining uneil it. matures. Today the going interest rate is 6 percent, and it is expected to remain at this level for mamy years in the future. a. Compute the current yield. Do not round intermediate calculations. Round your answer to two decimal places. b. Compute the capital gains yield that the bond will generate this year, Do not round intermediate calculations, Round your answer to two decimal piaces. One year ago, Henderson Honey issued a 20-year bond for $1,000. The bond's coupon rate of interest is 5 percent, and interest is paid annualy. The current value of the bond 5811. a. What are the current vield and capital gains yield Henderson's bondholders earned during the year? Do not round intermediate calculations. Round your answers to ont decimal place. Use a minus sign to enter a negative value, if any. Current yieid: Capital gains yield: b. What is the bond's yield to maturity today? Do not round intermediate calculations. Round your answer to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts